Ishares bond ladder

Blackrock recently launched a suite of exchange-traded funds that make it easy to invest in Treasury inflation-protected securities government bonds that move in step with inflation and pay a fixed coupon rate on top of different maturities. All of the 10 new iShares iBonds ETFs — so-called target-maturity funds — come ishares bond ladder in different years and sport target dates that range between and

Each ETF provides regular interest payments and distributes a final payout in its stated maturity year, similar to traditional bond laddering strategies. The unique features of iShares iBonds ETFs can help you more easily build bond ladders, pick points on the yield curve, or even match expected cash flow needs in the future. Financial professionals can test drive the iBonds ETFs suite with our fully customizable bond laddering tool. Treasuries, U. TIPS, municipals, investment grade and high yield bonds. Whether you are looking for a conservative or aggressive strategy, iBonds ETFs has a solution to help you build a customized portfolio for your specific needs. When you are ready to purchase an iBonds ETF, we have tools to help you understand the estimated net acquisition yield of the fund.

Ishares bond ladder

The above results are hypothetical and are intended for illustrative purposes only. Fund expenses, including management fees and other expenses, were deducted. As a result of the risks and limitations inherent in hypothetical performance data, hypothetical results may differ from actual performance. Unlike an actual performance record, simulated results do not represent actual performance and are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk. There are frequently differences between simulated performance results and the actual results subsequently achieved by any particular fund. In addition, since trades have not actually been executed, simulated results cannot account for the impact of certain market risks such as lack of liquidity. There are numerous other factors related to the markets in general or the implementation of any specific investment strategy, which cannot be fully accounted for the in the preparation of simulated results and all of which can adversely affect actual results. Tax Distribution Characteristics: link. At least once each year, the Fund will distribute all net taxable income to investors. These distributions will either be paid in cash or reinvested in the Fund, as may be determined by BlackRock Asset Management Canada Limited from time to time.

All amounts given in Canadian dollars.

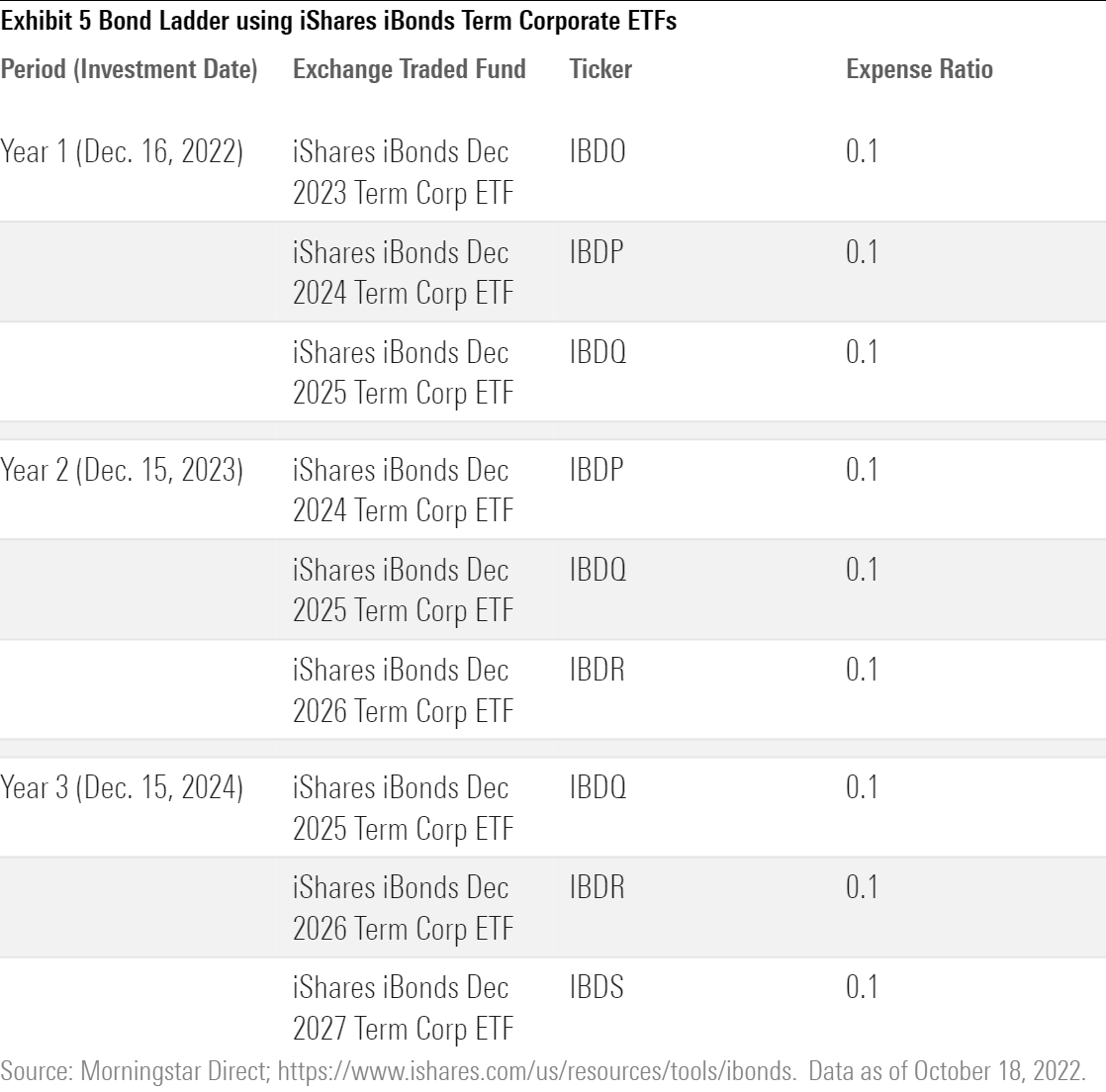

Bond-fund investors learned all too well in and again this year that the prices of existing bonds adjust downward as interest rates rise so that their yield matches that of new issues. Indeed, in its quest to combat inflation, the Federal Reserve has hiked its overnight bank lending rate by basis points since March Treasury bonds of all maturities, yields are now high enough that investors may want to consider bonds for their income if not their total return potential. Assuming inflation does not continue to surge, a bond ladder can help them do just that while preserving and even growing wealth amid rising rates. And they are easy to implement through defined-maturity, exchange-traded funds like those offered by iShares and Invesco.

Each ETF provides regular interest payments and distributes a final payout in its stated maturity year, similar to traditional bond laddering strategies. The unique features of iShares iBonds ETFs can help you more easily build bond ladders, pick points on the yield curve, or even match expected cash flow needs in the future. Financial professionals can test drive the iBonds ETFs suite with our fully customizable bond laddering tool. Treasuries, U. TIPS, municipals, investment grade and high yield bonds. Whether you are looking for a conservative or aggressive strategy, iBonds ETFs has a solution to help you build a customized portfolio for your specific needs. When you are ready to purchase an iBonds ETF, we have tools to help you understand the estimated net acquisition yield of the fund. The estimated net acquisition yield provides a yield estimate, net of fees and market price impact, if the fund is held to maturity. Anticipated investor YTM driven by monthly income distributions and end-date distributions. In the final months when the bonds in the portfolio mature, the fund's holdings transition to cash and cash equivalents.

Ishares bond ladder

Bond-fund investors learned all too well in and again this year that the prices of existing bonds adjust downward as interest rates rise so that their yield matches that of new issues. Indeed, in its quest to combat inflation, the Federal Reserve has hiked its overnight bank lending rate by basis points since March Treasury bonds of all maturities, yields are now high enough that investors may want to consider bonds for their income if not their total return potential. Assuming inflation does not continue to surge, a bond ladder can help them do just that while preserving and even growing wealth amid rising rates. And they are easy to implement through defined-maturity, exchange-traded funds like those offered by iShares and Invesco. A traditional bond ladder involves building a portfolio of individual bonds, typically noncallable, that mature at regular intervals and reinvesting the principal in a new longer-term bond every time the nearest-term bond matures. Assuming no defaults, a traditional bond ladder generates a predictable income stream and immunizes the portfolio against permanent losses—provided the bonds are held to maturity and redeemed at par.

Actress emilia

The above results are hypothetical and are intended for illustrative purposes only. MSCI has established an information barrier between equity index research and certain Information. Interactive chart displaying fund performance. Distributions Interactive chart displaying fund performance. Sustainability Characteristics provide investors with specific non-traditional metrics. There are some guidelines to writing a check for a wedding gift for newlyweds. Learn more This fund does not seek to follow a sustainable, impact or ESG investment strategy. To the extent that data becomes more readily available and more accurate over time, we expect that ITR metric methodologies will evolve and may result in different outputs. Holdings data shown reflects the investment book of record, which may differ from the accounting book of record used for the purposes of determining the Net Assets of the Fund. Privacy Policy.

Just as equity ETFs give investors access to baskets of stocks, bond ETFs do the same with the bond market, while offering similar benefits:. Bond ETFs simplify access to the bond market by making investing as easy as buying a stock. If you're looking for income, you may want to consider investing in bonds, given most make regular income payments in the form of coupons.

The ITR metric is not a real time estimate and may change over time, therefore it is prone to variance and may not always reflect a current estimate. All amounts given in Canadian dollars. Errors in respect of the quality, accuracy and completeness of the data may occur from time to time. Build bond ladders: iBonds ETFs make it is easy to create scalable bond ladders with only a few ETFs, rather than trading numerous bonds. An investment in the Fund s is not guaranteed, and an investor may experience losses, including near or at the termination date. Weighted Avg Coupon as of Feb 29, 3. Convexity as of Feb 29, Fees Fees as of current prospectus. In addition, apart from scheduled rebalances, index providers may carry out additional ad hoc rebalances to their benchmark indices in order to, for example, correct an error in the selection of index constituents. Diversify like a fund iBonds ETFs hold several bonds from different industries or states. Privacy Policy. For tax purposes, these amounts will be reported by brokers on official tax statements. Funds may change bands as methodologies evolve. The information displayed on this website may not include all of the screens that apply to the relevant index or the relevant fund. Trade like a stock iBonds ETFs can be bought and sold like a share of stock.

As it is impossible by the way.