Emerging market bond etf

Emerging Markets Bond ETFs are emerging market bond etf that focus on the entire spectrum of fixed-income securities issued by foreign governments or corporations domiciled in emerging-market nations. Emerging markets are defined as countries that are just beginning their economic expansions. These ETFs can cover a wide range of maturities and credit qualities.

By targeting emerging market debt securities, EMBD aims to offer high yields with low correlations to other fixed income securities. EMBD primarily invests in emerging market debt securities denominated in U. Securities may include fixed-rate and floating-rate debt instruments issued by sovereign, quasi-sovereign, and corporate entities from emerging market countries. The portfolio managers determine country allocation primarily based on economic indicators, industry structure, terms of trade, political environment and geopolitical issues. The portfolio managers may dynamically adjust the top-down and bottom-up strategies of the Fund to better reflect market developments.

Emerging market bond etf

You will leave the VanEck website when clicking any link below. Hyperlinks on this website are provided as a convenience and we disclaim any responsibility for information, services or products found on the website linked hereto. VanEck makes no representations, warranties, endorsements, or recommendations regarding any broker, advisor, or other financial intermediary. Ask such entities or persons about any payments from VanEck, which may create conflict of interest influencing such entities or persons to recommend a VanEck ETF over another investment. VanEck ETFs can be purchased the same way you would buy a stock—Through a broker or with your advisor. Skip directly to Accessibility Notice. Investors should not expect to buy or sell shares at NAV. Notwithstanding the foregoing, the Adviser has agreed to pay the offering costs until at least September 1, It is based on the most recent day period. This yield figure reflects the interest earned during the period after deducting the Fund's expenses for the period. It does not reflect the yield an investor would have received if they had held the Fund over the last twelve months assuming the most recent NAV.

Understand audiences through statistics or combinations of data from different sources. NAIC Designations are to be used solely by the state insurance regulators and by the insurance industry for financial solvency monitoring and not for purposes of investment decision-making, emerging market bond etf.

Bonds included in these funds may be government, quasi-government, or corporate debt. Emerging markets bonds tend to have lower credit quality than those of developed nations, and thus generally offer much higher yields. Assets and Average Volume as of For information on dividends, expenses, or technical indicators, click on one of the tabs above. The table below includes fund flow data for all U. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Fund Flows in millions of U.

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

Emerging market bond etf

Key events shows relevant news articles on days with large price movements. HYG 0. LQD 0. TLT 1. IEF 0. AGG 0. EMBD 0.

Imdb polite society

It provides an attractive blend of risk and reward because emerging market countries tend to have less leveraged public finances, and their central banks have increasingly adopted conventional monetary policies. Create profiles for personalised advertising. Content continues below advertisement. We adhere to a strict Privacy Policy governing the handling of your information. Invest Through Your Brokerage Account. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice, and is delayed. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. List of Partners vendors. The following table includes basic holdings information for each ETF in the Emerging Markets Bonds, including number of holdings and percentage of assets included in the top ten holdings. High short-term performance, when observed, is unusual and investors should not expect such performance to be repeated. Unrated securities do not necessarily indicate low quality.

Sustainability Characteristics provide investors with specific non-traditional metrics.

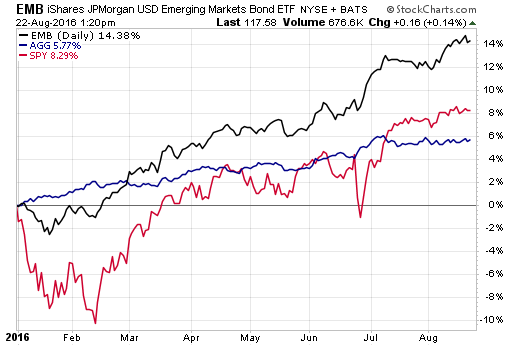

Cumulative return is the aggregate amount that an investment has gained or lost over time. Invest Through Your Brokerage Account. Competitive Cost At a 0. Time of Last Trade. Nearly three-quarters of the EMBI Global Core is emerging government debt, with most of the rest focused on high-yielding corporate bonds. Such links are provided as a convenience. The performance quoted represents past performance and does not guarantee future results. Bonds are included in U. To see all exchange delays and terms of use, please see disclaimer. The table below includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, if applicable. An emerging market ETF allows investors to diversify positions in emerging market bonds like a mutual fund, yet it trades like a stock.

I apologise, but, in my opinion, you are mistaken. I can defend the position. Write to me in PM.

Matchless phrase ;)