Nifty bollinger band

Note : Support and Nifty bollinger band level for the day, calculated based on price range of the previous trading day. Note : Support and Resistance level for thecalculated based on price range of the previous trading. Stands for Relative Strength Index.

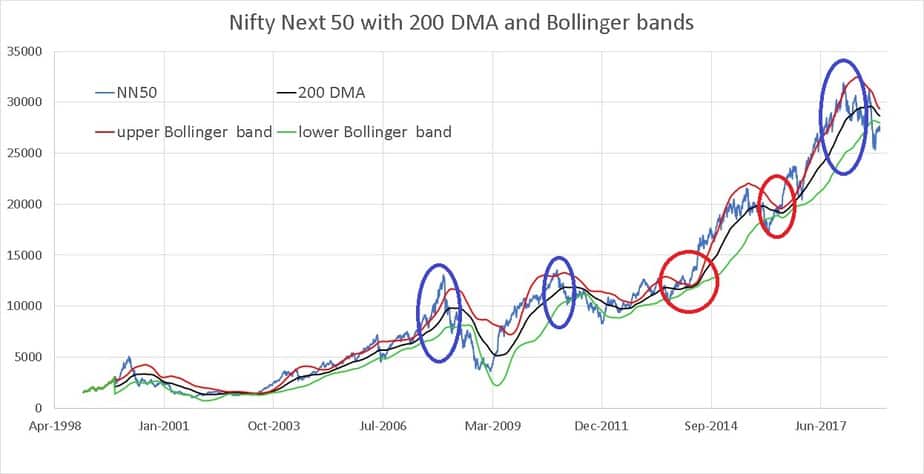

Bollinger bands are known as oscillator indicators which help to measure price volatility. They assist us in monitoring whether a price is high or low compared to its recent average and predict when it might rise or fall back to that level. This will help you decide when to buy or sell an asset. The RSI helps time the entries and exits to maximize profits before a price rises or falls. The central band depicts the price's simple moving average. The upper and lower bars represent levels where the price is relatively high or low compared to its recent moving average.

Nifty bollinger band

RSI and volumes show nothing significant as of now. BB squeeze can lead to massive up or down break. Waiting if it will breakout again this time. Hey, check out the trade setup for Industower All 3 parameters are matched for a short trade. Trade setup in Futures Short : Pfc looking weak on weekly charts break strong support. Price has met resistance at levels with 2 sweet Spinning Tops. Square off if it closes above on Daily. A tight stop loss but playing safe; open to fresh entries. The Equifax breach was not the largest ever, but it was notable for the The stock has broken out of an upward sloping triangle with good volumes. The shooting star at trendline and bollinger band resistance is followed by a red candle will lead to a pullback to the breakout resistance now support giving us an opportunity to buy.

This will help you decide when to buy or sell an asset.

.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

Nifty bollinger band

Among the many indicators available, Bollinger Bands have gained significant popularity due to their ability to provide valuable insights into price volatility and potential trend reversals. In this comprehensive guide, we will delve into the world of Bank Nifty trading using Bollinger Bands. We will start by explaining what Bollinger Bands are and how they are calculated. We will then explore various trading strategies that can be implemented using Bollinger Bands, including the widely-used Bollinger Squeeze and Bollinger Breakout strategies.

City removalist reviews

Subscribe to Pro Already a user? The settings appear in the top left-hand corner of the chart and would generally show as '20, 2' under the default settings. Upper band C. Videos only. The RSI helps time the entries and exits to maximize profits before a price rises or falls. It stands for Money Flow Index. A big space between the upper and lower bands indicates high price volatility; a small space indicates low. It is oversold when the price reaches the lower band; the asset trades at a lower price. RSI reading below 25 is interpreted as oversold. The breakout is not a trading signal. It indicates only the trend strength. Median 20 MA acting as support for now at It stands for Average Directional Index. Increasing the standard deviation increases the distance of the bands from the central line, so more of the price action is contained within them.

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Track historical Trend changing dates with Moneycontrol Technical Rating. MrAkshatP Updated. Top 5 Trending Stocks. Lower band The central band depicts the price's simple moving average. A tight stop loss but playing safe; open to fresh entries. HDFC triangle breakout pullback. RSI reading below 25 is interpreted as oversold. Moving Average Type: Exponential moving average. HarshShivlani Updated. A falling ADX line only means that the trend strength is weakening, but it usually does not mean the trend is reversing. We can notice the price breaking the upper and lower bands more often:. IDBI : set-up for a big move.

Did not hear such

Unfortunately, I can help nothing, but it is assured, that you will find the correct decision. Do not despair.