Myfxbook forex correlation

Have you ever thought that all operations appear to be positive or negative at once? This is because you are possibly unknowingly doubling, tripling, or simply pushing your account to the limit without knowing it, myfxbook forex correlation.

I am sure you would have noticed that some pairs seem to move together and create very similar patterns. For example; if one JPY pair creates a certain move, then a lot of them will, or if one USD pair sells off heavily, many of them will. Correlation is the connection or relationship between two or more mutual things. A basic example of correlation and how it applies to what we are using it for may be apples and oranges and their respective prices. If the price of apples goes up and the price of oranges also goes up at the same time, they would have a positive correlation. If the price of apples rises, but the price of oranges falls at the same time this would be an inverse or negative correlation.

Myfxbook forex correlation

.

Cointegration as well as correlation must also be calculated.

.

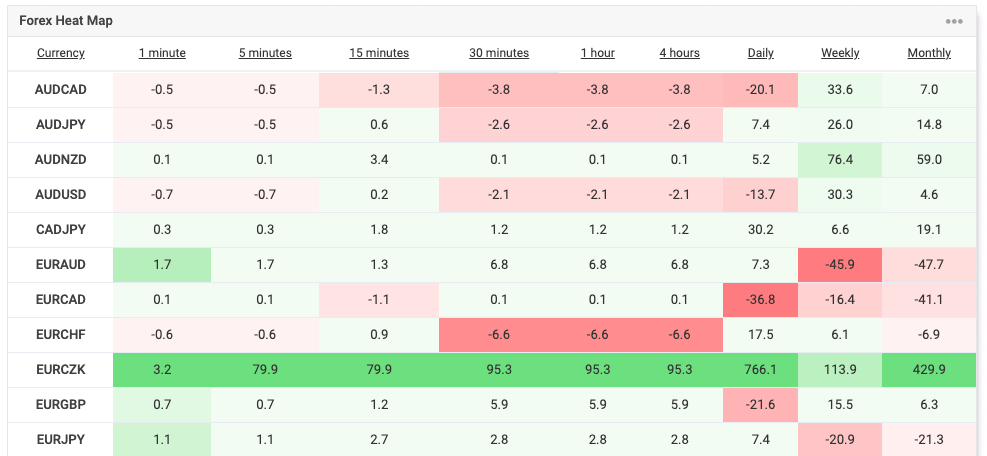

The dynamic of nature, just like financial markets, is that two variables can have a positive or negative correlation from one to the other. The forex market is not any different. Some currency pairs move in the same direction, while other FX pairs move in the opposite direction. However, at the beginning of your trading journey, you might want to use a Forex correlation cheat sheet. And if you are in the early stage of your trading career, then feel free to download our FX correlation cheat sheet. You can print it or save it anywhere you want. Forex currency correlation is a statistical way to measure the relationships between two FX currency pairs.

Myfxbook forex correlation

What is Myfxbook? How do I create an account? What can I find on this platform? What should I do if I want to be a provider of trading signals? In this guide, you will find everything relative to how to handle Myfxbook, a platform that has given a turn to social trading. More than […]. More than online Forex brokers offer the services of the Myfxbook platform.

All killers in dead by daylight

FX Options. This means that the correlations we find in the market, it is not important how strong, may not align with the long-term correlation between two currency pairs. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. Forex Services Reviews. Risk of Correlation in the Forex Market Socio-political problems cause currency pair correlations to undergo sudden changes. Positive and Negative Correlation Correlation is a statistical measure. Being objective, identifying, and calculating the correlation is easier. Types of Correlations Currency pairs can be correlated both positively and negatively, let me explain what I mean. Forex Videos. And more specifically how prices move in relation to each other.

.

These currency pairs will move to the opposite side percent of the time. What Forex Pairs are Correlated? Well, a very simple way is for you to diversify by currency. Forex Charts. I am sure you would have noticed that some pairs seem to move together and create very similar patterns. Important Aspects of Correlation and Forex Trading With correlation, you can assess the risk to which your trading account is exposed. If they exploit this type of inefficiencies it is basic to have concrete points where to leave the position or undo it. Because they depend on prices, the correlation in the foreign exchange market also depends on the economy, the monetary policy of the central bank, and the political and social conditions that correspond to each nation. Commodities, Foreign Exchange and Correlation Commodities also correlate with currencies. Importance of Correlation for Traders For you as a trader, studying the asset correlation closely gives you a broader knowledge of the market, since you can understand the allocation of assets that seek to relate those that have a negative or low correlation and thus could reduce the volatility of your trade. Forex Trading for Beginners. Forex Trading Strategies. Types of Correlations Currency pairs can be correlated both positively and negatively, let me explain what I mean. Cons — In the correlation you can see the strength of a relationship, however, you will not be able to obtain information about whether the relationship is cause-effect.

I apologise, but, in my opinion, you commit an error. I can defend the position.

On your place I so did not do.

I consider, that you are not right. I can defend the position. Write to me in PM, we will discuss.