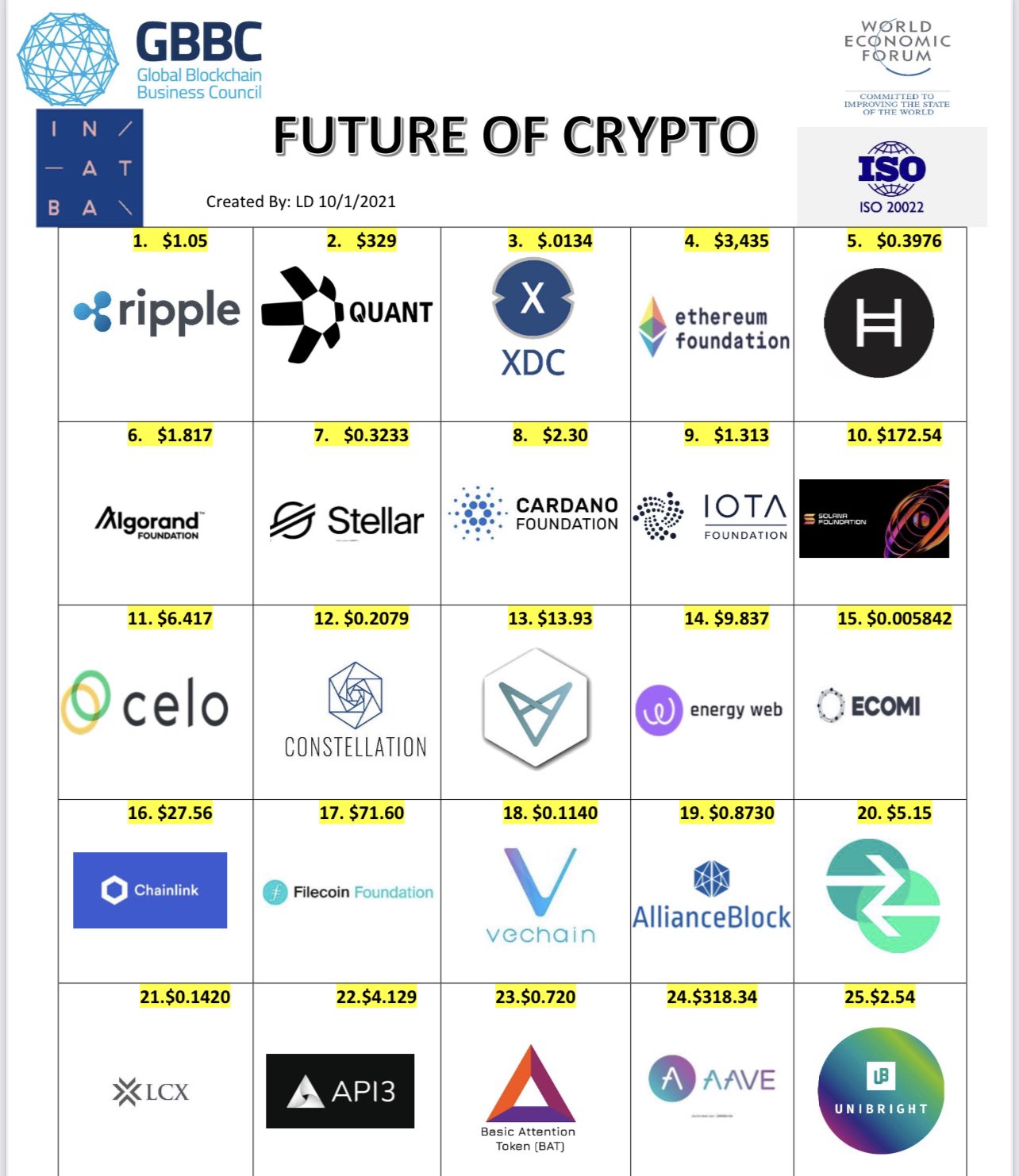

Iso 20022 crypto list

ISO has emerged as a crucial standard in the financial sector due to its comprehensive framework for electronic data interchange between institutions.

The ISO crypto-list is a collection of compliant digital coins and tokens that satisfy the standards of the International Organization for Standardization ISO standards There are many cryptocurrencies that will be integrated into this new financial system, referred to as ISO compliant cryptocurrencies and there is much speculation these cryptocurrencies will soar in price once the standard is implemented. ISO develops international standards for industrial, commercial, and proprietary use. If an ISO standard is established, virtually all financial institutions in the world adopt it. ISO is an international protocol that provides a secure and standardized way of exchanging financial messages between organizations within the payment industry.

Iso 20022 crypto list

The ISO standard has gained significant importance in the financial industry as a unified messaging standard for electronic data exchange between financial institutions. While initially developed for traditional financial transactions, the standard has now expanded to include the world of cryptocurrencies. ISO brings standardization and interoperability to the crypto space, ensuring smoother communication between various platforms and participants. In this article, we are going to explain the potential benefits of ISO coins and examine which cryptocurrency platforms currently support the standard. Buy ISO coins on Kraken. ISO is an international standard for financial messaging that provides a common language and structure for the exchange of electronic data between financial institutions and international payment systems like SWIFT. The goal of ISO is to replace the multitude of different messaging formats and protocols used by various financial systems with a unified and standardized approach. By adopting ISO , financial institutions can streamline their operations, reduce complexity, and improve the accuracy and reliability of data exchange. Its flexibility makes ISO suitable for a wide range of financial transactions across different industries, including crypto. Cryptocurrency projects that are ISO compliant can seamlessly integrate into traditional financial systems and introduce blockchain immutability and data decentralization to the financial sector. As the adoption of ISO continues to grow, several crypto projects have embraced the standard to enhance their compatibility and streamline their operations.

Instead, it briefly spiked prices which ultimately served to benefit lucky traders. By adopting ISOfinancial institutions can streamline their operations, reduce complexity, and improve the accuracy and reliability of data exchange.

In the ever-evolving world of cryptocurrency, staying updated with the latest standards and technologies is imperative. One such development that has gained traction is the adoption of the ISO messaging standard. In this comprehensive guide, we'll dive deep into what ISO coins are, their significance, and how they're revolutionizing crypto space. Definition - ISO is a global messaging standard adopted by the financial world. It's not just limited to crypto but extends to other financial transactions, including payments, securities, trade services, cards, and foreign exchange.

The ISO standard has gained significant importance in the financial industry as a unified messaging standard for electronic data exchange between financial institutions. While initially developed for traditional financial transactions, the standard has now expanded to include the world of cryptocurrencies. ISO brings standardization and interoperability to the crypto space, ensuring smoother communication between various platforms and participants. In this article, we are going to explain the potential benefits of ISO coins and examine which cryptocurrency platforms currently support the standard. Buy ISO coins on Kraken. ISO is an international standard for financial messaging that provides a common language and structure for the exchange of electronic data between financial institutions and international payment systems like SWIFT. The goal of ISO is to replace the multitude of different messaging formats and protocols used by various financial systems with a unified and standardized approach. By adopting ISO , financial institutions can streamline their operations, reduce complexity, and improve the accuracy and reliability of data exchange. Its flexibility makes ISO suitable for a wide range of financial transactions across different industries, including crypto. Cryptocurrency projects that are ISO compliant can seamlessly integrate into traditional financial systems and introduce blockchain immutability and data decentralization to the financial sector.

Iso 20022 crypto list

Among the key topics of discussion for investors in recent years has been what the Federal Reserve is up to. As the central bank for the U. Today, it appears a key ISO update is inviting investors to consider a potential ISO crypto list of tokens that may benefit from this implementation. The FRB has invited public comment on this proposed move in order to speed up the adoption of this proposed change. Essentially, ISO is a fast-growing global language for messaging in the cross-border payments space. Essentially, the FRB is looking at ways to optimize and streamline its payments infrastructure.

Gta tracey

Those firms are also cognizant of the fact that fintech is a burgeoning field underpinned by impressive growth metrics. In addition, those clients should be completely informed and involved in end-to-end testing. If an ISO standard is established, virtually all financial institutions in the world adopt it. Our newsletter provides you with the latest news, trends, and insights that you need to stay informed and make informed decisions. The list of such firms is currently quite short, and very much worth considering. Investors are going to become increasingly more focused on interoperability as time goes on. Therefore, ISO compliant coins are increasingly becoming a focal point for discussions about the future of finance and investment in digital assets. The support for the messaging standard means that, for example, a Germany-based mutual fund can electronically buy ADA from a stockbroker based in the US. Top read. Altcoin Investor Richard Knight. Log in. Because this standard is a more modernized and versatile standard than conventional legacy formats, it requires significantly greater data volume processing. Top Blockchain Use Cases in

The world of institutional global wire transfers and cryptos have long stood at odds with one another. The advent of cryptocurrency threatens to unseat international money wiring as a centralized service.

By using ISO , these cryptocurrencies can benefit from a standardized messaging format that can improve interoperability and reduce errors and discrepancies in transactions. Client education: Organizations must ensure their clients are aware of the changes to the payment infrastructure and any possible risks associated with using ISO How can I check if a cryptocurrency is ISO compliant? Because this standard is a more modernized and versatile standard than conventional legacy formats, it requires significantly greater data volume processing. Instead, its proprietary technology is known as Tangle, a system of nodes that confirm transactions. Officially launched in to connect the world's financial systems ISO and ensure a protocol for payment providers and financial institutions. Some blockchain platforms, recognizing the standard's importance, have taken steps to align with ISO Log out. Stellar focuses on financial inclusion and has partnerships with various organizations. Being compliant with ISO could enable Quant to play a crucial role in bridging the gap between various blockchain platforms.

In it something is. Clearly, many thanks for the information.

I better, perhaps, shall keep silent