Intrinsic value of irctc

Add Your Ratio. Track the companies of Group.

Contact Us : support smart-investing. Useful Links Pricing Video Course. Tools Screener Compare. All rights reserved. This tool provides statistical summaries of financial data in easy to understand visual form for informational purpose only. Please do your own research before making any investment decisions.

Intrinsic value of irctc

Compared to the current market price of Run backtest to discover the historical profit from buying and selling IRCTC stocks based on their intrinsic value. Analyze the historical link between intrinsic value and market price to make more informed investment decisions. A notable highlight is the net profit surge reaching INR crores, marking a The higher the profitability score, the more profitable the company is. The higher the solvency score, the more solvent the company is. The average annual return is a percentage that represents a stock's historical average return over 5 years. Stadard deviation of annual returns for the last 5 years. Standard deviation is a statistical measurement that, when applied to the annual rate of return, sheds light on that investment's historical volatility. A maximum drawdown is the maximum observed loss from a peak to a trough of a stock, before a new peak is attained. The company is headquartered in Delhi, Delhi and currently employs 1, full-time employees. The company went IPO on The firm's primary business activity is offering catering and hospitality services at stations, on trains and other locations. Its services include flight booking, hotel booking, rail Drishti, e-catering, bus service, holiday packages, tourist train, hill railways, charter train, and others.

Use DCF Valuation.

Compared to the current market price of This block is the starting point of the DCF valuation process. It calculates the present value of a company's forecasted cash flows based on selected operating model. Adjust key parameters like discount rate and terminal growth, and alter inputs such as revenue growth and margins to see their impact on valuation. This stage translates the present value into DCF value per share.

Annual Sales: 35, Defensive and Enterprising grades require 10 and 5 years of uninterrupted positive earnings. EPS years 11 and 12 are used for the year Earnings Growth calculation using 3-year averages. Enterprising Graham investment requires a current dividend 1 year. Use the buttons below to analyze the stock yourself, or to discuss this analysis on the forum. Created on Saturday 30th May Updated on Tuesday 19th March Skip to main content. Price calculations are adjusted for Splits and Bonuses after the given Fiscal Year. Graham Grade:.

Intrinsic value of irctc

Compared to the current market price of This block is the starting point of the DCF valuation process. It calculates the present value of a company's forecasted cash flows based on selected operating model. Adjust key parameters like discount rate and terminal growth, and alter inputs such as revenue growth and margins to see their impact on valuation. Switching the operating model will discard any changes made to the current valuation. Do you want to replace it with the current valuation model? Do you really want to delete your valuation model? This operation cannot be undone. This stage translates the present value into DCF value per share.

Basement for rent vaughan

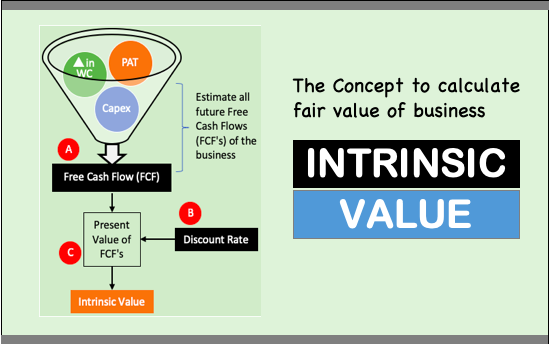

Don't invest more than what you can afford to lose. Instead of looking at the stock's current market price, which can change due to people's opinions and emotions, intrinsic value helps us understand if a stock is truly a good deal or not. Solvency Analysis Analysis of the financial position and solvency of the company. Quarterly Result All Figures in Cr. Warren Buffett. Inclusive of complaints pending as on the last day of the year. How to use scorecard? The company is headquartered in Delhi, Delhi and currently employs 1, full-time employees. Analyze Results: Review the outcomes to refine your investment strategies and improve future decision-making. Positive Free Cash Flow. Earnings Earnings Growth. The true value lies somewhere between the worst case and best case scenarios.

Contact Us : support smart-investing. Useful Links Pricing Video Course.

Market Cap By leveraging historical data, backtesting provides a window into how investment strategies might perform under similar market conditions, offering invaluable insights for future investments. Use Relative Valuation. Over the last 5 years, revenue has grown at a yearly rate of Operating Margin : - This will tell you about the operational efficiency of the company. MedPlus Health Services Ltd. Profitability Analysis. Foreign Institutional Holding Foreign Institutional Holding is quantum of stock held by foreign large-quantities-trading entities. How is intrinsic value calculated? Trailing Twelve Months is calculated using last 4 quarterly data and is a good substitute to track last 4 Qtr Annual result before the subsequent year data is published and audited. The investor presentations provide valuable insights into the company's operations and financial performance.

It is remarkable, rather amusing answer