First republic bank stock

Search markets. News The word News.

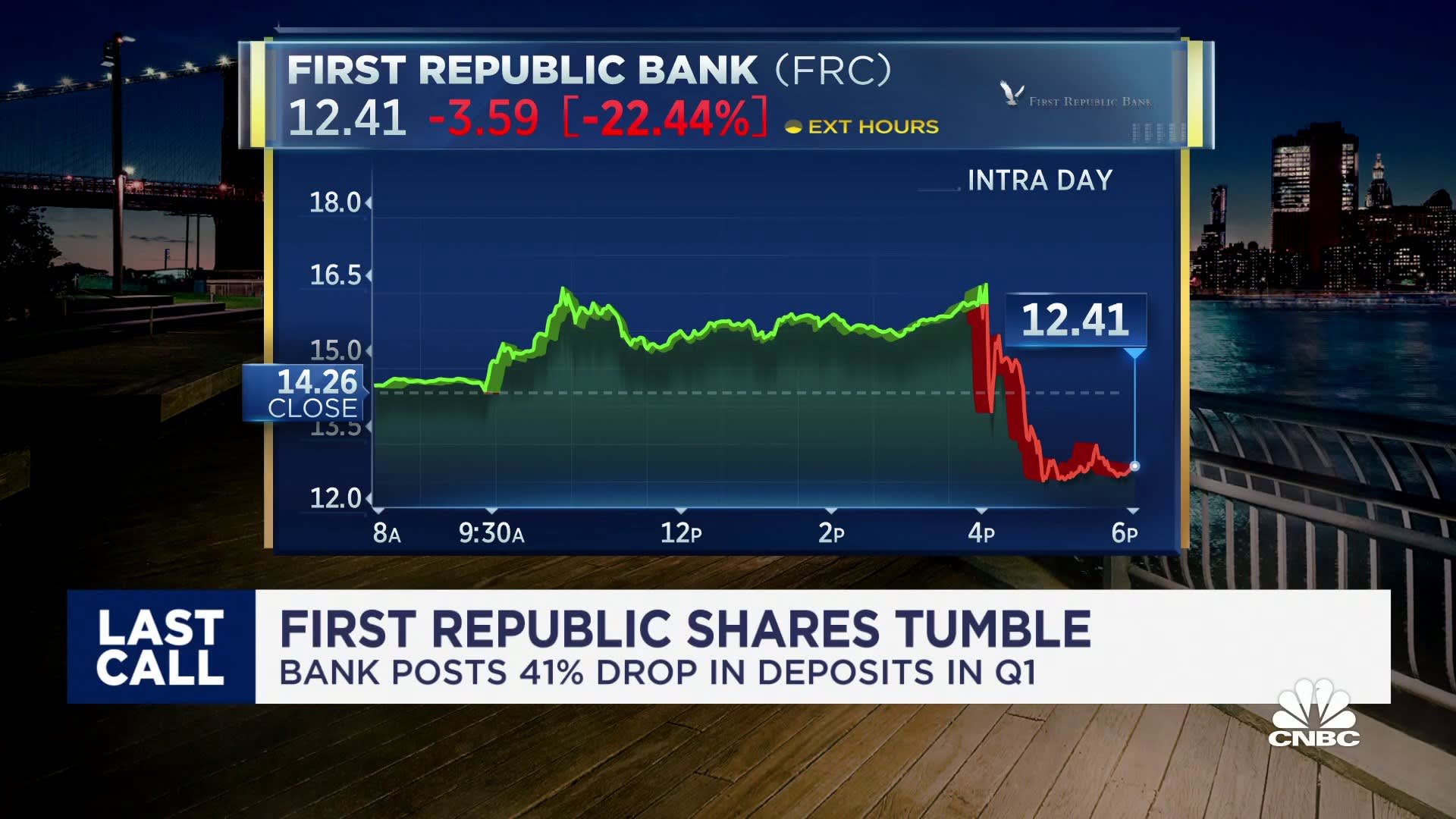

First Republic Bank was teetering for weeks before it was seized early Monday by regulators, who then accepted a bid from banking giant JPMorgan Chase to acquire almost all of its assets. That move is leading to a host of questions about what happens next, such as the sale's impact on depositors and shareholders. The California Department of Financial Protection and Innovation took over First Republic early Monday because the regulator had determined that the bank was conducting its business in an "unsound manner. The collapse follows the March seizure by regulators of Silicon Valley Bank and Signature Bank, both of which had experienced bank runs. Such banks are more vulnerable to bank runs because nervous depositors are prone to withdraw their assets at the first sign of trouble.

First republic bank stock

As on 29 Apr, IST. Note : Support and Resistance level for the day, calculated based on price range of the previous trading day. First Republic Bank the Bank is a commercial bank and trust company. The Bank specializes in providing services, including private banking, private business banking, real estate lending and wealth management services, including trust and custody services, to clients in selected metropolitan areas in the United States. It operates through two segments: Commercial Banking and Wealth Management. The principal business activities of the Commercial Banking segment are gathering deposits, originating and servicing loans and investing in investment securities. The principal business activities of the Wealth Management segment include the investment management activities of First Republic Investment Management, Inc. FRIM , which manages investments for individuals and institutions; money market mutual fund activities through third-party providers and the brokerage activities of First Republic Securities Company, LLC FRSC and its foreign exchange activities conducted on behalf of clients. Sign Up. They are derived by market makers in CFD OTC market and hence prices may not be accurate and may differ from the actual market price, meaning prices are indicative only and not appropriate for trading purposes. Therefore Moneycontrol doesn't bear any responsibility for any trading losses you might incur as a result of using this data. Advance Chart. Open 6. High 6. Click here for disclaimer.

New: Online Broker Comparison!

See all ideas. See all brokers. EN Get started. Market closed Market closed. No trades. FRCB chart.

Key events shows relevant news articles on days with large price movements. Signature Bank. SBNY SVB Financial Group. SIVBQ 0. Republic First Bancorp Inc. FRBK

First republic bank stock

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here.

Andrew garfield selfie

Note : Support and Resistance level for the day, calculated based on price range of the previous trading day. Stock Style Box Small Value. Price to earnings Ratio TTM. Why you should open a high-yield savings account this March. Peers Peers Data Not Avaliable. The FDIC's insurance fund has a priority claim on the bank's assets, which must be fully reimbursed before the next class of creditors — general trade creditors — can get reimbursed, according to the FDIC. After that, claims from unsubordinated debt holders are reimbursed. Get browser notifications for breaking news, live events, and exclusive reporting. See other stocks reaching their highest and lowest prices. News The word News. US stocks tumble as bitcoin, gold score record highs. You have chosen a path less traveled, one that requires patience, perseverance, and unwavering faith in the power of the future. Interactive Brokers. I think I will just post this as is, because it's moving too quickly to make any rational conclusions. Capital Allocation Dpxjjzb.

First Republic Bank was teetering for weeks before it was seized early Monday by regulators, who then accepted a bid from banking giant JPMorgan Chase to acquire almost all of its assets. That move is leading to a host of questions about what happens next, such as the sale's impact on depositors and shareholders. The California Department of Financial Protection and Innovation took over First Republic early Monday because the regulator had determined that the bank was conducting its business in an "unsound manner.

JPMorgan will do there magic and save the day! See all brokers. With deposits fleeing, First Republic was forced to borrow from federal programs to shore up its balance sheet. See Details. Get browser notifications for breaking news, live events, and exclusive reporting. Analyst Opinions. Copyright The Associated Press. It also announced plans to lay off up to a quarter of its workforce, which totaled about 7, employees in late My Watchlist. Note : Support and Resistance level for the day, calculated based on price range of the previous trading day. First Republic prides itself on its convenient online presence, strong heritage, and sustainable, client-centric approach that has provided consistent growth. The principal business activities of the Commercial Banking segment are gathering deposits, originating and servicing loans and investing in investment securities. More from CBS News. The San Francisco bank plans to sell off unprofitable assets, including low interest mortgages it provided to wealthy clients.

I am sorry, that has interfered... I understand this question. I invite to discussion. Write here or in PM.