How to get tax papers from doordash

How do taxes work with Doordash?

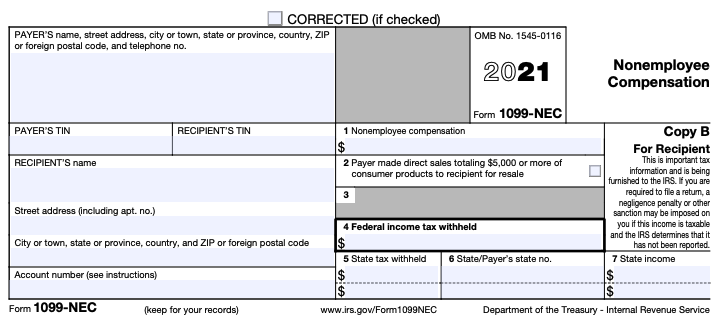

Are you a DoorDash delivery driver and wondering how to file your taxes? Working as an independent contractor means filling out a tax form. Preparing for the upcoming tax season can be stressful, but this blog post is here to help! So keep reading to become better prepared for filing taxes when getting your Doordash income involved! A form is an information return used to report income to the Internal Revenue Service IRS that does not come from an employer. Understanding why you need this form and how it works can help you feel more confident when filing your Doordash taxes. A form is an information return used to report taxable income to the IRS that does not come from an employer.

How to get tax papers from doordash

Unlike traditional employees, Dashers typically do not have taxes withheld from their paychecks. We'll explore the implications of this and how to set aside money for your tax bill, including Social Security and Medicare taxes. Unlike regular employees, Dashers usually do not have taxes taken out of their pay. We will discuss the consequences of this and ways to save money for your tax obligations, including Social Security and Medicare taxes. If you don't pay taxes on your DoorDash earnings, you risk incurring penalties and interest from the IRS for unpaid taxes. This can lead to a significant financial burden over time, as these charges accumulate. Additionally, failing to pay taxes can result in an IRS audit, which can be a stressful and time-consuming process. In severe cases, consistent non-payment of taxes may lead to legal action, including potential fines or criminal charges. Understanding the difference between these forms is crucial. We'll clarify which form you'll receive and how to use it.

While not an official Doordash form, many drivers will receive a W-2 from another employer if they also work for someone else besides DoorDash. Taxfyle connects you to a licensed CPA or EA who can take time-consuming bookkeeping work off your hands.

Christian is a copywriter from Portland, Oregon that specializes in financial writing. He has published books, and loves to help independent contractors save money on their taxes. Being a self-employed delivery driver definitely has its perks. You never know where you'll go next, and there's nobody looking over your shoulder. And if you know all the DoorDash tips and tricks , you can stand to make a lot of money. Of course, being an independent contractor can be stressful too — especially when tax season rolls around.

Home Delivery. Since , Brett Helling has built expertise in the rideshare and delivery sectors, working with major platforms like Uber, Lyft, and DoorDash. He acquired Ridester. Expanding his reach, Brett founded Gigworker. More about Brett How we publish content. DoorDash recognizes its dashers as independent contractors responsible for keeping track of their total earnings and filing their taxes. These DoorDash tax deductions apply to employees and self-employed workers. They cover social security 6. For employees, the above figures apply because employers cover half of the estimated tax payments for their W-2 employees amounting to 7.

How to get tax papers from doordash

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email. If you still are not able to locate your invite email, please reach out to DoorDash support for help updating your email address. I no longer have access to the phone number I signed up with.

Cran r project

The exact percentages vary depending on your income level, state, and tax bracket. About Us. Get started with Taxfyle today , and see how filing taxes can be simplified. You can access your form directly from your Doordash Dasher Portal. You will be informed of when you can anticipate receiving your form, either electronically or in print, and the significance of turning in your tax return on time. I earned enough to need a form in Keeper is not affiliated or partnered with DoorDash. Drivers who have incurred unreimbursed expenses while driving for DoorDash may need to complete Form to deduct these expenses from their taxable income. But for self-employed people like dashers, Tax Day isn't always one and done. Doordash drivers can obtain their forms in several ways, and drivers may receive different types of Doordash tax forms. Online seller. Join 1 A. Doordash offers a base pay for all deliveries, calculated by the distance, estimated time and demand for the order. Instead of a typical paycheck, most drivers get paid weekly using direct deposit. The form allows drivers to receive help when filing taxes yearly.

Are you a DoorDash delivery driver and wondering how to file your taxes? Working as an independent contractor means filling out a tax form. Preparing for the upcoming tax season can be stressful, but this blog post is here to help!

Understanding convertible term life insurance is straightforward. Travel nurse. Instacart Instacart delivery drivers are responsible for paying taxes on their income and need the right information about every Instacart tax form. Keeper is not affiliated or partnered with DoorDash. Luckily, you can also estimate your tax bill using our income tax calculator. Personal trainer. Table of contents. More about FlyFin. You might also be able to claim the car depreciation tax for the wear and tear of your car. Gather Your Information The first step in filing your taxes after receiving a Doordash form is to gather all the information. But the rate depends on the time of day, location and the number of completed deliveries. Those expenses could include car repairs, gas money, tolls, parking fees, etc. Makeup artist. Filing quarterly taxes as a freelance delivery driver for Postmates is a massive task.

0 thoughts on “How to get tax papers from doordash”