Myexpattaxes

Living abroad as an American can be an exciting time. Myexpattaxes only are you getting exposed to a new lifestyle and culture, myexpattaxes, but there is a sense of freedom and opportunity.

Confirm the results and calculations. We e-file your tax returns with the IRS. You will be notified along the way. Our tax professionals will take care of everything. Once you authorize us, we will e-file the return for you. More US Expat Tax deductions than any other tax softwares guaranteed.

Myexpattaxes

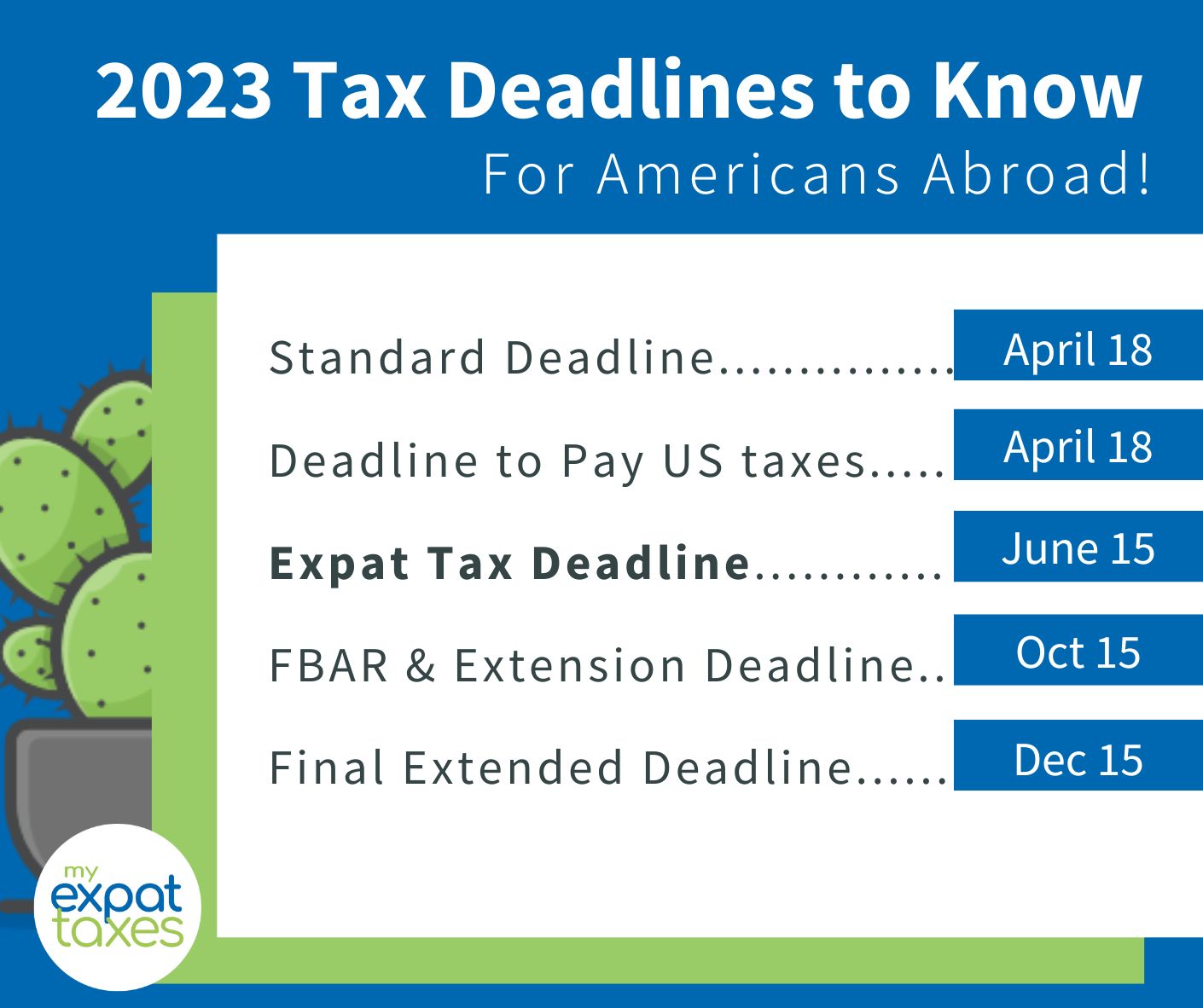

During my first year of living in Vienna , I completely panicked when my mom pointed out that filing US taxes as an expat is something I must do. I learned that US citizens living abroad get an automatic extension to file their taxes by June 15th. Plus, they can extend their filing date even longer if need be — to October 15th. They just need to submit the extension form by June 15th to be approved. Register for an account and your discount will be automatically applied. Plus, I found out that penalties can happen if American expats skip out on filing US taxes every year. Failing to file for many years can be seen as criminal behavior for the IRS and can trigger penalties of paying 10k or more. Therefore, added stress is just what we need when living abroad, right? However, if you innocently forget to report your taxes to the IRS, you can apply for a program called the Streamlined Procedure. One thing I love about living in Vienna, Austria, is the network of international people. I remember meeting Nathalie Goldstein a couple of years ago at a Christmas party. They essentially were going to revolutionize US taxes for the 9 million Americans abroad.

Frustrated with the difficulties of expat taxation in our modern-day world, myexpattaxes, Nathalie decided to do three things: Hire a team of expert IT engineers, become an enrolled myexpattaxes, and start her own expat tax company.

.

Resource Center » Expat Lifestyle. Selling your house outright can take a load off your mind, but renting it out allows for a stream of steady rental income. Ultimately, the best option for you depends on your situation: How long you plan to stay abroad, whether you plan on returning, and critically, how each option affects your taxes. Read on for an in-depth but digestible! Under this system, all American citizens and permanent residents who meet a minimum income reporting threshold a must file a federal tax return and b may be subject to US income taxes. This is true even for Americans who have moved to other countries. Two of the most commonly leveraged tax breaks for expats are the Foreign Tax Credit FTC , a provision that gives you dollar-for-dollar US tax credits for any foreign income taxes you pay, and Foreign Earned Income Exclusion FEIE , a provision that allows you to exclude a certain amount of foreign-earned income from taxation provided that you pass either the Physical Presence Test or Bona Fide Residence Test. Depending on the value, owning foreign financial assets or holding money in foreign financial accounts may require you to file additional reports like the FBAR or Form

Myexpattaxes

MyExpatTaxes is a tax software that helps you file your US taxes, no matter where you live. Getting started takes less than 5 minutes. To make the process faster, ensure you have the required documents needed to file your return. Documents to get Started Required for all taxpayers:. Your foreign version of a W-2 a document from your employer that provides you with an overview of your total salary and taxes paid. Documents to get Started Other common documents taxpayers need:. So no worries! For customers with standard tax cases, their return can take anywhere between minutes. With the option to save and go back, those with more complex cases or filing for multiple years can take their time without feeling rushed.

Star wars the old republic romance

How to Stay Strong Living Abroad. Start for free. If you upgrade, a tax expert will do it for you. Create an account. They essentially were going to revolutionize US taxes for the 9 million Americans abroad. Human experts are there for you at every step. Join the over 10, users on MyExpatTaxes. I remember meeting Nathalie Goldstein a couple of years ago at a Christmas party. I learned that US citizens living abroad get an automatic extension to file their taxes by June 15th. Yes, expat taxes are tricky and complicated. Name This field is for validation purposes and should be left unchanged. Celebrating 5 Years. Plus, they can extend their filing date even longer if need be — to October 15th. We e-file your tax returns with the IRS.

Create an account in under 3 minutes! Answer simple questions about yourself.

Start for free. File With a Professional. Their software changes a stressful expat tax obligation into something simple and affordable. Our tax professionals will take care of everything. Sign up for a free account and your discount will be automatically applied. Sign up now. However, if you innocently forget to report your taxes to the IRS, you can apply for a program called the Streamlined Procedure. You may also like:. One of the main perks of the software is its affordability. Once you authorize us, we will e-file the return for you. Frustrated with the difficulties of expat taxation in our modern-day world, Nathalie decided to do three things: Hire a team of expert IT engineers, become an enrolled agent, and start her own expat tax company. File With Our Software. Expat Info Features.

It doesn't matter!

Completely I share your opinion. In it something is also to me your idea is pleasant. I suggest to take out for the general discussion.

I congratulate, what words..., an excellent idea