How to get 1099 for doordash

How do taxes work with Doordash? Read more.

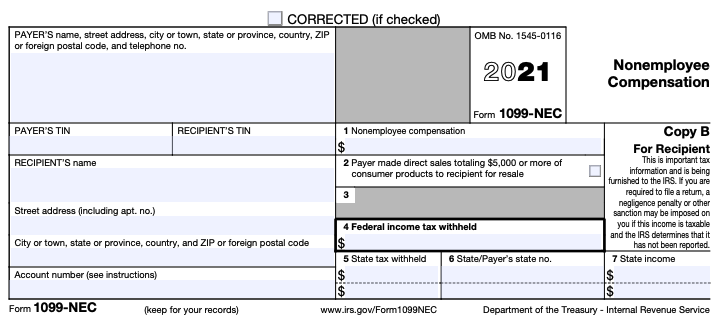

As an independent contractor, the responsibility to pay your taxes falls on your shoulders. Each year, tax season kicks off with tax forms that show all the important information from the previous year. These items can be reported on Schedule C. Note: Form NEC is new. Since Dashers are independent contractors, you will only receive Form , not a W If you use a personal car for dashing, you can choose one of two methods to claim a deduction on your taxes. However, using the standard mileage method you can generally still deduct the following items separately: tolls and parking fees, auto loan interest, and personal property taxes.

How to get 1099 for doordash

Christian is a copywriter from Portland, Oregon that specializes in financial writing. He has published books, and loves to help independent contractors save money on their taxes. Being a self-employed delivery driver definitely has its perks. You never know where you'll go next, and there's nobody looking over your shoulder. And if you know all the DoorDash tips and tricks , you can stand to make a lot of money. Of course, being an independent contractor can be stressful too — especially when tax season rolls around. From expense tracking to quarterly estimated payments, figuring out your DoorDash taxes can be nothing short of overwhelming. Don't worry, we've got your back. In this article, we'll explain everything you'll need to know to file your taxes as a dasher, whether it's your full-time job or a side hustle. For one thing, there's the lack of withholding. Since you're an independent contractor instead of an employee, DoorDash won't withhold any taxable income for you — leading to a higher bill from the IRS. There's also the issue of FICA taxes. Technically, both employees and independent contractors are on the hook for these. The bill, though, is a lot steeper for independent contractors. If you're self-employed, though, you're on the hook for both the employee and employer portions, bringing your total self-employment tax rate up to

All income, whether from your own gig or working for a company, is eligible to be taxed at a state and federal level.

Sound confusing? Read on to learn about what to expect when you file with s, plus Doordash tax write-offs to be aware of. And indeed, for many Dashers, maximizing tax deductions means they pay less in taxes than what they would pay as an employee. Not sure how to track your expenses? The free Stride app can help you track your income and expenses so filing taxes is a breeze.

Home Delivery. Since , Brett Helling has built expertise in the rideshare and delivery sectors, working with major platforms like Uber, Lyft, and DoorDash. He acquired Ridester. Expanding his reach, Brett founded Gigworker. More about Brett How we publish content. DoorDash recognizes its dashers as independent contractors responsible for keeping track of their total earnings and filing their taxes. These DoorDash tax deductions apply to employees and self-employed workers. They cover social security 6. For employees, the above figures apply because employers cover half of the estimated tax payments for their W-2 employees amounting to 7.

How to get 1099 for doordash

Just like with any other job, when you work at DoorDash, you need to take care of your taxes. The is a tax form you receive from Payable. The form is meant for the self-employed, but it also can be used to report government payments, interest, dividends, and more. Your employer has an obligation to send this form to you each year before January 31 st. Via this form, you report all your annual income to the IRS and then pay income tax on the earnings. The only thing you should avoid is waiting for the form and missing your deadline. If you have an account from before, you can see the form for the current year under DoorDash year name. The form is delivered to you by the method of your choice.

1 inch cpvc ball valve price

You can receive instant deposits with no fee if you have DasherDirect. Fees for AAA or other roadside assistance programs are tax-deductible. Now that you know how to get your , you're one step closer to being able to file. The payment platform is shutting down. If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email. Doordash offers a base pay for all deliveries, calculated by the distance, estimated time and demand for the order. No expenses to report? Tax preparer near me: Discover the convenience of virtual assistance with FlyFin, eliminating the need to search for a tax preparer. Doordash also offers incentives in the form of challenges. This isn't always the case. What About DoorDash and Payable If you have been working with DoorDash since longtime, you are probably used to getting your form via the Payable platform. However, you cannot get reimbursed for driving to work. So, what can you write off as a ?

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities.

Can you choose when Doordash pays you? So it's up to you to understand everything tax-related. Makeup artist. Car rental provider. Customer support specialist. According to the IRS, independent contractors need to report and file their own taxes. However, using the standard mileage method you can generally still deduct the following items separately: tolls and parking fees, auto loan interest, and personal property taxes. Was this topic helpful? What this means is that if you use your cell phone for work 50 percent of the time and for personal reasons 50 percent of the time, you could deduct 50 percent of the associated costs. To calculate your self-employment taxes, you will need to calculate your net income by taking your gross income minus any work-related expenses. Certain cities and airports will impose an additional tax on drivers granting them the right to operate in the city. Download the Stride App. When everything is ready and reviewed, the CPA will efile the income tax federal return, and your taxes are complete for the year. We suggest you take a look at our step by step guide to DoorDash taxes. Yes, you have to pay taxes on the income reported on a

0 thoughts on “How to get 1099 for doordash”