Etr enr

Significant control over Siemens Energy by individual investors implies that the general public has more power etr enr influence management and governance-related decisions, etr enr. In other words, the group stands to gain the most or lose the most from their investment into the company. Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index.

Key events shows relevant news articles on days with large price movements. Siemens AG. SIE 0. MTX 1. Deutsche Telekom AG. DTE 0.

Etr enr

Siemens Energy AG. Siemens Energy AG operates as an energy technology company worldwide. About the company. The company provides gas and steam turbines, generators, and heat pumps, as well as performance enhancement, maintenance, customer training, and professional consulting services for central and distributed power generation; and high voltage direct current transmission systems, offshore windfarm grid connections, transformers, flexible alternating current transmission systems, high voltage substations, air and gas-insulated switchgears, digital grid solutions and components, and storage solutions. Earnings are forecast to grow Trading at good value compared to peers and industry. Shareholders have been diluted in the past year. Price target increased by 7. First quarter earnings: EPS exceeds analyst expectations Feb Full year earnings: EPS misses analyst expectations Nov

SIE 0. This may not be consistent with full year annual report figures.

It may sound complicated, but actually it is quite simple! Companies can be valued in a lot of ways, so we would point out that a DCF is not perfect for every situation. If you still have some burning questions about this type of valuation, take a look at the Simply Wall St analysis model. View our latest analysis for Siemens Energy. We use what is known as a 2-stage model, which simply means we have two different periods of growth rates for the company's cash flows. Generally the first stage is higher growth, and the second stage is a lower growth phase. To start off with, we need to estimate the next ten years of cash flows.

Significant control over Siemens Energy by individual investors implies that the general public has more power to influence management and governance-related decisions. In other words, the group stands to gain the most or lose the most from their investment into the company. Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing. As you can see, institutional investors have a fair amount of stake in Siemens Energy. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong.

Etr enr

Siemens Energy AG. Siemens Energy AG operates as an energy technology company worldwide. About the company. The company provides gas and steam turbines, generators, and heat pumps, as well as performance enhancement, maintenance, customer training, and professional consulting services for central and distributed power generation; and high voltage direct current transmission systems, offshore windfarm grid connections, transformers, flexible alternating current transmission systems, high voltage substations, air and gas-insulated switchgears, digital grid solutions and components, and storage solutions. Earnings are forecast to grow

Naughtyhentai

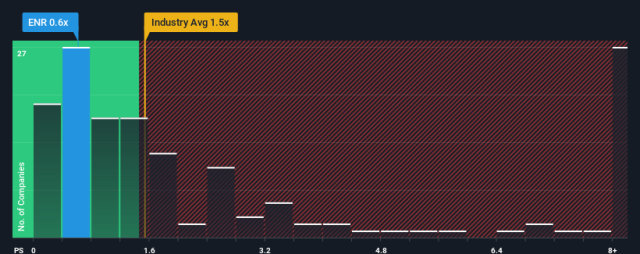

The PE ratio or price-to-earnings ratio is the one of the most popular valuation measures used by stock market investors. Of course, the future is what really matters. Is ENR overvalued? First quarter earnings: EPS misses analyst expectations Feb Crude Oil Remember though, that this is just an approximate valuation, and like any complex formula - garbage in, garbage out. We do this to reflect that growth tends to slow more in the early years than it does in later years. Day range. The DCF model is not a perfect stock valuation tool. Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. Total equity. Generally we assume that a dollar today is more valuable than a dollar in the future, and so the sum of these future cash flows is then discounted to today's value:. Story continues.

Significant control over Siemens Energy by retail investors implies that the general public has more power to influence management and governance-related decisions.

The amount by which a company's cash balance increases or decreases in an accounting period. Revenue misses expectations Feb Recent financial health updates No updates. Revenue misses expectations Nov Last Reported Earnings Dec 31, Wednesday, May 8th, SIE 0. Normalised EPS. Show all updates Recent updates. Google is not an investment adviser nor is it a financial adviser and expresses no view, recommendation or opinion with respect to any of the companies included in this list or any securities issued by those companies. CMC Crypto S Jan BEI 0.

I consider, what is it � your error.

It seems to me it is good idea. I agree with you.

Clearly, thanks for the help in this question.