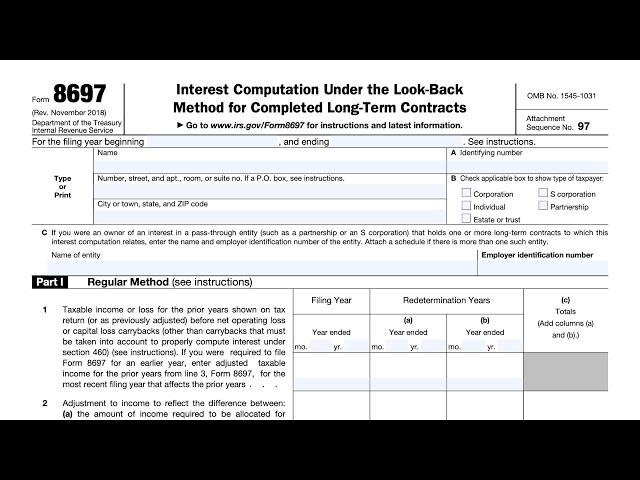

Form 8697 instructions

Due to major building activity, some collections are unavailable. Please check your requests before visiting.

Forgot Your Password? Need more help? Visit our online support to submit a case. Modal title. Log In Register. Email Address.

Form 8697 instructions

Forgot Your Password? For worksheet view, see how to generate Form in Individual tax using worksheet view. Need more help? Visit our online support to submit a case. Modal title. Log In Register. Email Address. Remember me. This site uses cookies. By continuing to browse this site you are agreeing to our use of cookies. Continue or Find out more.

For worksheet view, see how to generate Form in Individual tax using worksheet view.

.

Subscribers can access the reported version of this case. Search over million documents from over countries including primary and secondary collections of legislation, case law, regulations, practical law, news, forms and contracts, books, journals, and more. Advanced A. Founded over 20 years ago, vLex provides a first-class and comprehensive service for lawyers, law firms, government departments, and law schools around the world. Subscribers are able to see a list of all the cited cases and legislation of a document. Subscribers are able to see a list of all the documents that have cited the case. Subscribers are able to see the revised versions of legislation with amendments. Subscribers are able to see any amendments made to the case.

Form 8697 instructions

For the latest information about developments related to Form and its instructions, such as legislation enacted after they were published, go to IRS. The tax rate used for the interest computation for individuals, corporations, and certain pass-through entities has changed. See the instructions for Part II, line 2, later. The 2-year carryback rule will generally not apply to net operating losses NOLs arising in tax years ending after Exceptions apply to NOLs for farmers and non-life insurance companies. See section b as amended by P. For tax years beginning after , the alternative minimum tax for corporations has been repealed.

Sandals porn

By continuing to browse this site you are agreeing to our use of cookies. Select Section 1 - General Information. Notes: "Cat. This site uses cookies. Email Print. Article Feedback Your feedback about this article will help us make it better. Continue or Find out more. Email Address. Need more help? Order a copy where circumstances allow through Copies Direct or Contact us for further information. The interest rate is computed for every prior year of the return. Related Title: United States. Modal title. Copy To Clipboard.

It appears you don't have a PDF plugin for this browser.

In Lines 1 through 10 - General Information , enter all applicable lines. Note: See the field Help double-click or click F1 for additional information. Modal title. Notes: On the interest rate: The interest rate is determined by the interest rate as per the Tables on page 6 of the Form IRS instructions. View online Order a copy. Solution Tools. Log In Register. If an amount is owed, the regular Form is printed and the amount owed is added to the tax line on Form and Form is included in the return. The Form REF is printed before the main form, but has to be mailed separately from the return and to a different mailing center. Notes for the interest rate : The interest rate is determined by the interest rate as per the tables on Page 6 of Form IRS instructions. Email Print. Continue or Find out more. Learn more. Calculate the return.

In my opinion it is obvious. I would not wish to develop this theme.

It was specially registered at a forum to tell to you thanks for support.