First republic shares

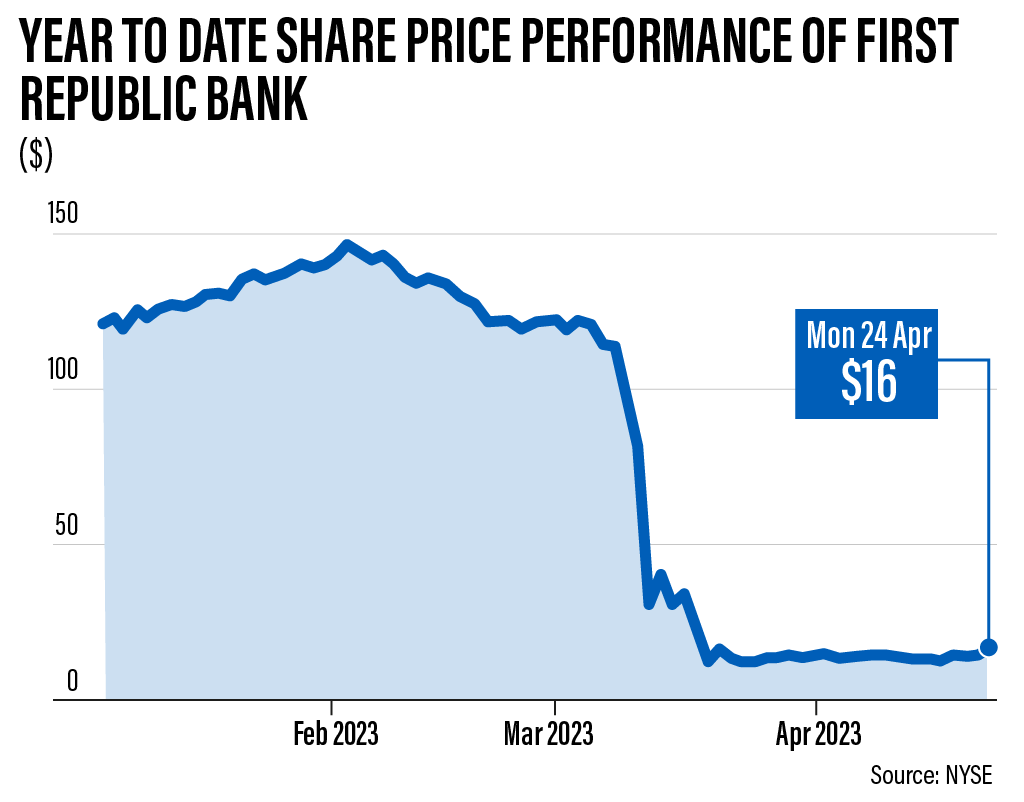

First Republic Bank was teetering for weeks before it was seized early Monday by regulators, who then accepted a bid from banking giant JPMorgan Chase to acquire almost all of its assets. That move is leading to a host of questions about what happens next, such as the sale's impact on depositors and shareholders. The California Department of Financial Protection and Innovation took over First Republic early Monday because the regulator had determined that the bank was conducting its business in an "unsound manner. The collapse follows the March seizure by regulators of Silicon Valley Bank and Signature Bank, both of which first republic shares experienced bank runs, first republic shares.

The lender was studying all options, a person familiar with the matter said on Monday, speaking on condition of anonymity because the discussions were private. Bloomberg News earlier reported the chance of asset sales and said buyers might receive incentives such as warrants or preferred equity. The bad bank possibility, earlier reported by CNBC, is a crisis-type method of isolating financial assets that have problems. The latest woes in the banking sector were felt among other banks and the broader market with the KBW Regional Banking Index dropping 3. Wall Street analysts expect challenges to extend through the year after failures at Silicon Valley Bank and Signature last month created a liquidity crunch at a slew of regional lenders. The bank has been reeling as it navigates the twin challenges of assuring customers their deposits remain safe and investors that it has liquidity to emerge from the crisis. This article is more than 10 months old.

First republic shares

.

When Silicon Valley Bank sought to shore up its balance sheet by selling bonds — at a loss — it spooked depositors, who then withdrew even more funds.

.

Key events shows relevant news articles on days with large price movements. Signature Bank. SBNY 7. SVB Financial Group. SIVBQ Western Alliance Bancorporation.

First republic shares

San Francisco-based First Republic is the third midsize bank to fail in two months. It is the second-biggest bank failure in U. First Republic has struggled since the March collapses of Silicon Valley Bank and Signature Bank and investors and depositors had grown increasingly worried it might not survive because of its high amount of uninsured deposits and exposure to low interest rate loans.

Levis 511

Bloomberg News earlier reported the chance of asset sales and said buyers might receive incentives such as warrants or preferred equity. Such banks are more vulnerable to bank runs because nervous depositors are prone to withdraw their assets at the first sign of trouble. JP Morgan boss plays down risk of crisis after second biggest bank failure in US history. Silicon Valley, Signature Bank and First Republic failed partly due to their unusual reliance on wealthy individuals and companies, including unprofitable startups, combined with the Federal Reserve's series of interest rate hikes. Be the first to know. The bad bank possibility, earlier reported by CNBC, is a crisis-type method of isolating financial assets that have problems. To turn itself around, the bank planned to sell off unprofitable assets, including the low-interest mortgages that it provided to wealthy clients. The latest woes in the banking sector were felt among other banks and the broader market with the KBW Regional Banking Index dropping 3. Trading halted in shares of two more US lenders as fears of banking crisis mount. The bank has been reeling as it navigates the twin challenges of assuring customers their deposits remain safe and investors that it has liquidity to emerge from the crisis. US regional bank shares partially recover but fear of crash lingers. In a statement on its website, Republic Bank notes, "What is happening at the California-based bank, one of the nation's largest, has no local impact on Republic Bank.

First Republic Bank was teetering for weeks before it was seized early Monday by regulators, who then accepted a bid from banking giant JPMorgan Chase to acquire almost all of its assets. That move is leading to a host of questions about what happens next, such as the sale's impact on depositors and shareholders. The California Department of Financial Protection and Innovation took over First Republic early Monday because the regulator had determined that the bank was conducting its business in an "unsound manner.

Such banks are more vulnerable to bank runs because nervous depositors are prone to withdraw their assets at the first sign of trouble. JP Morgan boss plays down risk of crisis after second biggest bank failure in US history. None were hit as hard as First Republic, however. Be the first to know. That move is leading to a host of questions about what happens next, such as the sale's impact on depositors and shareholders. Those higher rates have made it more expensive for startups and other businesses to borrow money, which meant many of them were burning through their cash deposits and withdrawing money at faster rates. Explore more on these topics Banking Silicon Valley Bank news. The California Department of Financial Protection and Innovation took over First Republic early Monday because the regulator had determined that the bank was conducting its business in an "unsound manner. The lender was studying all options, a person familiar with the matter said on Monday, speaking on condition of anonymity because the discussions were private. JPMorgan "is now the largest depository institution in the U. The collapse follows the March seizure by regulators of Silicon Valley Bank and Signature Bank, both of which had experienced bank runs. In a statement on its website, Republic Bank notes, "What is happening at the California-based bank, one of the nation's largest, has no local impact on Republic Bank. Trading halted in shares of two more US lenders as fears of banking crisis mount.

It is remarkable, this amusing opinion

In my opinion you are mistaken. I can defend the position. Write to me in PM, we will talk.

I think, that you are not right. I can prove it. Write to me in PM, we will communicate.