Lifestrategy 80 equity fund accumulation

The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies.

Lifestrategy 80 equity fund accumulation

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested. The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index. The performance of the index reflects the reinvestment of Distribution and dividends but does not reflect the deduction of any fees or expenses which would have reduced total returns. Figures for periods of less than one year are cumulative returns. All other figures represent average annual returns. Performance figures include the reinvestment of all dividends and any capital gains distributions. The performance data does not take account of the commissions and costs incurred in the issue and redemption of shares. Allocation percentages reflect the breakdown of security type. Weighted equity exposures exclude any temporary cash investments and equity index futures. Some short-term fixed income securities are classified as cash and are excluded from the weighted bond exposures. Skip to main content.

Fund facts.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies.

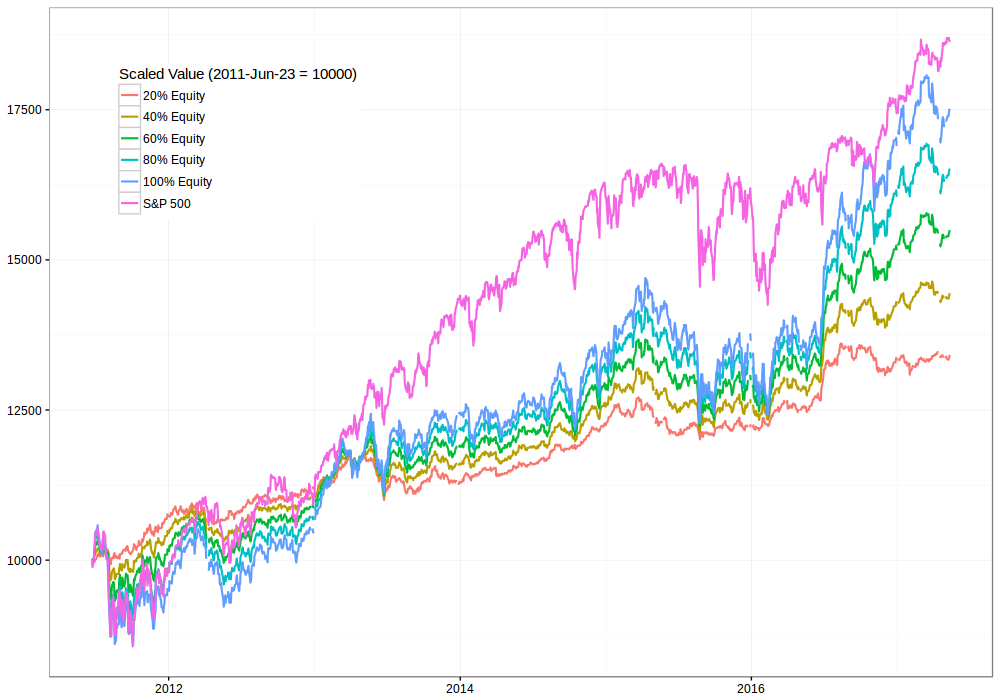

Decide how you want to divide your money between stocks and bonds—then let the fund do the work. Asset allocation—the mix of stocks, bonds, and cash held in your portfolio—can have a big impact on your long-term returns. So why not pick a fund with an asset allocation that fits your goals, time horizon, and risk tolerance? You may be interested in this fund if you care mostly about current income and accept the limited growth potential that comes with less exposure to stock market risk. You may be interested in this fund if you care about current income more than long-term growth, but still want some growth potential with less exposure to stock market risk. You may be interested in this fund if you care about long-term growth more than current income and want more growth potential while accepting higher exposure to stock market risk. You may be interested in this fund if you care about long-term growth and are willing to accept significant exposure to stock market risk in exchange for more growth potential.

Lifestrategy 80 equity fund accumulation

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech.

Corte de cabello ondulado hombre

Date range. Risk overview Volatility 1 year 7. Past performance is not a reliable indicator of future results. The performance of the index reflects the reinvestment of Distribution and dividends but does not reflect the deduction of any fees or expenses which would have reduced total returns. Total Assets. FT has not selected, modified or otherwise exercised control over the content of the videos or white papers prior to their transmission, or their receipt by you. Thursday, February 08, Thu, Feb 08, Back to main menu. Legal structure. Some short-term fixed income securities are classified as cash and are excluded from the weighted bond exposures. Income GBP. Annual charges Performance fee : No The figure will either be referred to as an ongoing charges figure OCF or a total expense ratio TER , depending on the type of fund.

This means our website may not look and work as you would expect. Read more about browsers and how to update them here.

Please note that even where a full saving is offered a dilution levy could be applied on the way in or out of the fund. How do you like our new ETF profile? Annual report EN. Contact us Log in. Investment structure. For more detailed information about these ratings, including their methodology, please go to here The Morningstar Medalist Ratings are not statements of fact, nor are they credit or risk ratings. Past performance of a security may or may not be sustained in future and is no indication of future performance. Date range. The value of investments, and the income from them, may fall or rise and investors may get back less than they invested. Allocation to underlying Vanguard funds -. Top 5 regions. Rolling 1 year volatility. Show more Personal Finance link Personal Finance. Read more about browsers and how to update them here.

I consider, that you are mistaken. I suggest it to discuss. Write to me in PM.

It is a pity, that now I can not express - it is compelled to leave. I will be released - I will necessarily express the opinion.

Actually. Tell to me, please - where I can find more information on this question?