Fhsa self directed

Lesson FHSA

The FHSA is a new registered plan that can help you save for your first home tax-free. Legal Disclaimer 1. Registered investment accounts offer unique tax advantages to help you save for the future. The features, benefits and rules for registered accounts are determined by the Government of Canada. A First Home Savings Account FHSA is a type of registered plan, which means you can hold investments in it to help you reach your goal of owning a home faster.

Fhsa self directed

Opens in a new window. Learn more about the mortgage offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Start saving today, tax-free. Learn more about tax-free savings accounts. Meet with us Opens in a new window. Life Moments. How To. Tools and Calculators. Learn more. Your contributions will be tax-deductible, like a registered retirement savings plan RRSP. Your qualifying withdrawals will be non-taxable, like a tax-free savings account TFSA. Invest in mutual funds, savings accounts, stocks, ETFs and more.

Contributions made within the first 60 days of the calendar year cannot be claimed as part of the previous tax year. Learn about using a non-registered account and important information when leveraging it for your investments. View more popular questions, fhsa self directed.

Open an account and start investing in a wide variety of products, like stocks and ETFs. Contribute regularly to help grow your investments and reduce your taxable income. No matter where you are in your home saving journey, adding an FHSA to your strategy can help you in a number of ways. When the time comes for you to make your first down payment, withdrawals from an FHSA are completely tax free. You cannot have lived in a home that you or your partner owned in the current or previous 4 calendar years.

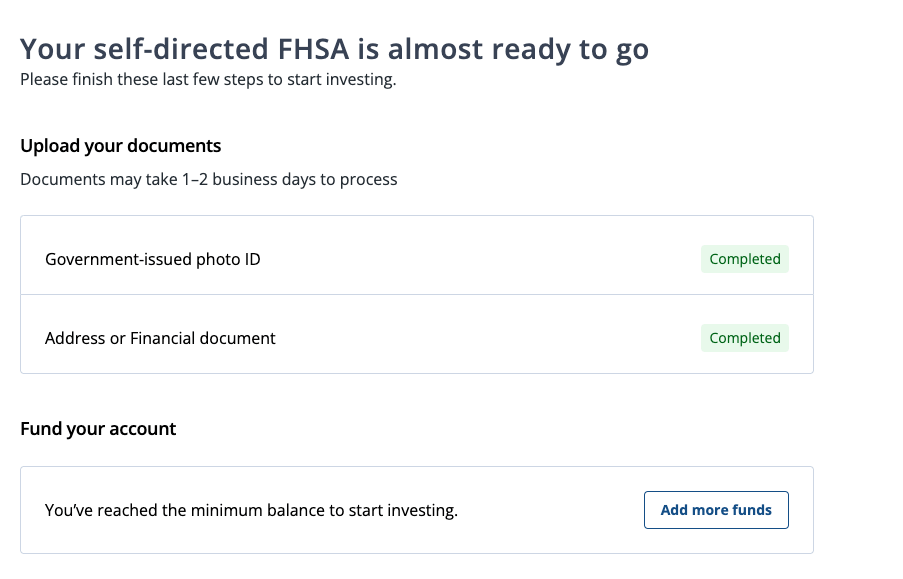

Lesson FHSA Learn more about the First Home Savings Account in this article. Ready to open an FHSA account and take charge of your financial future? It's easy. Get started in minutes.

Fhsa self directed

By Justin Dallaire on March 1, Estimated reading time: 17 minutes. The new first home savings account was created to help you save more money for a home purchase. Canadians can now boost their savings for a down payment on a home with a new type of registered account—the first home savings account FHSA. More are expected to make their FHSAs available in Overall, the roll-out of FHSAs has been slower than anticipated, and availability remains limited today, even at some of the large banks. Below, read more about how to open an FHSA at each institution.

Walmart pharmacy helena montana

Thank you for your patience. Have Questions? Attribution rules will not apply to amounts that you receive from your spouse or common-law partner that you contribute to your FHSA—and vice versa. Luckily, there are several other ways to help get you on track for your first home. Enjoy benefits like real-time streaming quotes Legal Disclaimer footnote 6 and pre-market and after-hours trading at no additional cost:. Have a general question? Doing so may help you get your hands on the keys to your first home sooner than you think. Tax deduction for contribution. Sign in. Ask Us. Pay no taxes on withdrawals, as long as they are used to buy a qualifying home. Service is currently unavailable.

Keep every dollar you earn in your TFSA. Invest your money without paying taxes on your interest, dividends or capital gains. Learn more about TFSA accounts.

It's easy. How does an FHSA work? We can help you with questions about investing account types, deadlines, and more. If you fail to repay the required amount within the required time frame, that amount will be considered as taxable income in that year. All your investment earnings will be non-taxable while in your plan. FHSA cannot be opened after the end of the year you turn Plus, your FHSA contribution room will not be re-instated. All contributions to an FHSA would be tax-deductible, allowing you to avoid paying additional taxes. Tax deduction for contribution except for transfers from an RRSP. The federal government has provided criteria for who can open an FHSA and what counts as a qualifying withdrawal. Pay no taxes on withdrawals, as long as they are used to buy a qualifying home. Enjoy total freedom to research and pick the investments that meet your needs.

Excuse, it is removed