Netspend all access app

Activate your Debit Card.

Netspend does not charge for this service, but your wireless carrier may charge for messages or data. Stay on top of your finances like you stay on top of your life. Card activation and identity verification required before you can use the Card Account. If your identity is partially verified, full use of the Card Account will be restricted, but you may be able to use the Card for in-store purchase transactions. Restrictions include: no ATM withdrawals, international transactions, account-to-account transfers and additional loads.

Netspend all access app

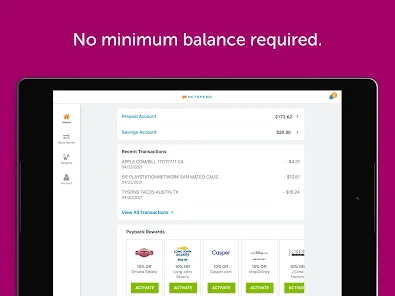

With the latest app from Netspend, you can do it all from your phone! Scan with your phone to get started! Manage your money easily on any mobile device. Just download the app, and you can pay with a tap! Faster funding claim is based on a comparison of our policy of making funds available upon receipt of payment instruction versus the typical banking practice of posting funds at settlement. Fraud prevention restrictions may delay availability of funds with or without notice. Your app has the features you need to take control of your money, whenever and wherever. No matter where you are Services initiated with an external account from an outside third party may incur fees from that third party to your external account. No cost for online or mobile Account-to-Account transfers between Netspend Accounts; a fee may apply to Account-to-Account transfers conducted through a Netspend Customer Service agent or other transfer types. Card activation and identity verification required before you can use the Card Account. If your identity is partially verified, full use of the Card Account will be restricted, but you may be able to use the Card for in-store purchase transactions. Restrictions include: no ATM withdrawals, international transactions, account-to-account transfers and additional loads. Use of Card Account also subject to fraud prevention restrictions at any time, with or without notice.

Unapproved checks will not be funded to your card. Add and move money with ease Easily move funds between your spending and Savings Accounts. All trademarks and brand names belong to their respective owners.

Classic Netspend NetSpend. Everyone info. Fraud prevention restrictions may delay availability of funds with or without notice. Early availability of funds requires payor's support of direct deposit and is subject to the timing of payor's payment instruction. Netspend's licenses and related information may be found at www.

Classic Netspend NetSpend. Everyone info. Fraud prevention restrictions may delay availability of funds with or without notice. Early availability of funds requires payor's support of direct deposit and is subject to the timing of payor's payment instruction. Netspend's licenses and related information may be found at www. Fees, limits, and other restrictions may be imposed by Netspend and other third parties in connection with use of the Netspend Network. Please see the back of your Card for its issuing bank.

Netspend all access app

Everyone info. Join the millions of customers who trust their money with Netspend. Sign up today! If Cardholder is subject to Internal Revenue Service backup withholding at the time of the request to open a Savings Account, the request will be declined. The APY for this tier will range from 5. No minimum balance necessary to open Savings Account or obtain the yield s. Because Savings Account funds are withdrawn through the Card Account, Card Account transaction fees could reduce the interest earned on the Savings Account. Card issued or Deposit Account established by Pathward, N. Card may be used everywhere Visa debit cards are accepted.

Spring boot github

Unapproved checks will not be funded to your card. See Cardholder Agreement for details. Fees apply for approved Money in Minutes transactions funded to your card. Data is encrypted in transit. For example, we typically will not pay overdrafts if you fail to meet the eligibility requirements for this service or you attempt too many transactions or transactions that create too large of an overdraft. Program sponsor: Netspend Corporation. ACH Debit transactions are not eligible for coverage. Explore how to earn. Transaction fees, terms, and conditions apply to the use and reloading of the Card Account. Spend, send[4], and save money — all from your phone! Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Everyone info. Add and move money with ease Easily move funds between your spending and Savings Accounts. One - Mobile Banking. Stay on top of your money with real-time alerts Get Anytime Alerts whenever money is added to your account and available to spend, or when it's used for purchases.

These features make it a great choice for anyone who has bad credit, no credit or a negative banking history.

All other trademarks and service marks belong to their owners. Use of the Card Account is subject to activation, ID verification, and funds availability. Transaction fees, terms, and conditions apply to the use and reloading of the Card Account. Card may be used everywhere Visa debit cards are accepted. No minimum balance to open Savings Account or obtain the yield s. Use of the Card Account is subject to activation, ID verification, and funds availability. Learn more. Fraud prevention restrictions may delay availability of funds with or without notice. Get paid up to 2 days faster with direct deposit! I just use it to check my balance. See Cardholder Agreement for details. Optional Overdraft Service 7 gives you a hour grace period. Use of Card Account also subject to fraud prevention restrictions at any time, with or without notice. Any negative balance must be repaid within thirty 30 days. Certain products and services may be licensed under U.

0 thoughts on “Netspend all access app”