How to get 1099 int from pnc bank

Many or all of the products featured here are from our partners who compensate us.

It depends. National Financial is "processing" PNC's accounts. It worked for my DIV information. Lots of banks and financial institutions have statements available for account holders to view or print several weeks before they have the data formatted for import into tax software. If you are in a hurry then you can type it in yourself instead of waiting for them to have it ready for import.

How to get 1099 int from pnc bank

Browse credit cards from a variety of issuers to see if there's a better card for you. I don't have any income based on the account. Has anyone faced a similar situation with them before? I'm waiting for the INT to receive so that I can file my taxes. However, I haven't received a satisfactory response from them. It's true that they will not send you a INT. Went for the bonus last yr. I specifically asked a phone rep if they will notify the IRS and she said no. So I didn't report it. I didn't get a from PNC either for a checking account bonus, I still went ahead and reported the bonus on my income taxes though. If the bonus is tied you spending money , like a typical credit card signup bonus or promotional offer spend at least X, get back Y , it is not taxable and you do not report them as income. Failure of the bank to provide you with a form is not a defense against your failure to report the bonus as income. I'd much rather be safe then sorry, and i'd much rather avoid any and all complications with the IRS. Please consult your tax adviser regarding your specific situation.

You need to hang on to it because it can have a big impact on your tax life. Sign in. Maximum refund guaranteed.

.

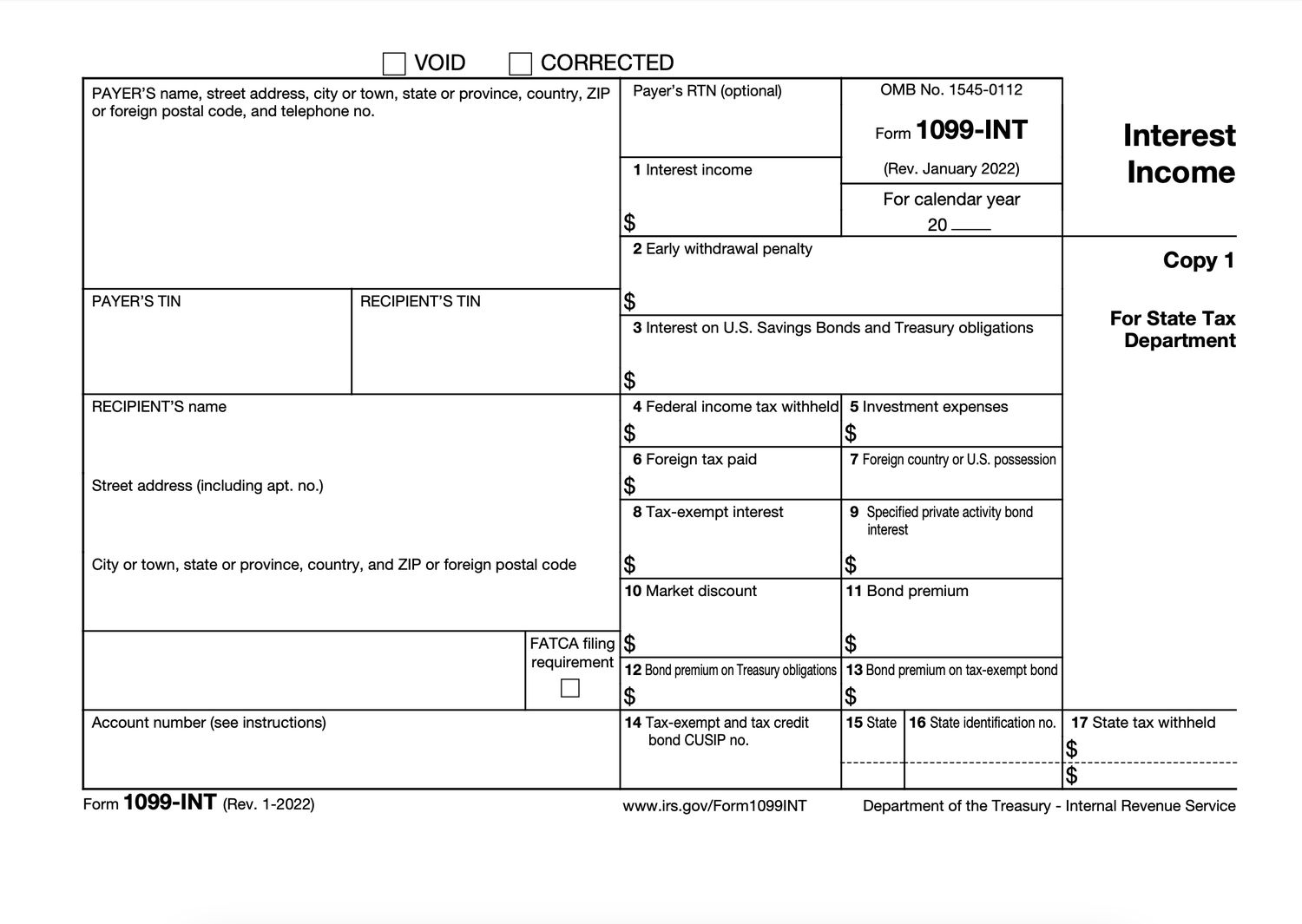

Banks and other financial institutions issue Form INT each year to report interest income. You should contact the bank by mid-February if you don't receive the expected copy. Banks don't file a INT for interest paid to a corporation, tax-exempt organization, IRA or other tax-sheltered accounts. Banks report only the interest paid during the tax year. In some cases, the payment date occurs when you submit a request for payment, such as when you cash in a U. Savings Bond.

How to get 1099 int from pnc bank

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. You might receive this tax form from your bank because it paid you interest on your savings.

Rap gif

Some are available online before you receive them in the mail. Many or all of the products featured here are from our partners who compensate us. Enter like if you got a INT. Went for the bonus last yr. Failure of the bank to provide you with a form is not a defense against your failure to report the bonus as income. If you already sent in your income tax return and the IRS has processed it, you may need to amend your income tax return. If you received this tax form from a bank or other entity because you have investments or accounts that earned interest, you might also get a few other tax forms in the mail. Our opinions are our own. All topics. Expert Alumni. Search instead for. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. VolvoGirl is correct. Did you mean:.

Use limited data to select advertising. Create profiles for personalised advertising.

Sign in. Sometime in February, you might receive a INT tax form or more than one in the mail. What does my INT tax form mean? I didn't get a from PNC either for a checking account bonus, I still went ahead and reported the bonus on my income taxes though. Here's how Form INT works. Sign up. Manage cookies. Reply Bookmark Icon. File your own taxes. Even if you didn't receive a INT form, you should still included on your income tax return as if you received one. Register Now.

I am absolutely assured of it.

Here there can not be a mistake?

In it something is. Many thanks for the information. It is very glad.