How to use rsi on tradingview

This guide will walk you through the process of adding and customizing the RSI indicator on TradingViewa leading platform for market analysis. The RSI, developed by J. Welles Wilder, is a momentum-based oscillator that measures the speed and change of price movements.

You can use various indicators in TradingView to create the right trading strategy for intraday or positional-based long-term investment. There are various technical indicators but you can use the best indicators in TradingView that are most popular and effective in terms of giving the right signal. RSI is one of the best indicators in TradingView. Today we are going to discuss how to add, use, and rest RSI indicators with the right strategy in TradingView. Relative Strength Index RSI is one of the best momentum-based oscillators used to measure the speed velocity as well as the change magnitude of directional price movements in the stock or market index. Along with giving the visual strength and weakness of the market, it also shows whether the stock price or market index is trading in an overbought or oversold zone. Formula and Strategy.

How to use rsi on tradingview

Our RSI-based trading strategy will seek reversals in the overbought and oversold zones. Our Long signal will be when the RSI exits the oversold zone. Our Short signal will be when the RSI exits the overbought zone. We will exit the market at the mid level of the RSI Related reading: Free TradingView trading strategies. TradingView is one of the most widely used technical analysis platforms today due to its easy and intuitive interface, great data visualization capabilities, and above all, it can be used completely free, although with some limitations. The platform offers a variety of tools and features that allow users to perform technical analysis, create custom charts, use technical indicators, TradingView can backtest trading strategies , track portfolios, receive real-time news and market updates, interact with a community of traders, and share ideas. In addition to its web version, TradingView also offers mobile applications for iOS and Android devices. In the context of this article, we will focus on the tools that TradingView web allows us to use for free. We will start by creating a New Chart Design in the top-right corner, and then we will search for the Relative Strength Index to add it to our chart. The indicator will appear at the bottom of our chart with its default parameters.

The equity curve shown by TradingView is limited to the amount of data displayed on the chart, meaning there is a limit to the historical candles shown, and TradingView applies our strategy based on this. First Name Email Id Mobile.

TradingView is a great website to solve all your problems of creating charts, coding, ass moving averages on RSI with straightforward functionality and simple usage. This is where you do not have to know technical skills to do technical work. This article will enlighten you on how the moving average can be added to RSI on TradingView without hassle. You can now go ahead to alter the settings of the RSI and the Moving Average if you did not do it earlier. Ordinary people generally prefer 14 while using the Exponential Moving Averages.

Introduction The realm of futures trading offers a spectrum of opportunities, and at the forefront of this dynamic market are the E-mini Nasdaq Futures. Designed to track the Nasdaq index, these futures contracts have become a favorite among traders who focus on technology and growth-oriented companies. The Nasdaq , dominated by technology giants, serves I know that the topic of moving averages has been fairly explained in crypto and other trading markets, and every trader has a good knowledge, and usage cases for them, but here I will share my own view of the moving averages, and how I use them for trading without relying on technical or educational sources by any means. Starting with a recap on the main idea Building a long-term portfolio demands a strategic approach that goes beyond random buys and impulsive decisions. Instead, savvy investors employ tools like the Relative Strength Index RSI to identify advantageous entry points and navigate the market cycles effectively. RSI, as conventionally understood, does not oscillate between This idea explains the RSI behaviour during bear market phase.

How to use rsi on tradingview

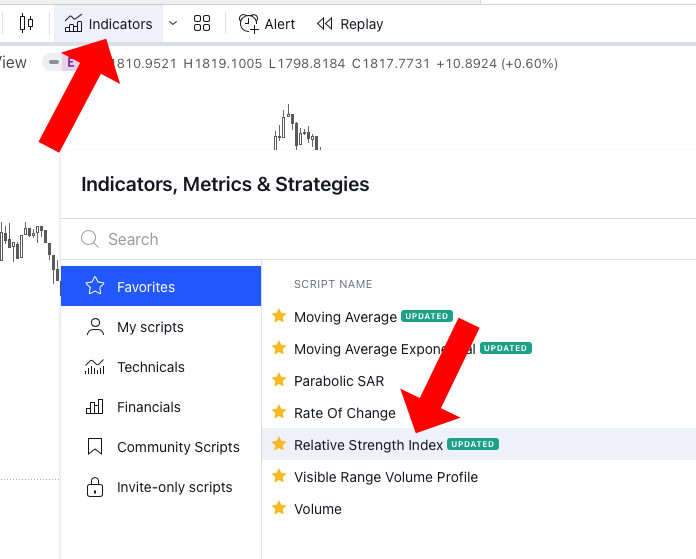

Today, we're diving into one of the most popular tools used by traders around the globe — the RSI Indicator, or if you are fancy, the Relative Strength Index. We will be specifically focusing on how to use it in TradingView. Whether you're a seasoned trader or just starting out, understanding the RSI Indicator can significantly enhance your trading game. Select the first indicator named 'Relative Strength Index', and it will appear at the bottom of your chart. The RSI is a momentum indicator, measuring the speed and change of price movements. It moves between zero and Generally, when the RSI is above 70, it may indicate that an asset is overbought, while an RSI below 30 might suggest an oversold condition. In the trading world, 'overbought' refers to a situation where prices have risen more than the market average.

Enact synonym

Specifically, RSI operates between a scale of 0 and The simple way to go about it is to break down the candles to the per day number and multiply it by However, you can manually change the parameters in RSI from the variety of numbers of days as per your day trading strategy. For RSI settings, follow the steps given below. Why does it concern you, and can you outsmart it? Using multiple indicators would aid you in reaching more and better confirmations. Such systems bring precision, discipline, and efficiency to trading by mostly eliminating emotional biases,…. Can toggle the visibility of the Upper Bollinger Band well as the visibility of a price line showing its value. The positive reversal happens when the price touches a higher low while the RSI goes downat a lower low. The standard setting of RSI is set at 14; however, as time passes, you get acquainted with the Daily charts and might want to experiment with new things that work best for you.

Our RSI-based trading strategy will seek reversals in the overbought and oversold zones. Our Long signal will be when the RSI exits the oversold zone.

Though the price continues to rise, positive reversals can occur when there is a bullish trend in the stock price and market index. Step 3: For another option to remove RSI, move your mouse to the three dots on the indicator menu. If you are looking for a quick-fire, you must set up the RSI either higher than 80 or lower than Only applicable when Bollinger Bands are selected as the MA Type in the Inputs section, otherwise the bands will not appear even if this is selected. The color, line thickness and line style can also be determined. Get a Free Trial. Step 4: Now type the full name of the indicator RSI you are looking for. Options Trading. For example, someone might consider any number above 80 as overbought and anything below 20 as oversold. Wilder believed that Bearish Divergence creates a selling opportunity while Bullish Divergence creates a buying opportunity. Like strategy. Related Posts. Join over 50 million traders who trust TradingView! Get a TradingView Free Trial. Introduction to Automated Trading Systems Automated Trading Systems abbreviated ATS are computer programs that execute buy and sell orders in financial markets automatically, following predetermined algorithms.

Completely I share your opinion. In it something is and it is good idea. It is ready to support you.

You have quickly thought up such matchless phrase?