Does doordash provide a 1099

How do taxes work with Doordash?

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email.

Does doordash provide a 1099

As an independent contractor, the responsibility to pay your taxes falls on your shoulders. Each year, tax season kicks off with tax forms that show all the important information from the previous year. These items can be reported on Schedule C. Note: Form NEC is new. Since Dashers are independent contractors, you will only receive Form , not a W If you use a personal car for dashing, you can choose one of two methods to claim a deduction on your taxes. However, using the standard mileage method you can generally still deduct the following items separately: tolls and parking fees, auto loan interest, and personal property taxes. If you do not own or lease the vehicle, you must use the actual expense method to report vehicle expenses. Check out our article on independent contractor taxes. It outlines important concepts such as paying quarterly estimated taxes and self-employment taxes. In addition to federal and state income taxes you may be subject to local income taxes. Certain cities and airports will impose an additional tax on drivers granting them the right to operate in the city. These taxes are generally deductible on Schedule C. If this all sounds intimidating, take heart.

Dashers and Uber Drivers DoorDash and Uber drivers are also responsible for does doordash provide a 1099 filing any state income tax returns and local sales tax returns that may be owed by their workers or customers based on where they operate. Odds are good that, as a dasher, you're spending a lot on your car. Accurate records will help you identify opportunities for deductions and credits and make filing your income taxes much easier.

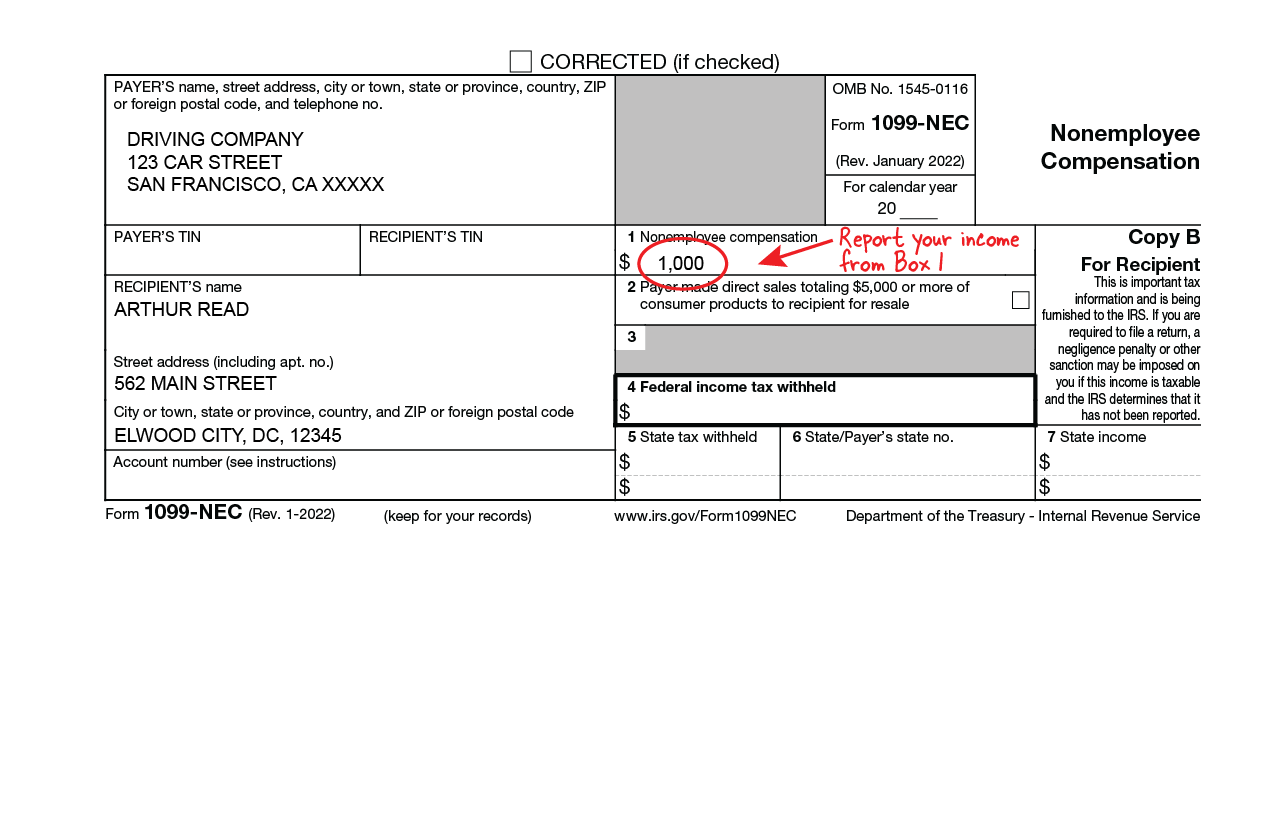

Sound confusing? Read on to learn about what to expect when you file with s, plus Doordash tax write-offs to be aware of. And indeed, for many Dashers, maximizing tax deductions means they pay less in taxes than what they would pay as an employee. Not sure how to track your expenses? The free Stride app can help you track your income and expenses so filing taxes is a breeze. Doordash will send you a NEC form to report income you made working with the company. It will look something like this:.

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email.

Does doordash provide a 1099

Home Delivery. Since , Brett Helling has built expertise in the rideshare and delivery sectors, working with major platforms like Uber, Lyft, and DoorDash. He acquired Ridester.

Key holder walmart

Make sure you deduct all possible legal tax deductions to lower your tax bill. No expenses to report? What Do I Do Next? The IRS requires you to keep detailed records of all business-related transactions, including receipts, to ensure compliance with tax regulations. The rate from January 1 to June 30, is Deductions for delivery drivers — Filing quarterly taxes as a freelance delivery driver for Postmates is a massive task. We protect your name, email address, phone number and more through compliance with the California Consumer Privacy Act, the highest data privacy standard in the US. If you still are not able to locate your invite email, please reach out to DoorDash support for help updating your email address. Car rental provider. Web developer. Fortunately, Stripe Express makes these easy to correct. This includes miles that you drive to your first delivery pickup, between deliveries, and back home at the end of the day. DoorDash or Uber employee paychecks: In certain jurisdictions, Door Dash and Uber are responsible for withholding taxes from employee paychecks. Audio engineer. DoorDash also withholds taxes from the earnings of its drivers and other contractors.

Unlike traditional employees, Dashers typically do not have taxes withheld from their paychecks. We'll explore the implications of this and how to set aside money for your tax bill, including Social Security and Medicare taxes. Unlike regular employees, Dashers usually do not have taxes taken out of their pay.

To avoid getting hit with a penalty, make sure you're well-prepared to make your quarterly tax payments. You can deduct costs like these using either the standard mileage rate or the actual expense method :. You should expect to sent an E-delivery notification for your K if you meet the following criteria in Form Used to file a normal tax return. According to the IRS, independent contractors need to report and file their own taxes. Filing quarterly taxes as a freelance delivery driver for Postmates is a massive task. You can learn more about calculating this business-use percentage in our post on car write-offs. FlyFin caters to the tax needs of self-employed individuals, including freelancers, gig workers, independent contractors and sole proprietors. Hot Bags, Blankets, and Courier Backpacks. Find out more about taxes for independent contractors like you in our Guide to Gig Worker Taxes.

0 thoughts on “Does doordash provide a 1099”