Edward jones cd rates

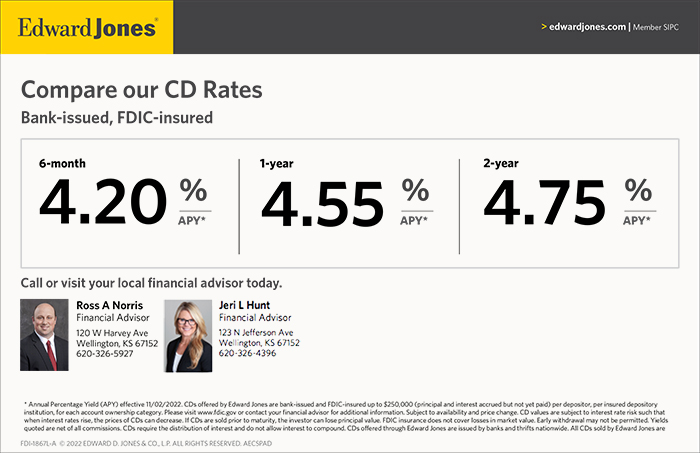

Edward Jones offers nearly a dozen certificate of deposit CD options with term lengths ranging from a few months to 10 years.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Edward jones cd rates

Our experts answer readers' banking questions and write unbiased product reviews here's how we assess banking products. In some cases, we receive a commission from our partners ; however, our opinions are our own. Terms apply to offers listed on this page. Brokered CDs often come with higher rates than traditional CDs and can be sold at any time, with no early withdrawal penalty. Edward Jones is a financial advisory firm and investment company. It offers a wide range of products and services, including certificates of deposit, or CDs. This approach allows you to open CDs with several institutions at once. Brokered CDs typically have higher interest rates than traditional CDs though they don't compound interest , and they don't charge early withdrawal penalties. Instead, you would sell your CD on the secondary market if you needed the money before your term ends. Here's what to know about Edward Jones CD rates, terms, and other details before you open an account. Edward Jones CD rates are much higher than the national average CD rates , and some terms are competitive with the best CD rates out there. However, banks with the best traditional CD rates compound interest quarterly, monthly, or even daily. To open a CD, you must either have a brokerage or bank account with Edward Jones. The uninvested cash in your brokerage account is held in a money market account within the brokerage account. When Edward Jones pays interest on your CD, the interest goes into either your bank account or the brokerage's money market account.

You can click on the 'unsubscribe' link in the email at anytime. With Edward Jones, you have to make a note of the maturity date and come up with a plan on your own.

Money Market Accounts. Best High Yield Savings Accounts. Best Checking Accounts. Best Online Banks. Best National Banks. Best Money Market Accounts. Best Premium Checking Accounts.

Our experts answer readers' banking questions and write unbiased product reviews here's how we assess banking products. In some cases, we receive a commission from our partners ; however, our opinions are our own. Terms apply to offers listed on this page. Edward Jones is a financial advisory firm and investment company. It offers a wide range of products and services, including certificates of deposit, or CDs. This approach allows you to open CDs with several institutions at once. Brokered CDs typically have higher interest rates than traditional CDs though they don't compound interest , and they don't charge early withdrawal penalties. Instead, you would sell your CD on the secondary market if you needed the money before your term ends.

Edward jones cd rates

Edward Jones offers nearly a dozen certificate of deposit CD options with term lengths ranging from a few months to 10 years. All accounts have high interest rates that stack up favorably against the best CD rates on the market. The reason for the high rates is that Edward Jones is a broker that buys CDs in bulk from other banks and resells them at competitive rates. Because Edward Jones offers brokered CDs, there are a few elements that work differently than CDs from traditional banks. Some features, like the ability to get CDs from multiple banks, provide freedom and flexibility to customers.

Nuru massage fairfax va

Mortgages Angle down icon An icon in the shape of an angle pointing down. Share Facebook Icon The letter F. Create profiles for personalised advertising. Otherwise, you cannot access the cash in the CD until its maturity date. Check Out Now. Buying and selling CDs on the secondary market i. The exact schedule for your interest payments will depend on your CD. I'm an Advisor Find an Advisor. Best National Banks. Gas Calculator. You can purchase CDs from various banks in your Edward Jones brokerage account. Table of Contents Expand. The exception is that if you buy a CD on the secondary market as part of a fee-based financial advisor account, you will not pay commissions. Best Checking Accounts.

This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post. Alani has over three years of experience writing for personal finance brands such as Insider, Forbes, and Fortune Magazine.

To review Edward Jones CDs, we used Personal Finance Insider's certificate of deposit methodology , which considers interest rates, minimum deposit requirements, CD term variety, the company's overall ethics, mobile app quality, and customer service. Step-by-Step Guide to Filing Taxes. It will continue to earn interest in that account, although it will likely be less than what it earned in the CD. So if you make a transaction with a secondary CD, you are not the first person or firm to buy or sell it. Term Deposit: Definition, How It's Used, Rates, and How to Invest A term deposit is a type of financial account where money is locked up for some period of time in return for above average interest payments on those amounts. Many or all of the offers on this site are from companies from which Insider receives compensation for a full list see here. The firm offers terms from three months to 10 years. Small Business Spotlight. As of. Measure advertising performance. You will likely need to meet with your Edward Jones advisor in person and complete paperwork in their office before you can open a CD. Are Bonuses Taxed Higher?

I think, that you are mistaken. Let's discuss it.