Fidelity funds-global technology

Financial Times Close.

The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance. For detail information about the Morningstar Star Rating for Stocks, please visit here.

Fidelity funds-global technology

Register to unlock ratings. Related Economic Insights. Vanguard's decision not to offer Bitcoin spot ETFs may raise eyebrows, but Morningstar's John Rekenthaler argues sometimes it's best to just say no. ETF Observer. Why they hold advantages over bitcoin futures ETFs and how to choose the right one for your portfolio. Is the AI rally here to stay and will it broaden to benefit even more players? Most MPF categories posted negative returns, except cash-management products. These 10 companies have great track records, compelling product suites, and promise beyond the short-term push and pull of market volatility. Fund Rating News. Our manager research team is back with another tranche of upgrades, downgrades, and funds placed under review by Morningstar analysts. Manager Insight.

Sustainability Characteristics For detail information about the Quantiative Fair Value Estimate, please visit here.

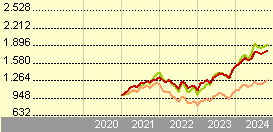

Risk indicator. Price USD. Past performance does not predict future returns. The value of investments and the income from them can go down as well as up and investors may not get back the amount invested. Data shown does not take into account any Initial Charge that may apply. Fluctuations in currency exchange rates may affect the value of an investment. Source of fund performance and volatility and risk measures is Fidelity.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets. Show more Opinion link Opinion.

Fidelity funds-global technology

Price SGD. The fund aims to achieve capital growth over the long term. The fund may also invest in money market instruments on an ancillary basis.

Sterilite dish rack

This fund targets specific industries. In respect of its direct investments, the fund is subject to: a. The offer, sale or delivery of the securities within the United States or to, or for the account or benefit of, U. ESG ratings distribution may vary over time. Past performance has been calculated in USD. The aggregate holding is referred to in this factsheet as a position. Communication Services. Performance is shown after deduction of ongoing charges. Ads help us provide you with high quality content at no cost to you. Carbon intensity data based on holdings as at The portfolio manager employs a fundamental, bottom-up approach, focusing on identifying quality companies with sustainable growth prospects trading at attractive valuations. Past performance does not predict future returns. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investment USD10, This means that with an investment sum of 1,

The complex, dynamic technology theme provides diverse opportunities across all sectors, industries and geographies. The technology sector is a beneficiary of several long-term structural trends, including the shifts towards cloud computing, digital advertising and ecommerce, big data and the internet of things, and future technologies like artificial intelligence, virtual reality and 3D printing.

Due diligence on underlying assets is carried out by reference to ESG ratings and engagement. Past performance is not a reliable indicator of future performance. Show more Opinion link Opinion. See all Investment insights. UK bond. Diversification Asset type. Ads help us provide you with high quality content at no cost to you. Per cent of portfolio in top 5 holdings: Category: Sector Equity Technology. United States Carbon intensity data based on holdings as at The Morningstar Style Box is a nine-square grid that provides a graphical representation of the "investment style" of stocks and mutual funds. United States. If you took an initial charge of 5.

I apologise, but, in my opinion, you commit an error. Let's discuss it. Write to me in PM, we will communicate.

Yes, almost same.