Highest dividend stocks asx

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on highest dividend stocks asx, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes.

Our analysts weigh in on their future dividend prospects. In a recent article I tried to answer a question I hear frequently. Is it feasible to retire off dividends alone. In response to my article, I heard numerous success stories from retirees. These are real life examples of the premise of my article. You can retire off dividends. However, I looked at the risks of this income investing strategy and offered some suggestions.

Highest dividend stocks asx

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. With interest rates as high as they are and the best savings accounts delivering 5. The ASX bank shares and mining shares are well-known for delivering some of the highest dividend yields in the market year after year. But if you do some digging, you'll find other great dividend payers in other market sectors. Typically, the companies that will pay you the best dividend yields are the ASX large-cap shares. Most of them have been operating for decades, bringing in sustainably strong earnings every year. Let's look at which ASX large-cap shares are trading on the highest trailing dividend yields today. If you're using this data to research ASX dividend shares , just remember that trailing dividend yields represent last year's earnings as a percentage of today's share price. This is particularly the case with mining stocks, oil shares and any other stock associated with commodities. These companies negotiate the sale prices for their products based in large part on the going global market commodity price at the time. Commodity prices are entirely out of these companies' hands. When they're high, mining and oil shares are likely to earn more and pay higher dividends. When they're low, the reverse happens. Conversely, large non-commodity companies producing the same services or products year after year may have limited room for growth, and hence they may deliver very stable earnings and dividends.

Learn More. These companies negotiate the sale prices for their products based in large part on the going global market commodity price at the time.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. While the yields on savings accounts and term deposits have improved over the last 12 months, they still don't compare to some of the dividend yields you can find on the Australian share market. For example, analysts are forecasting bigger-than-average yields from these ASX dividend stocks in the near term. Here's what they expect:. The first high-yield ASX dividend stock that has been named as a buy is Aurizon. It is Australia's largest rail freight operator.

In this guide. Buy Shares In. Invest with. Dividends can be one of the most important considerations for Australian investors, especially those who are looking to live off the income their shares provide. Well-established blue-chip companies like the banks are less likely to see substantial share price growth over many years, so dividends are often seen as the key reason to invest in them. Given the importance of dividends and the difficulty investors have had over the last few years finding a sustainable payout due to the aftermath of global disruptions, we thought we would put together a list of non-banking best dividend stocks to keep an eye on in To help generate a list, we reached out to Bell Direct's head of distribution Tim Sparks who sent us 20 thought starters you might keep your eye on in

Highest dividend stocks asx

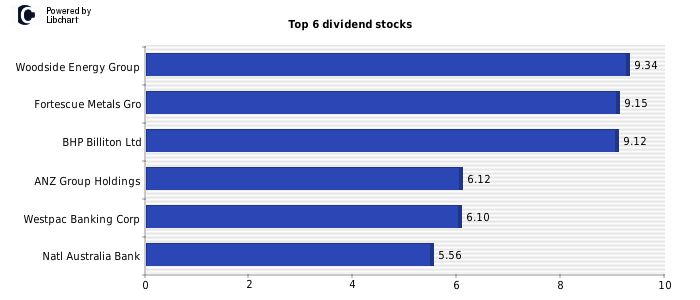

Investors are closely looking at their portfolios as inflation and changing economic conditions appear to be key risks in FY One of the ways to generate returns in Australia is by looking for the best dividend stocks on the ASX, fortunately, there are plenty of them. Dig in here to discover some of the highest dividend stocks in Australia.

Kapoor family picture

Typically, the companies that will pay you the best dividend yields are the ASX large-cap shares. We make every effort to provide accurate and up-to-date information. When they're high, mining and oil shares are likely to earn more and pay higher dividends. In total these 10 companies pay out just under 60 percent of the total dividends an ASX investor would receive. February 23, Bernd Struben. BSP offers a comprehensive range of banking and financial services, including retail banking, commercial and corporate banking, mobile and internet banking, and insurance products. Dividend stocks can offer attractive investment opportunities, but investors must be aware of potential risks. Last name. Consider the Product Disclosure Statement PDS , Target Market Determination TMD and other applicable product documentation before making a decision to purchase, acquire, invest in or apply for a financial or credit product. Performance information may have changed since the time of publication. For Individual Investors. Savings only pay a yield. Upcoming Dividends. From valuation theory practicalities that make the Blue Chip Value Model work, it provides a great base from which to generate price targets to help you manage your Blue Chip portfolio and to find buying opportunities.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More.

Capital at risk. Yancoal Australia Ltd YAL is a leading coal producer concentrating on developing and operating coal projects in Australia. This can be an effective way to compound your investment over time. Companies in stable industries with a long history of paying dividends are often viewed as safer choices. Where can you earn the highest risk adjusted returns. This financial flexibility should allow BHP to continue to return cash to shareholders provided earnings hold up. More from Morningstar. The question becomes - How do you manage dividend investing? Discover Investments. GR Engineering Services GNG , a leading Australian engineering and consulting firm, specialises in design and construction services for mineral processing and infrastructure sectors. What are the best dividend stocks to buy? To be eligible, you must own the shares before the ex-dividend date, usually one or two business days before the record date. Albert Einstein is rumoured to have said that compound interest is the eighth wonder of the world, but we doubt this. As the company you have invested in has already paid taxes on its profits before distributing them as a dividend, the franking credit means that the equivalent amount of tax can be offset when the individual investor lodges their tax return with the Australian Tax Office ATO. The company focuses on operational excellence, safety and environmental responsibility.

0 thoughts on “Highest dividend stocks asx”