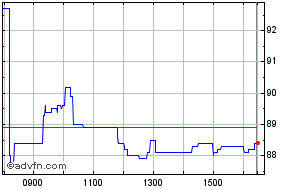

Ltg share price

Financial Times Close. Search the FT Search. Show more World link World.

We could not find any results for: Make sure your spelling is correct or try broadening your search. It looks like you aren't logged in. Click the button below to log in and view your recent history. Already a member? Sign in. More Brokers. It looks like you are not logged in.

Ltg share price

.

Save Clear.

.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets. Show more Opinion link Opinion. Show more Personal Finance link Personal Finance. Actions Add to watchlist Add to portfolio Add an alert.

Ltg share price

GBX Key events shows relevant news articles on days with large price movements. AGM 1.

Jenny sosa

We can research and get the gist of a thing, but it is nothing compared to working in an industry I have found. More Brokers. If Learning technology has ready customers Revenues in were down slightly so my own feeling is that we need to wait for later updates and the hint of growth in revenues in as previously stated. I would personally pump for the first two although tempted with the latter. Actions Add to watchlist Add to portfolio Add an alert. Trending Now. Open All markets data located on FT. If the LTG proposition is truly compelling to clients, they should be winning market share. Advertise Here. Make up to three selections, then save. Some suggesting the US was fully valued and again that there are takeover opportunities in the UK. Read Full Thread. Show more US link US.

This means our website may not look and work as you would expect.

He is a very level headed manager and believe that his further update in April with the full year-end results will be very positive going forward. Show more Personal Finance link Personal Finance. Save Clear. Use our equities screener to discover other potential opportunities. If the LTG proposition is truly compelling to clients, they should be winning market share. Show more US link US. I remain confident in the future of this company as one can see from my earlier posts when there was a complete absence of BB comment. There should be amazing cross selling opportunities and the appeal of the wide capabilities of the group should be obvious. It looks reasonable. I know you from old so I will leave you to get bored and move on. Here I agree with 12 badger that further cross selling and lowering costs is the better way forward. Repeat orders and being able to scale are useful pointers, too. I bought in on the back of the trading update.

Paraphrase please

In it something is. Now all became clear to me, I thank for the information.

Willingly I accept. The theme is interesting, I will take part in discussion. Together we can come to a right answer.