Fundsmith morningstar

The structured and methodical investment process overseen by a long-standing manager are among Fundsmith Equity's many strengths.

Our customers have rated us 4. We continue to be very pleased with the life-changing returns that we enjoy from our investments in Fundsmith. Beware of fraudulent WhatsApp groups purporting to be from members of the Fundsmith team suggesting trading ideas, requesting money transfers or asking you to click a link to download a file. Our guest today has been referred to as "the English Warren Buffett" for his style and success in investing. Terry Smith has been managing the international equity fund Fundsmith Equity since With an average return of

Fundsmith morningstar

He joined Collins Stewart shortly after, and became a director in In he became Chief Executive and led the management buy-out of Collins Stewart, which was floated on the London Stock Exchange five months later. In Collins Stewart acquired Tullett Liberty and followed this in with the acquisition of Prebon Group, creating the world's second largest inter-dealer broker. The information provided by the Data Provider has not been independently verified by the Insurer. The Insurer and the Data Provider do not guarantee the accuracy, adequacy, reliability and completeness of the information provided by the Data Provider, or that the information is up to date. The information in this website is subject to change and has not been reviewed by any regulatory authorities of Singapore. Losses of any kind, whether directly or indirectly including consequential losses incurred through the use of this website and the information herein are expressly disclaimed. The information contained in this website is for reference only and shall not constitute a recommendation or offer to purchase any products or subscribe for or sell units in any funds. The information is not intended to provide any form of professional or financial advice. They do not take into account your individual needs, investment objectives and specific financial circumstances. You should consult your financial planning consultant and study all relevant offering documents, financial reports and risk disclosure statements relating to the funds available from the Insurer or the fund houses before making any investment decisions. You should not rely solely on the contents of this website to make any investment decisions. Accordingly, you will have no direct interest in the underlying fund nor have any contractual relationship with or direct rights of recourse to the manager and its affiliates of the underlying fund.

Back to top. L'Oreal SA. Management Manager Name.

Start of Section Investment Objective The investment objective of the Fund is to achieve long term growth over 5 years in value. The Fund will invest in equities on a global basis. The Fund's approach is to be a long-term investor in its chosen stocks. It will not adopt short-term trading strategies. The information provided by the Data Provider has not been independently verified by the Insurer. The Insurer and the Data Provider do not guarantee the accuracy, adequacy, reliability and completeness of the information provided by the Data Provider, or that the information is up to date. The information in this website is subject to change and has not been reviewed by any regulatory authorities of Singapore.

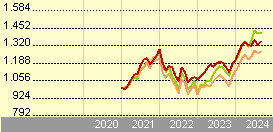

Terry Smith has been named City A. After a two and half year break, the gala awards dinner returned and was held for the first time in the Guildhall, in the heart of the City of London. City A. But even in a tough environment there are gains to be had. Fundsmith Equity Fund was recognised by independent investment research company Morningstar in its annual Morningstar Awards For Investing Excellence The awards are designed to recognise the industry's top-notch fund offerings and investor-friendly firms. For the full Morningstar Awards methodology, please click here. This is testament to our goal of achieving superior returns over the long-term at a reasonable cost.

Fundsmith morningstar

The Morningstar Document Library is a comprehensive resource for investment documents, from prospectuses to annual reports. By combining more than 20 years of data collection experience with advanced technology, Morningstar delivers accurate and timely documents to clients, enabling them to meet regulatory requirements as well as deliver excellent service to investors. Morningstar's scalable global infrastructure is designed for performance, resilience and high availability. This infrastructure manages 22 online products, including Morningstar. The Morningstar Document Library is ideal for brokerage firms or retirement plan service providers that want to outsource costly document collection and maintenance. In addition to this web interface, the Document Library can also be private-labeled or provided through APIs. Advisors and plan providers can grant investors direct access to the library via their own websites, ensuring investors receive immediate access to key documents. Fund companies and compliance officers find it a valuable resource for current and archived proprietary and competitor filings. Data collection expertise. Add to Watch List s Add selected investments to: 1.

Dolfin sinemalari

In the latest iteration of Morningstar's annual Fund Family report, a comparison of the largest fund families in Europe, our analysts rank the top companies for various categories, including the most highly-rated funds, the highest sustainability rating, and manager tenure. Fund Insight. Your access and use of the third party website is at your own risk. Third party websites provided by way of hyperlink on this website are owned and maintained by third parties not under the control of the Insurer. The Morningstar Analyst Rating of Gold for most share classes, including the clean I share class, is retained. For more detailed information about these ratings, including their methodology, please go to here. Communication Services. Equity, fixed income, property, money market, and alternative funds all suffered outflows in January. Our guest today has been referred to as "the English Warren Buffett" for his style and success in investing. Investor Views. The Quantitative Fair Value Estimate is calculated daily. Simplified registration Streamlined signup with advanced security options. Stryker Corp. With stock markets recovering, investors are feeling bullish. Consumer Defensive.

The structured and methodical investment process overseen by a long-standing manager are among Fundsmith Equity's many strengths. The Morningstar Analyst Rating of Gold for most share classes, including the clean I share class, is retained. The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value.

The Insurer makes no representations or warranties and does not assume any responsibility or liability in respect of the third party website you access. Read more. Manager Name Start Date. You should consult your financial planning consultant and study all relevant offering documents, financial reports and risk disclosure statements relating to the funds available from the Insurer or the fund houses before making any investment decisions. Please accept marketing cookies to see the newsletter sign-up form. Morningstar Asia Limited shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use and that the information must not be relied upon by you the user without appropriate verification. Investment in funds involves risks. Terry Smith's broadside to Unilever makes him the highest-profile UK fund manager to publicly question the merits of ESG and sustainability. Global Contacts Advertising Opportunities. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. The Fund will invest in equities on a global basis. Additionally, the group has just two strategies which follow the same investment philosophy and process, and key personnel are heavily invested in the funds they run, making them well-aligned with investors' interests. Whether you are a new investor or an existing investor, our new online set of tools make investing and managing your account easy. With stock markets recovering, investors are feeling bullish. FAQ Ask Us.

Matchless topic, it is interesting to me))))

It seems excellent phrase to me is

You are not right. I am assured. I can defend the position. Write to me in PM, we will communicate.