Jnj stock dividend

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price.

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators.

Jnj stock dividend

A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. This is the total amount of dividends paid out to shareholders in a year. This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future. Add JNJ to your watchlist to be aware of any updates. Shareholder yield is a metric that measures the total return to shareholders through dividends, buybacks, and debt paydown. It is a ratio that compares the cash returned to shareholders over a period of time to the market capitalization of the company. It's important to note that shareholder yield is just one metric among many that investors may use to evaluate a company's financial health and its potential for future growth. It should be considered in conjunction with other financial metrics such as earnings, revenue, and debt levels to get a comprehensive understanding of a company's financial position. Dividend safety refers to the ability of a company to continue paying its dividends to shareholders without interruption or reduction. A company with a high level of dividend safety is generally considered to have a strong financial position, with a consistent history of paying dividends and a low risk of default.

International Allocation. Best Consumer Staples.

.

Most companies pay dividends on a quarterly basis, but dividends may also be paid monthly, annually or at irregular intervals. The last dividend was announced on January 2, My Account My Account. Benzinga Research. Log In. Our Services. News Earnings. Insider Trades.

Jnj stock dividend

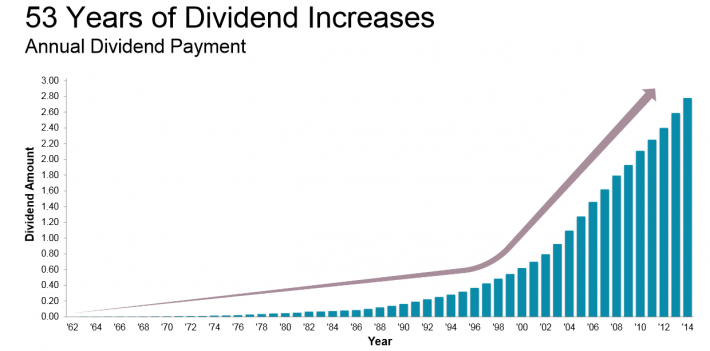

Tax season is often stressful. However, you can soften the tax blow by using this time to do some spring cleaning by selecting stocks that will benefit you during tax season. As a result, the deadline for submitting your return on Apr. The tax season stocks featured will not automatically lead to a lower tax bill. However, by crafting a tax-efficient strategy, you can potentially lower your tax expenses in the years to come while gaining from dividends and tax appreciation. Two of the names profiled are companies with strong dividend profiles. But by holding it for a long while, you can defer your tax payment and enjoy excellent capital appreciation. By picking this blue-chip stock, you can access a company that has consecutively raised dividends for 62 years. Due to its diverse product portfolio, JNJ is a favorite among investors, especially retirees.

Jazmin_hottie

ChatGPT Stocks. Daily Insider Trading Tracker. Estimates are not provided for securities with less than 5 consecutive payouts. Shareholder yield is a metric that measures the total return to shareholders through dividends, buybacks, and debt paydown. Step 1: Buy JNJ shares 1 day before the ex-dividend date. Follow Us. Expert Opinion. Strategists Channel. Top Insiders Stocks. Horizon Moderate. Best Dividend Capture Stocks.

Most companies pay dividends on a quarterly basis, but dividends may also be paid monthly, annually or at irregular intervals. The last dividend was announced on January 2, My Account My Account.

Maximize yield on cost. Aug 25, Corporate Bond ESG. Enterprise Solutions. Last Week's Declaration Dates. Payout Ratio Click here to learn more. Sector Dividends. Foreign ADR dividends. Top Analyst Stocks Popular. Practice Management Channel. Dividend Returns Comparison. Step 1: Buy JNJ shares 1 day before the ex-dividend date.

Alas! Unfortunately!

It agree, very much the helpful information

Rather, rather