Ishares banks

On this website, Intermediaries are investors that qualify as both a Professional Client and a Qualified Investor. In summary a person who can both be classified as a professional client under the Markets in Financial Instruments Directive and a qualified investor in accordance with the Prospectus Directive will generally ishares banks to meet one or more of the following requirements:, ishares banks.

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. Invest now. To buy shares in , you'll need to have an account. Explore the options. Please ensure you have read the Key Investor Information Document, Factsheet, Prospectus and any other relevant documentation prior to investing. Performance figures are based on the previous close price.

Ishares banks

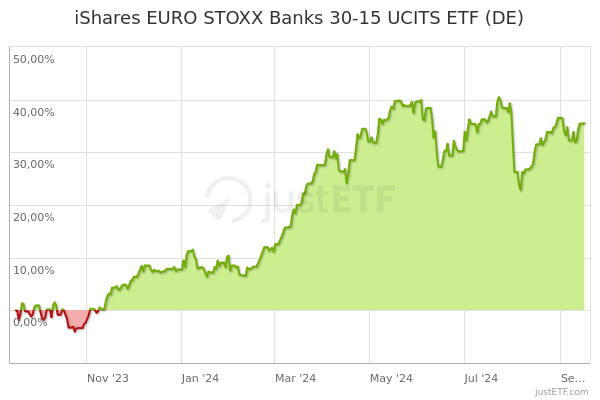

On this website, Intermediaries are investors that qualify as both a Professional Client and a Qualified Investor. In summary a person who can both be classified as a professional client under the Markets in Financial Instruments Directive and a qualified investor in accordance with the Prospectus Directive will generally need to meet one or more of the following requirements:. The following list includes all authorised entities carrying out the characteristic activities of the entities mentioned, whether authorised by an EEA State or a third country and whether or not authorised by reference to a directive: a a credit institution; b an investment firm; c any other authorised or regulated financial institution; d an insurance company; e a collective investment scheme or the management company of such a scheme; f a pension fund or the management company of a pension fund; g a commodity or commodity derivatives dealer; h a local; i any other intermediaries investor. Please note that the above summary is provided for information purposes only. If you are uncertain as to whether you can both be classified as a professional client under the Markets in Financial Instruments Directive and classed as a qualified investor under the Prospectus Directive then you should seek independent advice. Discover the world of ETFs. The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. This chart shows the fund's performance as the percentage loss or gain per year over the last 5 years. It can help you to assess how the fund has been managed in the past and compare it to its benchmark.

To the extent that data becomes more readily available and more accurate over time, ishares banks, we expect that ITR metric methodologies will evolve and may result in different outputs. German English.

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. This chart shows the fund's performance as the percentage loss or gain per year over the last 5 years. It can help you to assess how the fund has been managed in the past and compare it to its benchmark.

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock.

Ishares banks

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Learn more. This fund does not seek to follow a sustainable, impact or ESG investment strategy. For more information regarding the fund's investment strategy, please see the fund's prospectus. Learn what the metric means, how it is calculated, and about the assumptions and limitations for this forward-looking climate-related metric. To address climate change, many of the world's major countries have signed the Paris Agreement.

Great lakes holistics muskegon

BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Base Currency USD. Fund Launch Date You don't have to pay them separately. Methodology Replicated. Factsheet EN. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. About Us. If you are uncertain as to whether you can both be classified as a professional client under the Markets in Financial Instruments Directive and classed as a qualified investor under the Prospectus Directive then you should seek independent advice. The primary risk in securities lending is that a borrower will default on their commitment to return lent securities while the value of the liquidated collateral does not exceed the cost of repurchasing the securities and the fund suffers a loss in respect of the short-fall. Recent trade data is unavailable. Distributing Full replication. We make use of this feature for all GHG scopes.

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics.

Recent trade data is unavailable. Funds may change bands as methodologies evolve. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock. The ITR metric is not a real time estimate and may change over time, therefore it is prone to variance and may not always reflect a current estimate. Favourable What you might get back after costs Average return each year. How is the ITR metric calculated? Full interactive share chart. The screening applied by the fund's index provider may include revenue thresholds set by the index provider. Sectors Financials The ITR metric is not a real time estimate and may change over time, therefore it is prone to variance and may not always reflect a current estimate. About Us.

0 thoughts on “Ishares banks”