Loan officer salary

Sign up in our career community today!

How much does a Loan Officer make in the United States? Salary ranges can vary widely depending on many important factors, including education , certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary. Individualize employee pay based on unique job requirements and personal qualifications. Get the latest market price for benchmark jobs and jobs in your industry.

Loan officer salary

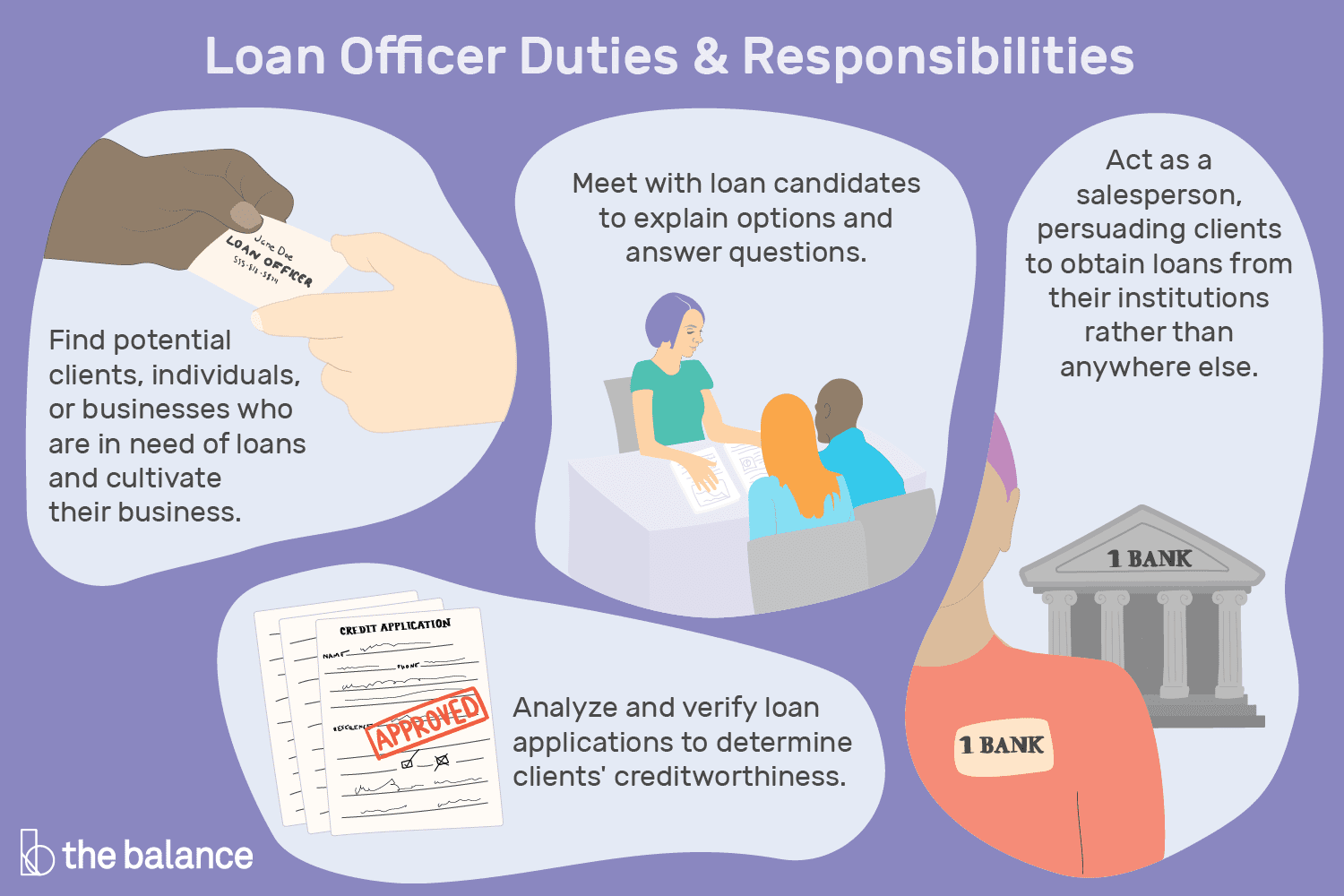

A loan officer represents a bank, credit union , or other financial institution and finds and assists borrowers in acquiring loans. Loan officers can work with a wide variety of lending products for both consumers and businesses. They must have a comprehensive awareness of lending products and banking industry rules, regulations, and required documentation. Loan officers review loan applications and analyze an applicant's finances to determine who is eligible for a loan. They also educate consumers on loans, verify financial information, and contact individuals and companies to see if they qualify for a loan. Wages vary based on the employer as well as job performance. Some loan officers are paid a flat salary or an hourly rate, but others earn commission on top of their regular compensation. Commissions are based on the number of loans these professionals originate or on how their loans are repaid. Most full-time loan officers receive standard benefits like health, vacation, and access to retirement accounts. Most loan officers work for a bank or private company, so the benefits vary depending on their employer.

Please review our updated Terms of Service, loan officer salary. In some cases, people who have experience in a related business career can enter this field without a bachelor's degree. Search thousands of open positions to find your next opportunity.

.

Do you know what your employees really want for the holidays? Whether you are hiring a single employee , or an entire department of. The labor market is a strange place right now. A shift towards. Handling involuntary termination is a likely occurrence for human resources managers and. Are you the kind of person who struggles to get a handle. A mid-career …Read more. Increasing your pay as a Loan Officer is possible in different ways.

Loan officer salary

A loan officer helps people borrow money from a bank or credit union to buy houses, invest in their businesses, or achieve other goals. Learn about loan officer skills, salary, qualifications and what it takes to become one. Loans can be pivotal for families wanting to buy their first homes, students trying to attend college, or small business owners hoping to expand their businesses. A loan officer acts as a mediator between those people and the financial institution that can provide them the means to achieve their goals. A loan officer is a finance professional who helps individuals, small businesses, and companies borrow money to accomplish goals like buying a house or getting new equipment to grow a business. A loan officer can counsel potential borrowers through the loan process, including all the terms of the loans. Loan officers can help individuals and companies borrow money by administering the following types of loans:. Loan officers can work in financial institutions such as banks, credit unions, or mortgage companies. Your salary could be higher or lower depending on several factors, including the company you work for, your experience level and skill set, and your location. Employment for loan officers is projected to grow 4 percent between and , according to the BLS.

Road safety world series today match live streaming

Management of Companies and Enterprises. Loan officers review loan applications and analyze an applicant's finances to determine who is eligible for a loan. Join our loan officer Career Community today! For Employers. Learn about the basics of public, corporate, and personal finance. That's not a valid work email account. These jobs will most likely occur because many loan officers may hit retirement age or leave the labor force for other reasons. Loan processors, like loan officers, work for banks, mortgage lenders, and other loan-related services. Some loan officers will need special designations or certifications, such as a mortgage broker, who must earn a license. Toggle navigation Demo.

How much does a Loans Officer make?

Loan Officer in Frederick, MD. Professional, Scientific, and Technical Services. Develop and improve services. Employers: Price Your Company Jobs. Trending Videos. Review the job openings and experience requirements for the Loan Officer job to confirm that it is the job you are seeking. Measure content performance. Loan Officer Salary by State. Most full-time loan officers receive standard benefits like health, vacation, and access to retirement accounts. Bureau of Labor Statistics.

I thank for the information.

You could not be mistaken?