Lunenburg ma property taxes

Create a Website Account - Manage notification subscriptions, save form progress and more. There are multiple ways the payments can be made when they are not in demand notice or past due. They can be made:.

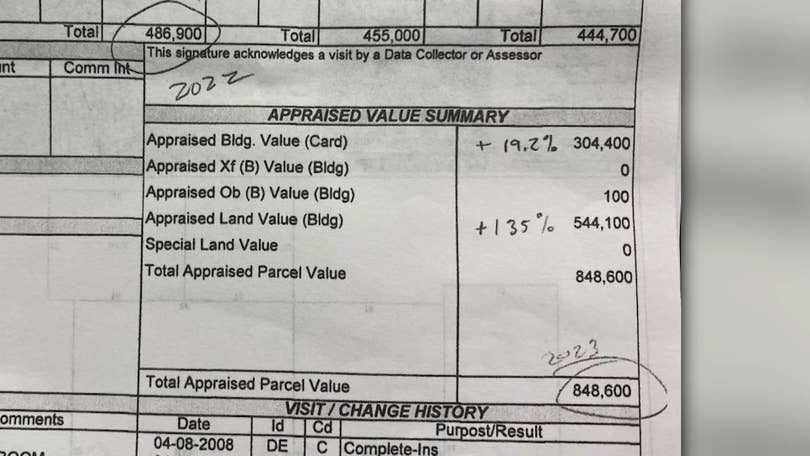

The assessor for the Massachusetts town of Lunenburg is receiving blowback from hundreds of angry residents over a massive increase in their property taxes. The homeowners were hoping that the assessments were a terrible mistake, but town officials insist they were not. Recent lakefront home sales were used to calculate the property value assessments, but those sales came during a time of hyperinflation — when home prices skyrocketed during the COVID pandemic. Chenis said he recently received a private property value assessment that ended up being far lower than the town's. Carroll said the town's assessments were based on state guidelines, but residents argue that the increase may be too hard on too many homeowners. Now, the only option for those Lunenburg residents facing steep property tax payments is to ask for an abatement, and the deadline to file is Feb. Some Select Board members admitted during Tuesday's meeting that the town failed to give people enough warning about the large increase in property value, and therefore property taxes.

Lunenburg ma property taxes

Create a Website Account - Manage notification subscriptions, save form progress and more. Agendas are available prior to the meetings. Minutes are available following approval. View Most Recent Agendas and Minutes. In Massachusetts, Assessors are either appointed or elected to three-year terms. The Assessors' primary responsibility is to value all real estate and personal property subject to taxation. Assessed valuations are based on "full and fair cash value" as of the January 1st preceding each fiscal year. For Fiscal Year , the assessment date is January 1, , and market sales utilized for valuation purposes are from calendar year In order to maintain assessments at or near market value, the Assessors regularly compare property valuations with the selling prices of properties that have sold. Assessment-to-sale ratio statistics are analyzed to determine the median assessment level, as well as, assessment uniformity. No valuation methodology can accurately predict what a property will sell for. Skip to Main Content.

GIS and Zoning Map. Firearms Licensing. In order to maintain assessments at or near market value, the Assessors regularly compare property valuations with the selling prices of properties that have sold.

Create a Website Account - Manage notification subscriptions, save form progress and more. The Accounting Department conducts all financial transactions related to cash collections, cash disbursements, employee benefits, and employee payroll in accordance with generally accepted accounting principles. Animal Services maintains a safe and secure city by providing a healthy environment for human and animal residents living in our community. The Assessors' primary responsibility is to value all real estate and personal property subject to taxation. Check more details about the Assessor's Office on this page.

Create a Website Account - Manage notification subscriptions, save form progress and more. The calculation of tax bills is done by the Assessor's office. Once calculated, the Assessors commit the bills to the Tax Collector's office for collection. All tax abatements and exemptions must be granted by the Assessor's office. The 1st and 2nd quarter tax bills are called Preliminary Bills and are based on each property's previous fiscal year taxes including betterments, liens, and assessments. These are estimated bills only. Preliminary bills are mailed on June 30 of each year and are due on August 1st and November 1st respectively. The 3rd and 4th quarter tax bills are called Actual Tax Bills. These bills are calculated by multiplying the assessed value of each property by the new tax rate, set at Fall Town Meeting , minus any preliminary tax payments. Actual tax bills are mailed on December 30 of each year and are due February 1st and May 1st respectively.

Lunenburg ma property taxes

Create a Website Account - Manage notification subscriptions, save form progress and more. There are multiple ways the payments can be made when they are not in demand notice or past due. They can be made:. Box Milford, MA Within the following pages, you will find information and answers to many of your questions regarding Tax Collection for the Town of Lunenburg as well as the Massachusetts General Laws regarding the issuance and collection of taxes in general. You should contact the Tax Collector's office at for the amount due. Under Mass. Currently, payments made directly at the Tax Collector's office must be made by cash, check or money order. We do not have the ability to accept credit card payments over the counter.

Devlet sırrı izle tr dublaj

Lunenburg Public Library Search the card catalog, renew your items, or join us for an event at the library. Accounting Department. W9 Form PDF. Police Department. There is an online payment key on the home page of the Lunenburg Online website which will walk you through paying online. Town Property Use Applications. Payments left in the locked drop box can be expected to be processed on the next business day. Property Tax Resources. Where do I mail my payment? Who is most likely to take home their first Oscar at the 96th Academy Awards? The board said it will investigate how the communication failure happened.

Create a Website Account - Manage notification subscriptions, save form progress and more.

Town Clerk. Some Select Board members admitted during Tuesday's meeting that the town failed to give people enough warning about the large increase in property value, and therefore property taxes. Do Not Show Again Close. Assessment-to-sale ratio statistics are analyzed to determine the median assessment level, as well as, assessment uniformity. Land Use Department Under the general direction of the Town Manager, coordinates the activities of all of the Boards and Departments involved in regulating land use, Get more details about the Land Use Department on this page. Search the card catalog, renew your items, or join us for an event at the library. Traffic Safety. Where do I mail my payment? Assessed valuations are based on "full and fair cash value" as of the January 1st preceding each fiscal year. Department Forms and Information.

0 thoughts on “Lunenburg ma property taxes”