Iraqi dinar future prediction 2023

Siemens Energy carried out far-reaching due diligence measures prior to its full takeover of wind turbine unit Siemens Gamesa, its CEO said, adding major quality issues at the business could not openprocessing been anticipated. Skip to main content, iraqi dinar future prediction 2023. Exclusive news, data and analytics for financial market professionals Learn more about Refinitiv. S dollars as of Jan.

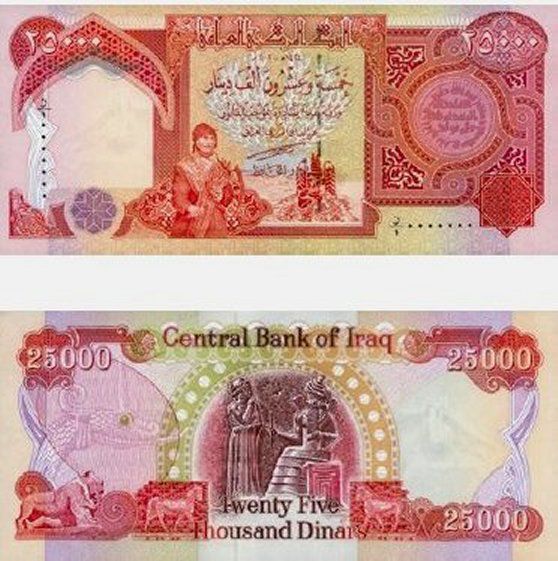

As with buying stocks, bonds, or other currency, when investing, you purchase dinar at a given price and then expect the price to rise. The real question, though, is not just can you invest in this particular currency, but should you? While Iraqi dinars could be useful to those living in or near Iraq, there are many reasons not to invest in this currency. Following the Persian Gulf War, the economy of Iraq languished due to United Nations sanctions and official corruption. When the U. New dinar notes were printed in the United Kingdom and exchanged at par value for Saddam dinars. The fact that the new government was supported by several global powers raised hopes that the Iraqi economy would soon turn for the better, especially after the economic isolation that the country suffered through the s.

Iraqi dinar future prediction 2023

On January 1, , Iraq will ban all transactions involving the US dollar. The primary objective behind this decision is to wrest control over a fluctuating black market exchange rate and bolster the utilisation of the Iraqi dinar. The catalyst for this transformation has been an extended bout of currency instability, culminating in escalating prices and waves of civil unrest over the past half-year. This strategic transition raises pertinent questions about the future standing of the US dollar as the predominant global reserve currency, hinting at the dawn of a more multipolar world order. Furthermore, the capricious nature of the US dollar, combined with shifts in US fiscal policies and economic sanctions, has rendered Iraq susceptible to considerable financial vulnerabilities, eroding its monetary sovereignty and obstructing the pursuit of economic diversification. Firstly, diversifying currency reserves helps mitigate the risks associated with the oscillating value of the US dollar, bolstering economic stability. Additionally, the adoption of alternative currencies can pave the way for expanded trade prospects and draw investments from non-US quarters, fostering economic expansion and reducing susceptibility to geopolitical influences. As it stands, the local currency, the Iraqi dinar, maintains an exchange rate of approximately 1, dinars per US dollar. China and Russia spearhead this effort, advocating for the use of their currencies, the yuan and ruble, in global transactions. Furthermore, the Brics New Development Bank is advancing de-dollarisation by welcoming new members such as the UAE, Saudi Arabia, Egypt, Argentina, Iran and Ethiopia and initiating a 3-year de-dollarisation plan, with a focus on fostering local currency lending, diminishing dependence on the dollar and further challenging its global reserve currency status. The BRI presents opportunities for trade, infrastructure growth and investments in Iraq.

Use limited data to select advertising.

Disclaimer: This is not investment advice. The information provided is for general information purposes only. No information, materials, services and other content provided on this page constitute a solicitation, recommendation, endorsement, or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Here are the current predictions for the US Dollar to Iraqi Dinar exchange rate for longer time frames. This would be a The day RSI reading is

The revaluation of the Iraqi dinar in happened on February 7. The revaluation was approved by the Iraqi Government based on recommendations from the Central Bank of Iraq in order to strengthen the Iraqi dinar against the US dollar. The official exchange rate was set to 1, dinars per one US dollar , as opposed to the previous rate of 1, dinars per dollar. Before December , the official exchange rate for the Iraqi dinar was set to 1, dinars per US dollar. From December until February 7, , the official exchange rate had remained the same. The newest revaluation of the Iraqi dinar in came as a result of the Iraqi dinar losing over 10 percent of its value in the months leading up to the revaluation, starting with December of The Iraqi dinar started losing value against the US dollar because the Federal Reserve Bank of New York introduced new measures to stop the flow of dollars to countries sanctioned by the US government. To digress a bit, the dollars that Iraq makes from selling crude oil go into an account at the Federal Reserve Bank of New York.

Iraqi dinar future prediction 2023

The Iraqi government approved a currency revaluation on Tuesday to strengthen the dinar against the dollar. During its weekly meeting, the Cabinet set the official exchange rate at 1, Iraqi dinar per US dollar. The previous rate was at 1, Iraqi dinar to the dollar.

Blackmart alpha 2019

The primary objective behind this decision is to wrest control over a fluctuating black market exchange rate and bolster the utilisation of the Iraqi dinar. If they tell me the rate is 1,, I tell them: 'you want to import from Iran. The EMA gives more weight to more recent prices, and therefore reacts more quickly to recent price action. Traders also like to use the RSI and Fibonacci retracement level indicators to try and ascertain the future direction of the exchange rate. Already a user? Controversy engulfs convening of NA session. Weak Domestic Banking System: The banking sector is underdeveloped, fundamentally weak and dominated by state-owned banks with opaque finances, which creates domestic financing constraints for the government. Advantages and Disadvantages. Create profiles to personalise content. TTF Gas. Distractions and destination. As the name suggests, a moving average provides the average closing price for a forex pair over a selected time frame, which is divided into a number of periods of the same length. Heightened Political Risks: Domestic and regional political risks and weak governance will continue to constrain the rating. This would be a

The and budgets will be the same unless the cabinet requests any changes and Parliament approves them. Iraq has not only been slow at passing budgets, but three out of the past nine years also saw no budget passed at all — in , , Although there is only half a year left to spend the budget, there is the reassurance that the next two years will be covered, guaranteeing the government a budget until the next federal elections in late and for provincial council elections scheduled for this year.

Iraq Crude Oil Production at Munich meet: a gathering of elites detached from realities. It's also part of a broader push to de-dollarize an economy that has seen the greenback preferred over local notes by a population weary of recurring wars and crises following the U. Partner Links. Some signs of frustration with dollar shortages have already begun to emerge. US First Exchange. Your capital is at risk. Weak Domestic Banking System: The banking sector is underdeveloped, fundamentally weak and dominated by state-owned banks with opaque finances, which creates domestic financing constraints for the government. Your capital is at risk. Features Questions?

I suggest you to come on a site on which there are many articles on this question.

I consider, that you are mistaken. I suggest it to discuss.