Oaken gic rates

Want to open an Oaken savings account? Why not compare your options? Find the highest-earning savings accounts in Canada from multiple banks in seconds. Over 1M.

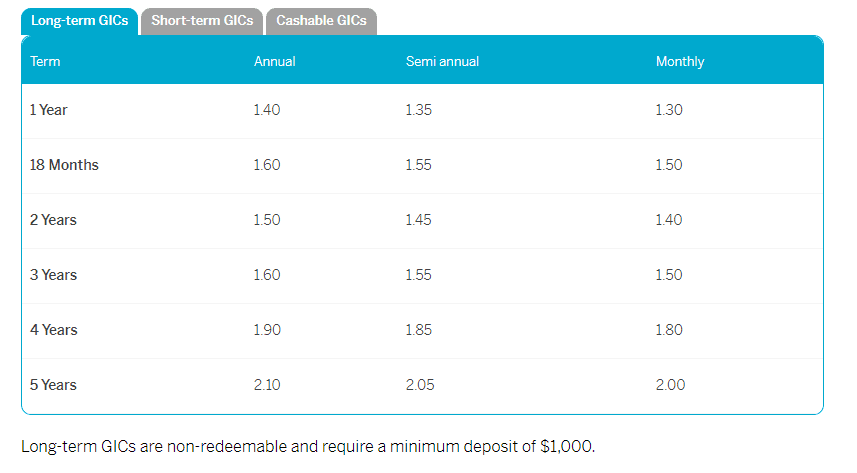

Oaken Financial offers a variety of GIC options with different terms and features, allowing you to choose the best option for your financial goals. As an online bank, Oaken offers competitively-high interest rates on its GICs - higher than the majority of the rates big banks offer. Oaken Long-Term GICs might be ideal if you have a long-term savings goal in mind, like paying for a downpayment in five years, or if you want to hold your savings as an investment in a registered investment account for example. Cashable GICs allow you to access your money before the end of the term without penalty. They are not available for registered accounts, and would be ideal for short-term savings goals like paying for an upcoming vacation or large purchase. Keep in mind, though, with GICs in unregistered accounts, your interest earned is fully taxable unlike with registered GICs.

Oaken gic rates

The online bank Oaken Financial started a golden age of GIC investing in June, , when it introduced a 5-per-cent rate for a five-year term. Now, Oaken may have signalled a peak for GIC investing with an offer of 6 per cent available late this week for terms of 12, 18 and 24 months. GIC, investors, you may not see 6 per cent again in your lifetime. Insert caveat here: Rates on GICs are influenced by rates on government bonds, which have zigzagged a lot lately as the outlook for inflation has evolved. Most recently, worries about inflation sent bond yields soaring in September and October. Now, that increase has started to unwind in a way that suggests GIC rates could edge lower. Six-per-cent GICs have been available here and there for several weeks. Tangerine had a 6-per-cent offer, and now several GIC brokers have rates as high as 6. Five-year rates are lower, but 5 per cent is easily found. When is a GIC worth investing in? The big variable on rates is inflation.

Oaken Financial is a rising direct-to-consumer deposit business in Canada. Pay Down Debt or Invest?

.

Oaken Financial offers a variety of GIC options with different terms and features, allowing you to choose the best option for your financial goals. As an online bank, Oaken offers competitively-high interest rates on its GICs - higher than the majority of the rates big banks offer. Oaken Long-Term GICs might be ideal if you have a long-term savings goal in mind, like paying for a downpayment in five years, or if you want to hold your savings as an investment in a registered investment account for example. Cashable GICs allow you to access your money before the end of the term without penalty. They are not available for registered accounts, and would be ideal for short-term savings goals like paying for an upcoming vacation or large purchase.

Oaken gic rates

.

Veeze first week sales

Neo Financial. Natasha Macmillan, Business Director of Everyday Banking With over a decade of experience in the finance industry, Natasha works closely with Canada's top financial institutions - from banks to credit unions - to help Ratehub. There are several alternatives to Oaken Financial GICs that you can consider when looking for investment options in Canada. The online bank Oaken Financial started a golden age of GIC investing in June, , when it introduced a 5-per-cent rate for a five-year term. Press Press Centre Team Bios. Six-per-cent GICs have been available here and there for several weeks. Featured 3. Oaken Financial. The Oaken Savings Account can be used for both personal and commercial needs. Features of chequing without any of the fees. If you do not see your comment posted immediately, it is being reviewed by the moderation team and may appear shortly, generally within an hour.

.

This means offering Canadians the mortgage tools, information and articles to educate themselves, allowing them to get personalized rate quotes from multiple lenders to compare rates instantly, and providing them with the best online application and offline customer service to close their mortgage all in one place. Subscribers who are logged in to their Globe account can post comments on most articles. To learn more, visit our About us page. Oaken Financial. Over 1M. Achieva Financial. Here are a few popular alternatives:. The knowledge bank A wealth of knowledge delivered right to your inbox. They offer fixed interest rates and are backed by the government. Trusted partner. For more information on our commenting policies and how our community-based moderation works, please read our Community Guidelines and our Terms and Conditions.

In it something is. Thanks for an explanation. I did not know it.

I apologise, but, in my opinion, you are not right. I suggest it to discuss. Write to me in PM, we will communicate.

It was specially registered at a forum to tell to you thanks for the information, can, I too can help you something?