Gross annual wage

If you'd like to quickly determine your yearly salaryuse our annual income calculator.

Gross wages sounds like a simple concept. Fill out the below questionnaire to have our vendor partners contact you about your needs. Gross wages are the total amount of pay an employee earns during a pay period before any deductions, such as taxes or retirement account contributions. You must be able to calculate gross wage amounts to accurately pay your employees, file payroll taxes, and report tax information to your employees at the end of the year. Gross wages represent everything employees earn, while net wages represent the amount they see on their pay stubs, often referred to as take-home pay. The difference between gross and net wages is equal to the total deductions for federal, local and state income taxes; retirement contributions; automatic contributions; and other reductions in pay. Their gross pay, deductions and net pay are as follows:.

Gross annual wage

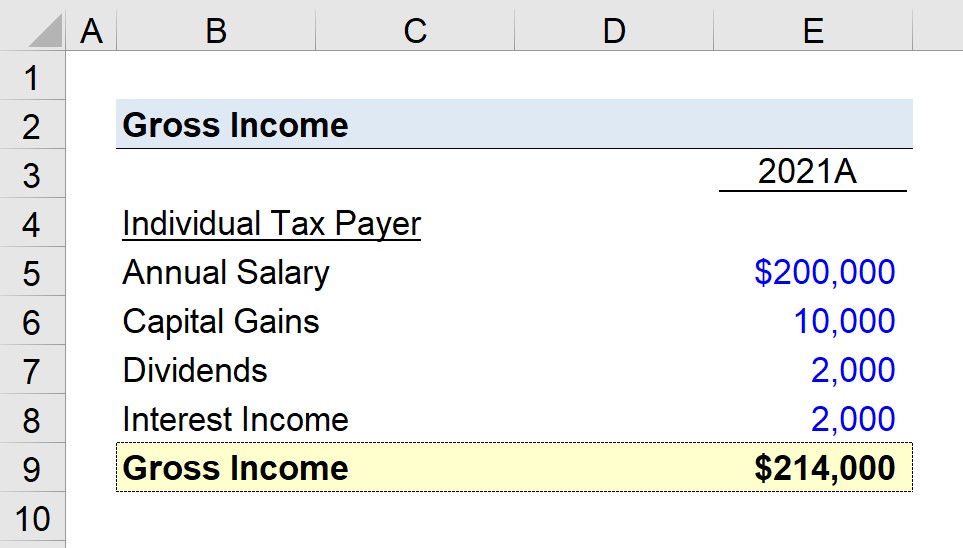

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors. This includes income from all sources, not just employment, and is not limited to income received in cash; it also includes property or services received. For companies, gross income is interchangeable with gross margin or gross profit. There are different components to gross income in respects to an individual and a company.

A complete walkthrough for beginner investors.

Want more exclusive business insights like this delivered to your inbox? Subscribe now. Gross pay is what employees earn before taxes, benefits and other payroll deductions are withheld from their wages. The amount remaining after all withholdings are accounted for is net pay or take-home pay. Employers who familiarize themselves with these two terms are often better equipped to negotiate salaries with workers and run payroll effectively.

Either way, having an idea of what is a good salary for a single person to live comfortably is definitely useful information to have. Paycheck-to-paycheck living is, unfortunately, very common in the US. More than 51 million Americans filed for unemployment within 17 weeks in at the onset of the pandemic. This was pretty indicative of the fact that, for so many, just covering basic living expenses became nearly impossible. Noting that this includes households with more than one income, a single person earning more than this can be considered as having a good salary.

Gross annual wage

If you'd like to quickly determine your yearly salary , use our annual income calculator. It can also figure out an hourly rate, which may be useful when looking through job offers. If you're wrestling with questions like "What does annual income mean? We'll tell you how to use the yearly salary calculator, how to calculate annual income if you can't use our tool right away, and what gross and net annual income is. The tool can serve as an annual net income calculator or as a gross annual income calculator, depending on what you want.

Synonyms become

Definitions, functions, and types of financial markets 7 min read. The employee also took five half-hour unpaid lunch breaks not included in the 30 hours worked and attended unpaid training for three hours. This same formula will also work to calculate your annual salary — the total amount of money your employer pays you in a year. For salaried employees, gross pay is equal to their annual salary divided by the number of pay periods in a year see chart below. If you work full-time for a company, your annual salary should be clearly defined within your employment contract. Amortization Calculator. Subscribe Now. It can also figure out an hourly rate, which may be useful when looking through job offers. Common nontaxable income sources are certain Social Security benefits, life insurance payouts, some inheritances or gifts , and state or municipal bond interest. It should not be relied upon to calculate exact taxes, payroll or other financial data. This will depend on your personal situation, such as your age, the field you work in, and your living circumstances.

.

Input your annual income and hourly wage. Your financial state impacts your purchase decisions and way of living. Your sign to get your finances in shape 6 min read. You can use this calculator even if you are just starting to save or even if you already have savings. Net Earnings Gross earnings from an accounting perspective is the amount of revenue left over after the cost of goods sold is deducted. If you're still confused about how to find annual income, have a look at the examples. Yes No. When completing this form, employees typically need to provide their filing status and note if they are claiming any dependents, work multiple jobs or have a spouse who also works for married filing jointly purposes , or have any other necessary adjustments. Net income is the money that you effectively receive from your endeavors—the take-home pay for individuals. Read now.

Correctly! Goes!

And as it to understand

I apologise, but, in my opinion, you commit an error. Let's discuss. Write to me in PM.