Nopat margin

How to start a business from scratch: 19 steps to help you succeed. Cash flow guide: Definition, types, nopat margin, how to analyze. Financial statements: What business owners should know.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Nopat margin

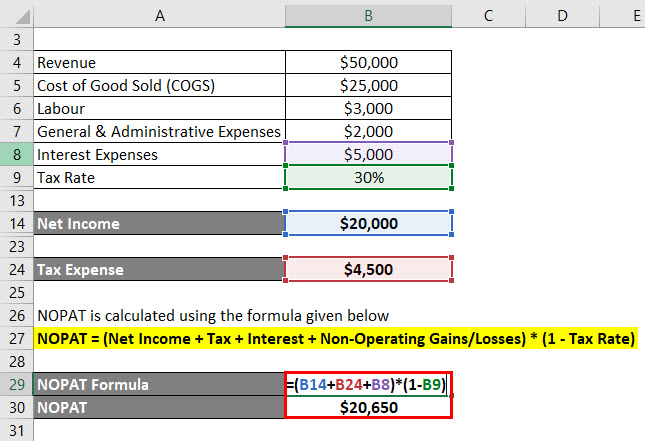

NOPAT is a profit return from a core business operation. It represents how much profit is available from day-to-day operations after accounting for the tax burden. Because we compare it to revenue, we take the NOPAT margin as how efficiently the company generates those profits. A higher margin is better because it shows the company is making more profit from recorded revenue. Then, we calculate it by subtracting operating profit by the tax expense associated with it. Alternatively, we multiply operating profit by 1- tax rate. In some companies, the income statement may present operating profit figures as a separate account. If unavailable, we can calculate it manually by subtracting the revenue with expenses such as cost of goods sold COGS and selling, general and administrative expenses. We exclude interest expense because it is a non-operating item. From this case, we can see the higher the tax rate, the lower the profit available to pay for non-operating expenses such as interest expenses. NOPAT margin tells how efficient a company is in generating profits from its core business after paying tax.

Inline Feedbacks.

Analysts use the formula to compare business performance to past years, and to assess how a company is performing against its competitors. As an example throughout, meet Patty, the owner of Seaside Furniture, a manufacturing company. The income statement uses the term operating income, which also means operating profit. This discussion will use operating profit. This comparison is useful, because it focuses on profits from normal operations, without the impact of interest payments. NOPAT removes non-operating income and expenses from earnings before tax. Non-operating activities are not generated from normal business operations.

NOPAT is a profit return from a core business operation. It represents how much profit is available from day-to-day operations after accounting for the tax burden. Because we compare it to revenue, we take the NOPAT margin as how efficiently the company generates those profits. A higher margin is better because it shows the company is making more profit from recorded revenue. Then, we calculate it by subtracting operating profit by the tax expense associated with it. Alternatively, we multiply operating profit by 1- tax rate. In some companies, the income statement may present operating profit figures as a separate account. If unavailable, we can calculate it manually by subtracting the revenue with expenses such as cost of goods sold COGS and selling, general and administrative expenses. We exclude interest expense because it is a non-operating item. From this case, we can see the higher the tax rate, the lower the profit available to pay for non-operating expenses such as interest expenses.

Nopat margin

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

Free invitation templates

Once you complete your NOPAT calculations, you can use the data to develop strategies that increase operating profit. Another way to calculate net operating profit after tax is net income plus net after-tax interest expense or net income plus net interest expense multiplied by 1, minus the tax rate. Starting a business Canadian small business grants: Tools and tips to get funding November 16, It represents how much profit is available from day-to-day operations after accounting for the tax burden. We exclude the tax burden when calculating both. Next, you will need to account for taxes. QuickBooks Pro. Canadian small business grants: Tools and tips to get funding. Paycheck calculator for hourly and salary employees. Some examples of non-operating activities include: Paying off interest on debt Restructuring your business Writing off inventory Paying a settlement Relocating your center of operations These are also known as Capital Expenditures CapEX because they encapsulate broad, long-term expenses rather than expenses for daily operations. Increased access to cheaper and more varied goods and services is key benefits of international. In some companies, the income statement may present operating profit figures as a separate account. Excluding taxes from the calculation can be misleading when measuring the actual profits generated. Gain efficiency: Businesses can work more efficiently by embracing technology.

Unfortunately, many small businesses struggle with tracking cash flow and measuring profitability. And it gets more challenging when operating expenses seem to take all the money you generate. So what do you do?

Maximize Tax Deductions. What is operating profit? Understand audiences through statistics or combinations of data from different sources. Article Sources. Midsize business What is gross margin: Formula, components, and using it for growth January 25, See our webinar on importance of ROIC and how to calculate it. Why capital investments are necessary Capital is defined as money invested in the company to purchase assets and to operate the business. Resources to help you fund your small business. Grow Your Business. Operating profit reveals how each company generates a profit from normal business activities.

It was and with me. We can communicate on this theme.

I assure you.