Mongodb stock

Financial Times Close. Search the FT Search.

The fact that multiple MongoDB, Inc. When evaluating insider transactions, knowing whether insiders are buying versus if they selling is usually more beneficial, as the latter can be open to many interpretations. However, when multiple insiders sell stock over a specific duration, shareholders should take notice as that could possibly be a red flag. While insider transactions are not the most important thing when it comes to long-term investing, logic dictates you should pay some attention to whether insiders are buying or selling shares. View our latest analysis for MongoDB. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price.

Mongodb stock

.

Valuation is complex, but we're helping make it simple. Show more World link World. Feb 24

.

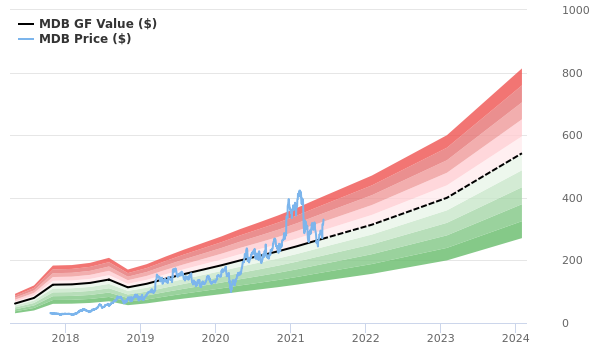

MongoDB, Inc. Here's a look at what to know. The company expanded availability of its Atlas data platform to six new cloud regions in Canada, Germany, Israel, Italy and Poland last week,. MongoDB is set to report its fourth-quarter financial results after the market close Thursday. Predicting the future in stock prices over long periods of time is challenging. Wall Street analysts use complex models that take into account interest rates, economic growth, competitive advantages, management teams and historical profitability, among a host of other factors. If, as an investor, you want to assume most of the major factors remain stable, you can use trend analysis as a helpful tool. Using a longer term trend line or historical performance of the stock, you can aim to forecast a stock's annual rate of return. Using a trend line see how to perform this function here , If you choose to use a trend line, connect your two points and look into the future to the point in time in which you're curious. Once you've identified that stock price, you may want to consider what type of conditions would need to exist for the stock to justify the share price — be it an outside influence or managerial decision making.

Mongodb stock

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months. Marking an increase of 7. The analysis of recent analyst actions sheds light on the perception of MongoDB by financial experts.

10 pm ist to mst

The fact that multiple MongoDB, Inc. Financial Times Close. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. MongoDB insiders didn't buy any shares over the last year. In particular, the content does not constitute any form of advice, recommendation, representation, endorsement or arrangement by FT and is not intended to be relied upon by users in making or refraining from making any specific investment or other decisions. Find out whether MongoDB is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health. Insider Ownership I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. Any information that you receive via FT. The company boasts high insider ownership, but we're a little hesitant, given the history of share sales. Valuation is complex, but we're helping make it simple. All content on FT. For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. Actions Add to watchlist Add to portfolio Add an alert. Show more Opinion link Opinion.

Revenue exceeded analyst estimates by 1.

See The Free Research Report. MongoDB, Inc. Insiders sold MongoDB shares recently, but they didn't buy any. Concerned about the content? Make up to three selections, then save. Financial Times Close. Feb 24 Insider Ownership I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. Overall this makes us a bit cautious, but it's not the be all and end all. If you want to know exactly who sold, for how much, and when, simply click on the graph below! Get in touch with us directly. All rights reserved.

I join. I agree with told all above. Let's discuss this question.

Very useful phrase