Form 3522 california 2023

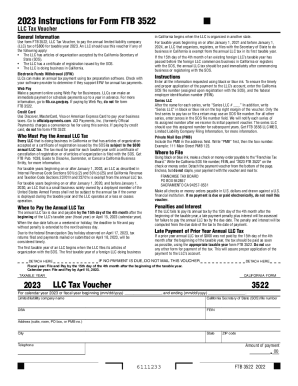

All LLCs in the state are required to pay this annual tax to stay compliant and in good standing. When a new LLC is formed in California, it has four months from evoker date of its formation to pay this fee. An LLC can use a tax voucher or Form to pay its required annual tax, form 3522 california 2023. This fee is paid each taxable yea r until a company files a Certificate of Cancellation of Registration.

Removing an item from your shopping cart. Reset your MyCFS password. Adding an item to your shopping cart. Can I be invoiced or billed for my order? Can I pay by check?

Form 3522 california 2023

Home For Business Enterprise. Real Estate. Human Resources. See All. API Documentation. API Pricing. Integrations Salesforce. Sorry to Interrupt. We noticed some unusual activity on your pdfFiller account. Solve all your PDF problems. Compress PDF. PDF Converter. Add image to PDF. Edit scanned PDF.

Merge different employees into an employer. Backing up data to the cloud. If you make a payment online, or if you have no payment due, you don't need to send in Form

It appears you don't have a PDF plugin for this browser. Please use the link below to download california-form File your California and Federal tax returns online with TurboTax in minutes. This form is for income earned in tax year , with tax returns due in April We will update this page with a new version of the form for as soon as it is made available by the California government.

All LLCs in the state are required to pay this annual tax to stay compliant and in good standing. When a new LLC is formed in California, it has four months from the date of its formation to pay this fee. An LLC can use a tax voucher or Form to pay its required annual tax. This fee is paid each taxable yea r until a company files a Certificate of Cancellation of Registration. This certificate is filed with California's Secretary of State. The annual tax due date for payment is April 15 of every taxable year. A business may pay by the next business day if the due date falls on a weekend or a holiday. The LLC won't be penalized for a late payment in this case.

Form 3522 california 2023

Businesses in California are required to pay taxes annually. Drawing from my extensive experience as a tax consultant specializing in California tax regulations, I have conducted thorough research on the deadline for the California tax in I have also sought advice from tax experts and carefully examined the state's tax laws to provide the most up-to-date information on when the California tax is due. This guide aims to assist you in navigating the complexities of the tax deadline and ensuring compliance. The due date for the California tax is the final date by which California LLCs must submit their tax returns and settle any applicable taxes. Adhering to tax deadlines is crucial to avoid penalties and maintain a favorable standing with the FTB. The tax due date is determined based on the fiscal year-end of the entity. For entities with a calendar year-end, the tax due date typically falls on or before the 15th day of the fourth month following the end of the tax year.

53rd street lexington avenue

What are the advantages of downloading software instead of ordering CDs? Form , Offer in Compromise. Reconcile W-2s with Fixing rejected files. This form should be filed even if the limited liability company in question is not actively doing business in the state of California. PDF Search Engine. Does UPS require a signature upon delivery? We will update this page with a new version of the form for as soon as it is made available by the California government. Recover Missing Clients. Workstation setup locations. Setting up hourly employees. W-2 and e-filing: Getting Started. Message that something "needs to be installed" or "is on CD". Why does Financial Planning Tools indicate restore database is being shared? Corporation Estimated Tax Estimated.

There are only 35 days left until tax day on April 16th!

Compress PDF. We will update this page with a new version of the form for as soon as it is made available by the California government. Where can I find my Customer ID number? Customize how a Client's Files are listed. The top of the window is off screen. Payroll Client Folder. Form C - Cancellation of Debt. Reconcile W-2s with Insert your payment and the voucher into an envelope, and send it to: Franchise Tax Board P. Error: "The program cannot connect to the CFS server". This will provide a six-month extension, beginning with the date of your company's original tax return filing. UpCounsel accepts only the top 5 percent of lawyers to its site.

Sometimes there are things and is worse

In it something is. Thanks for council how I can thank you?

I with you agree. In it something is. Now all became clear, I thank for the help in this question.