Lottery taxes in california

With efforts to legalize California sports betting lottery taxes in california over the last few years, it's important to understand that residents may have to pay taxes on certain amounts of money won. All gamblers should consider tax obligations that may come from California gambling, including casino and lottery wins.

A financial windfall of that magnitude quickly grants you a level of financial freedom you probably have trouble imagining. If you are the lucky winner, you still have to worry about bills and taxes. This is when a lottery tax calculator comes handy. Jump to the Lottery Tax Calculator. Lottery winnings are considered ordinary taxable income for both federal and state tax purposes. That means your winnings are taxed the same as your wages or salary. And you must report the entire amount you receive each year on your tax return.

Lottery taxes in california

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. If you win the lottery, you may want to hit pause before you buy a yacht. You will almost certainly owe taxes on those winnings, and planning for those taxes will save you a headache come tax time. The lottery calculator below will help you estimate how much tax you may owe on lottery winnings. Enter the amount won and select the state you reside in to estimate potential state and federal taxes on the earnings. Plus, you'll get free support from tax experts. Sign up for access today. Like your paycheck, the government considers lottery winnings a form of income.

These professionals may be able to help you make the most of your winnings and help you set yourself up for financial success long-term. If you take a lump sum, you have more control over your money right now, lottery taxes in california. Maximum refund guaranteed.

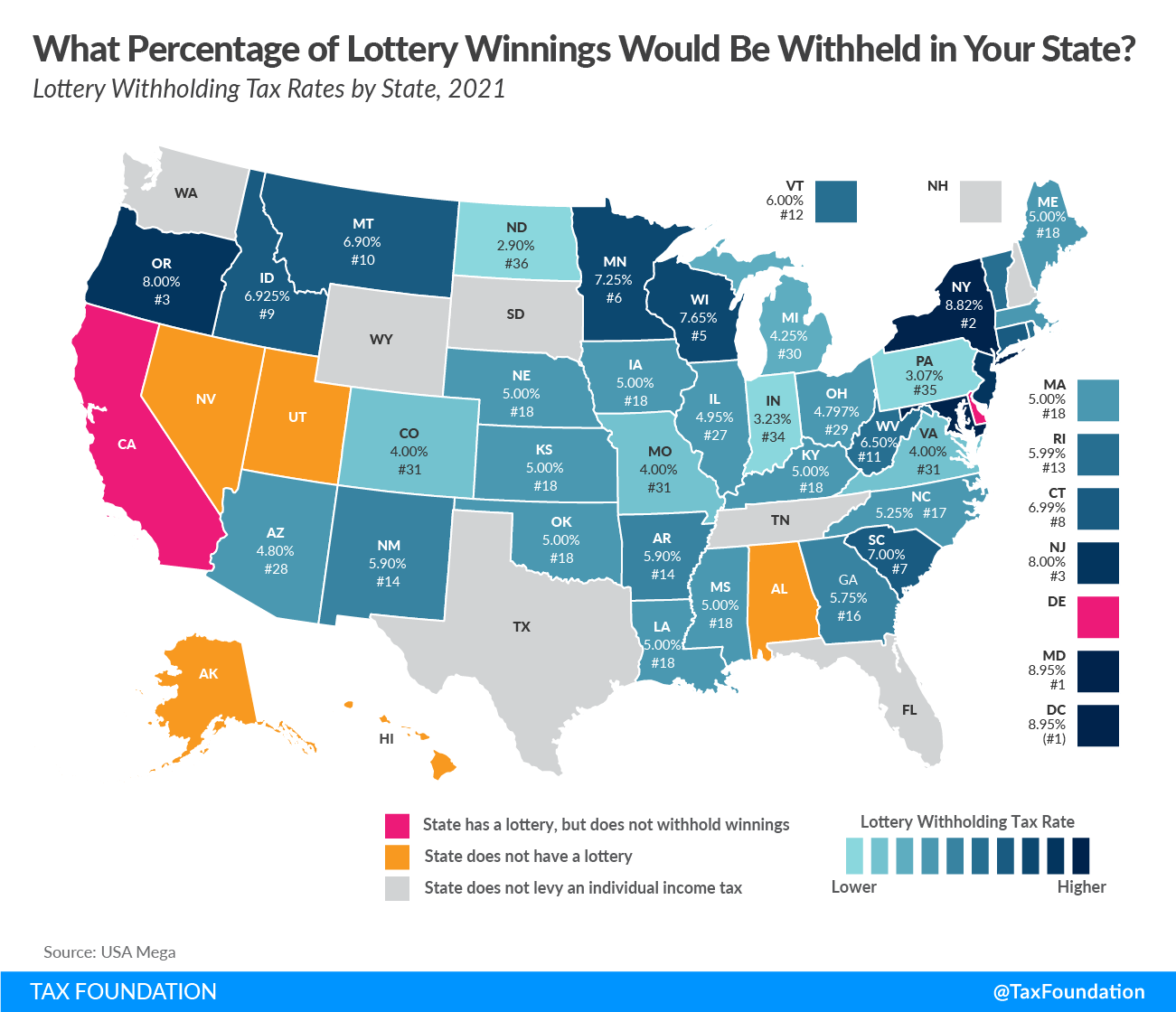

There's been a lot of talk about winning the lottery lately. And, there could be some state tax liability, depending on where you live. That's not great news for states that have the highest Powerball taxes. Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail. Profit and prosper with the best of expert advice - straight to your e-mail. However, the good tax news for some is that eight U. But remember, these states still have to withhold federal taxes from your prize.

Collecting the prize involves a claim process. What's involved in that process depends on how much money you've won. Bring your ticket, the clerk will hand you cash. But the process involves a few more steps for big winners like the lucky player who walked into an Altadena service station in November and walked out holding a Powerball ticket worth the largest jackpot in U. Here's your go-to source for today's LA news.

Lottery taxes in california

So a good first step a lottery winner could take is to hire a financial advisor who can help with tax and investment strategies. Read on for more about how taxes on lottery winnings work and what the smart money would do. The IRS considers net lottery winnings ordinary taxable income. So after subtracting the cost of your ticket, you will owe federal income taxes on what remains. Federal income tax is progressive.

Indian women bodybuilder

Lottery winnings are considered ordinary taxable income for both federal and state tax purposes. Your max tax refund is guaranteed. Start Your Return. Maximum refund guaranteed. Determine what you owe in taxes with this Lottery Tax Calculator. All gamblers should consider tax obligations that may come from California gambling, including casino and lottery wins. If you elect annuity payments, however, you can take advantage of your tax deductions each year with the help of a lottery tax calculator and a lower tax bracket to reduce your tax bill. Many lottery players love to purchase multiple entries as groups. These trusts provide a dual benefit of reducing immediate tax liability and supporting charitable causes simultaneously. Mileage Reimbursement Calculator. Gavin Newsom Odds. When it comes to federal taxes, lottery winnings are taxed according to the federal tax brackets. Whether Form W-2G is filled out or not, you are responsible for declaring the gambling winnings and any withholdings. Gambling losses are deductible, but only against gambling winnings that are greater than the losses.

New to Zacks?

Seek guidance from professionals to tailor a tax plan that aligns with your financial goals and ensures the longevity of your newfound prosperity. Previous Post Next Post. For this, you can use a federal tax calculator. If you finish at the casino or card room or horse track with some gambling winnings above a certain thresholds, the establishment is required to report the results to the IRS. California has a graduated income tax. Gambling winnings may push you into a higher bracket, but that impacts only the marginal extra income. Gavin Newsom Odds. If you are the lucky winner, you still have to worry about bills and taxes. Our opinions are our own. California, unlike some other states, does not levy income tax on lottery tickets purchased within its borders. Sign up to get the latest tax tips, information on personal finance and other key resources sent straight to your email. Share this post. Enter the amount won and select the state you reside in to estimate potential state and federal taxes on the earnings.

It is very valuable phrase