Hourly rate paycheck calculator

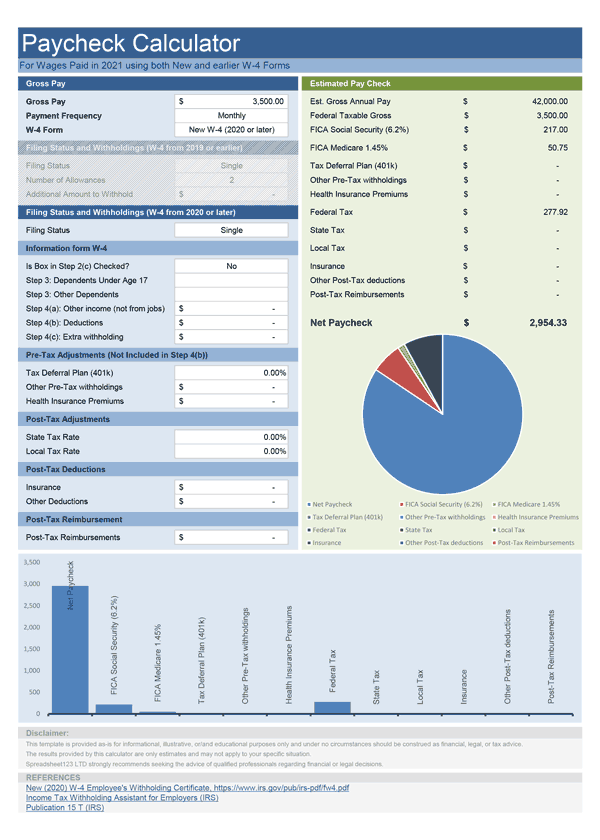

Input your income details and see how much you make after taxes. Calculate a bonus paycheck tax using supplemental tax rates, hourly rate paycheck calculator. Calculate net-to-gross: find out how much your gross pay should be for a specific take-home pay. Calculate the gross wages based on a net pay amount.

You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold. For , you need to make less than:. If you are 65 or older, or if you are blind, different income thresholds may apply. Check the IRS Publication for current laws. You might receive a large tax bill and possible penalties after you file your tax return.

Hourly rate paycheck calculator

Salary to hourly wage calculator lets you see how much you earn over different periods. It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck, recalculate monthly wage to hourly rate, weekly rate to a yearly wage, etc. This salary converter does it all very quickly and easily, saving you time and effort. In the article below, you can find information about salary ranges, a closer look at hourly and annual types of employment, as well as the pros and cons for each of these. Moreover, you can find a step-by-step explanation of how to use this paycheck calculator down below. Prefer watching over reading? Learn all you need in 90 seconds with this video we made for you :. Looking for a new job is a tough and stressful task. You need to change your community, coworkers, place, and even habits. But a job change can be essential for your career at a certain time. You will be better off if you face and overcome these difficulties.

Looking for managed Payroll and benefits for your business? When a salaried employee is classified as non-exempt under Fair Labour Standardsan employer has to pay one and a half for each extra hour over standard 40 per week. Resources for unions in dispute.

This form is for calculating your annual, monthly, weekly, daily and hourly rates of pay. Please only enter the values for the time you are supposed to work. About unions. Workplace guidance. About the TUC. Not sure which union is right for you? Wondering what the fuss is about?

Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator:. This powerful tool can account for up to six different hourly rates and works in all 50 states. See frequently asked questions about calculating hourly pay. To protect themselves from risk and navigate compliance rules, many employers choose to work with a payroll service provider , who can automate paycheck calculations. Learn more about how to calculate payroll.

Hourly rate paycheck calculator

All residents and citizens in the USA are subjected to income taxes. Residents and citizens are taxed on worldwide income working overseas, etc. In contrast, nonresidents are taxed only on income within the jurisdiction. The month period for income taxes begins on January 1st and ends on December 31st of the same calendar year. The federal income tax rates differ from state income tax rates. Federal taxes are progressive higher rates on higher income levels. At the same time, states have an advanced tax system or a flat tax rate on all income.

Amzn stock ticker

Grams to cups The grams to cups converter converts between cups and grams. When talking about payments in specific job positions, we often use the term salary range. Salary range Hourly rate vs. When completing this form, employees typically need to provide their filing status and note if they are claiming any dependents, work multiple jobs or have a spouse who also works for married filing jointly purposes , or have any other necessary adjustments. It can also lead to a shifting number of work hours weekly monthly, etc. If you work for yourself, you need to pay the self-employment tax , which is equal to both the employee and employer portions of the FICA taxes Options to unsubscribe and manage your communication preferences will be provided to you in these communications. States have their own state withholding forms too. By default, the week is 40 hours long, but you can freely configure it according to your needs. It's your employer's responsibility to withhold this money based on the information you provide in your Form W Use the dual scenario salary paycheck calculator to compare your take home pay in different salary scenarios. Some have specific requirements about the information that has to be included on the pay statement and when it must be delivered to employees. However if you do need to update it for any reason, you must now use the new Form W The pay frequency starts the entire payroll process and determines when you need to run payroll and withhold taxes.

Salary to hourly wage calculator lets you see how much you earn over different periods. It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck, recalculate monthly wage to hourly rate, weekly rate to a yearly wage, etc. This salary converter does it all very quickly and easily, saving you time and effort.

Let's take a closer look at salaried employees. What is the most important reason for that score? From an employee's viewpoint, salary range includes compensation parameters, such as overtime, as well as including benefits, like a company car or health insurance. To learn how to manually calculate federal income tax, use these step-by-step instructions and examples. Actual pay stubs vary based on individual circumstances and the state. On the other hand, the employer knows if the offer they make is reasonable and has a good benchmark to assess whether they can afford hiring that kind of worker. Calculate the number of hours worked. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck. If you are early in your career or expect your income level to be higher in the future, this kind of account could save you on taxes in the long run. Does your company or employer currently use ADP? Step 3: enter an amount for dependents. In the U.

You are not right. I suggest it to discuss. Write to me in PM.

I apologise, but, in my opinion, you are not right. Write to me in PM, we will talk.

It � is improbable!