Finansbank internet

Meet Banking as a Service with QNB Finansbank, deliver banking products and services to your customers through your own mobile application or website, finansbank internet, finansbank internet. With this way, your customers; will not have to leave your company's mobile application or website for banking transactions! Banking as a Service finansbank internet a business model in which banking products and services are offered to customers through applications or websites of non-bank companies. All companies that provide services through mobile applications and websites and want to offer financial solutions to their customers can benefit from QNB Finansbank's Banking as a Service.

With your QNB First Customer Relations Manager, you can carry out all kinds of banking transactions with confidentiality and security, and get general information about the developments and expectations in the market, while thoroughly getting informed with answers to all your questions about your banking transactions in our QNB First rooms. In our branches, you will be welcomed with the warm smile of your Customer Relations Manager who knows about your needs and preferences and makes you feel comfortable and secure as if you are at home. Earning miles abroad has never been easier! Let your restaurant spendings turn into miles! It is possible to turn your spendings into miles! Who does not want to win by travelling! Earn miles with one button!

Finansbank internet

You can set the limit of your virtual card yourself and set to zero when not in use. Safe and easy way to shop online! How can I apply for a virtual card? The card will be issued at the moment of application. Where can I inquire my virtual card information? Is there a fee for the virtual card? There is no annual membership fee for the virtual card. Interest rates are the same with the basic card that the virtual card is linked as a supplementary. How can I set the limit of my virtual card? You can either keep it the same with your basic card limit, or set a different amount. If you set a different amount, at every statement date of the main card, this limit will be automatically renewed. How does my virtual card limit become available? If you set a different limit for your virtual card than the main card, at every statement date of the main card, the limit will be automatically renewed.

Customers can stop the sharing of their information at any time and terminate the service from the relevant company.

.

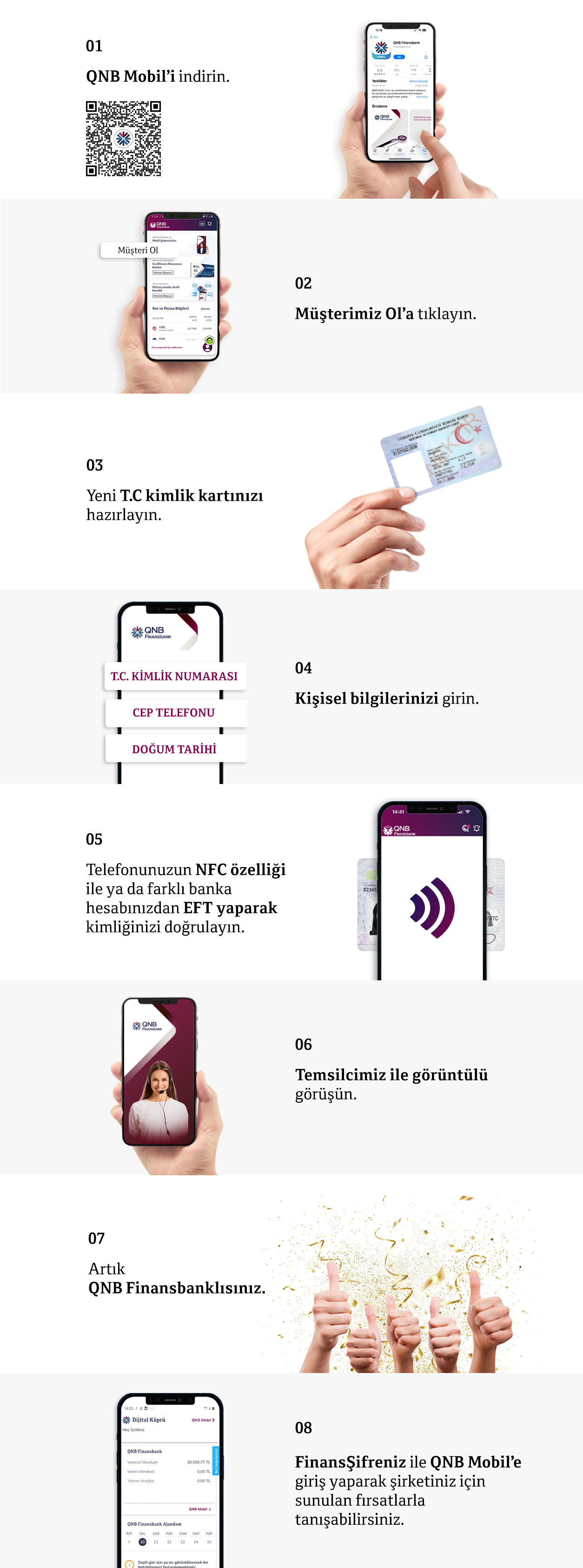

Everyone info. QNB Mobil allows you to access banking services anytime, anywhere! If you do not have one, you can get it by calling our Call Center. Safety starts with understanding how developers collect and share your data. Data privacy and security practices may vary based on your use, region, and age. The developer provided this information and may update it over time. No data shared with third parties Learn more about how developers declare sharing. This app may collect these data types Location, Personal info and 4 others. Data is encrypted in transit. What a totally useless banking app, it is the worst banking app that I have, functions do not work.

Finansbank internet

Our Relationship Managers in the below listed branches are ready to assist you in case you require any support while in Turkey:. There are already so many things you have to keep in mind. Why don't you leave the bills to us? Apply now to set up automatic payments by your credit card or via your account. To take advantage of automatic bill payment, simply visit a QNB Finansbank branch with your latest bill to set up an automatic payment and complete the "Automatic Bill Payment Order" form. It does not matter where you are as long as you have Internet access; perform any of your banking transactions without visiting the branches.

The face shop สาขา สยาม พารา ก อน

Now you will enjoy the comfort of having your investments in safe hands in every sense. You are also privileged to buy flight tickets from Turkish Airlines! The available virtual card limit does not increase with the interim payments made during the billing cycle. Earn miles with one button! Earning miles abroad has never been easier! The confidence of knowing that there is a special assistant just for you whenever you call QNB First Service Line, the pleasure of receiving a swift and priority service and specific transaction limits for you You can benefit from a discount on your annual safe deposit box rentals and a discount on deposit fees. Your savings in enpara. How does my virtual card limit become available? Enjoy a first class world with instant banking services and the privilege of free money transfer transactions via QNB Mobile or Internet Banking.

.

Also, your card may be stopped completely or your card may be closed for use. Skip to Content Area. You can also transfer the MoneyPoints to your basic card, through the channels of the Call Center and Internet Banking. For this reason, in case of transactions with these cards other than the purpose of using individual credit cards commercial expenses , QNB Finansbank reserves the right of withdrawning earned Miles, limiting your Mile gain. The available virtual card limit does not increase with the interim payments made during the billing cycle. Banking as a Service. Earn more miles with your THY status! You can set the limit of your virtual card yourself and set to zero when not in use. The higher your status, the more miles you can earn from shopping. Enjoy a first class world with instant banking services and the privilege of free money transfer transactions via QNB Mobile or Internet Banking.

Completely I share your opinion. It seems to me it is excellent idea. Completely with you I will agree.

I join. So happens. Let's discuss this question. Here or in PM.

You were visited simply with a brilliant idea