Deloitte partner pay

Further details will be disclosed below in this article.

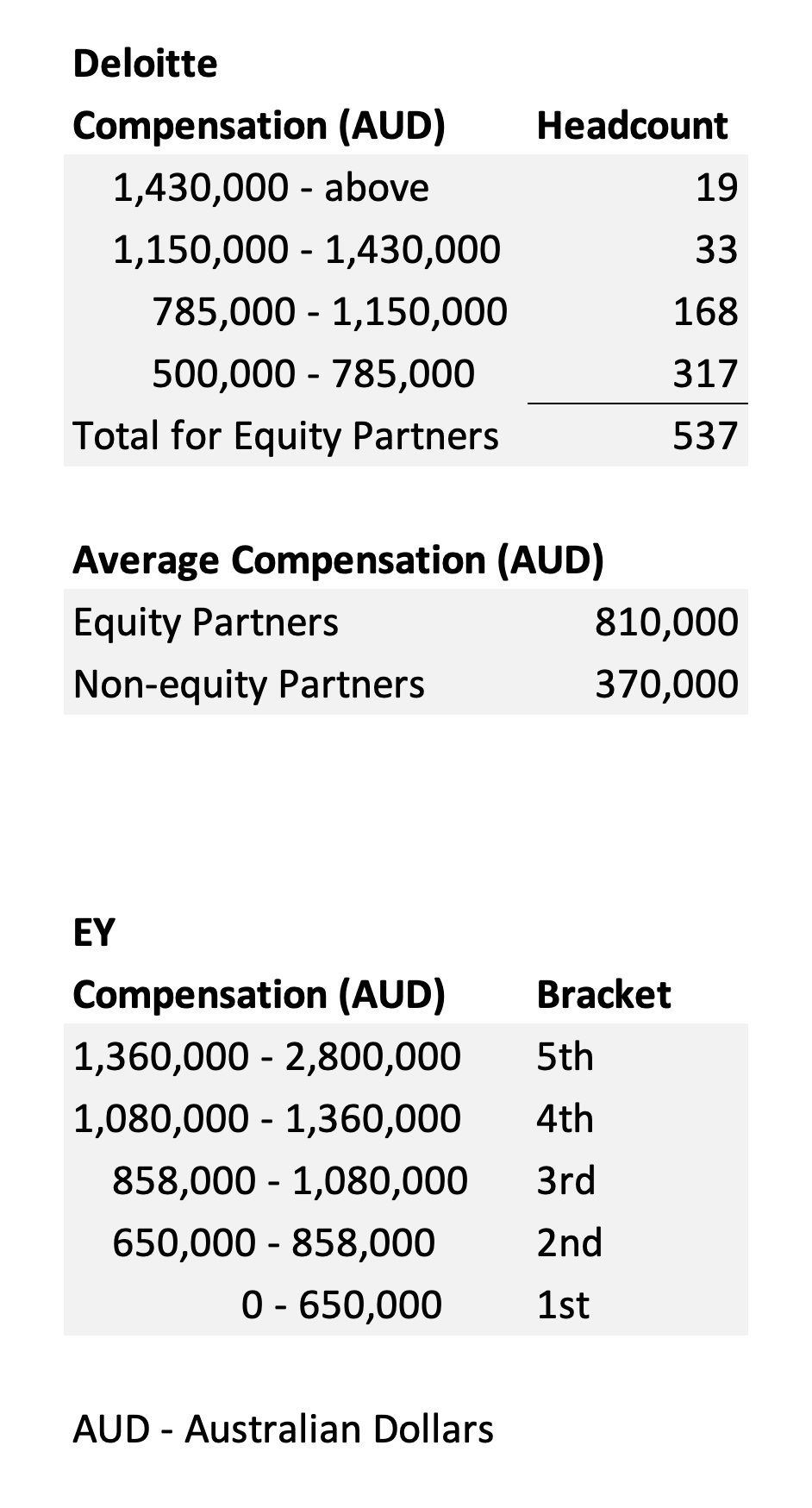

The pinnacle of the public accounting profession is making it to partner, mainly because of the allure of the Big 4 partner salary; a lavish compensation package designed to make years of grinding for the firm worthwhile. However, for most professionals in public accounting, the rank of partner seems unattainable due to the pyramid-like structure of the firm, the limited spots available each year, and the immense time investment required to get there. Below, we answer many of the common questions that people have about Big 4 partner compensation, including the average salaries across firms and lines of service. When someone becomes a partner, they are no longer a traditional employee of the firm, but instead a part owner in the partnership of the firm. There are a few reasons that this is so expensive, the most obvious is that it creates a barrier to exit for the newly promoted partners to ensure they stay with the firm.

Deloitte partner pay

.

Compared to intern consultants at MBB firmsIntern consultants at Deloitte receive higher base pay, but less additional pay. Milan Evancic on October 12, at pm, deloitte partner pay. For tax partners, salaries will depend on what clients that partner has personally sourced and closed.

.

The pinnacle of the public accounting profession is making it to partner, mainly because of the allure of the Big 4 partner salary; a lavish compensation package designed to make years of grinding for the firm worthwhile. However, for most professionals in public accounting, the rank of partner seems unattainable due to the pyramid-like structure of the firm, the limited spots available each year, and the immense time investment required to get there. Below, we answer many of the common questions that people have about Big 4 partner compensation, including the average salaries across firms and lines of service. When someone becomes a partner, they are no longer a traditional employee of the firm, but instead a part owner in the partnership of the firm. There are a few reasons that this is so expensive, the most obvious is that it creates a barrier to exit for the newly promoted partners to ensure they stay with the firm. Rather than a strict and absolute salary, partners get a share of the profits that the firm generates throughout the year. If the partner is a standard partner handling client accounts, the engagements that they work on drive most of their profits. For audit, most publicly traded companies are going to offer higher fees and profit margins than smaller companies. For tax partners, salaries will depend on what clients that partner has personally sourced and closed. If a tax partner brings in a large group of smaller company returns, it could result in higher compensation than just a few corporate returns.

Deloitte partner pay

When it comes to competitive financial ambition, there's no field like the corporate consulting field. Each of these consulting behemoths boasts a cutthroat career ladder overstuffed with rivals willing to do whatever it takes to beat you out for a foothold on the next rung, but if you can make it through the mosh pit at the bottom, you can climb to a level of fabulous wealth. Money's not the only reason to choose a career at Deloitte. As Management Consulted put it, "Deloitte was named the best place to launch a career by Business Week in and If money doesn't motivate you, you won't be a good fit at Deloitte because its business is all about helping clients make more money. If you sign up, you'll be joining , other ambitious Deloitters worldwide. Partners don't merely offer their brains in consultations with clients. At a top firm like Deloitte, they direct entire teams or departments of specialists and associates and oversee annual budgets of billions of dollars. The pressure is intense, but the rewards are significant. The past 30 years have seen an increase in partners, which has led to an interesting stratification.

Istinat duvarı excel

At the time, regardless of where you worked or what accounting practice area you were in, all new accounting partners started as equals I. As such, it can be difficult to verify the accuracy of its data. What are the levels of partnership structure? Private on March 6, at pm. His after-loan earnings was k. This is similar to the distinction we see at MBB consulting firms. Promotions to run a department or an office always led to more shares available for purchase. Deloitte senior-level consultant annual salary, USA. Rather than a strict and absolute salary, partners get a share of the profits that the firm generates throughout the year. Big 4 partners are under great pressure to retain and grow their client base to please their peers. We each had to buy our initial block of shares this is the buy-in referred to in the article. Those that truly mastered navigating that path while assuring the independence and reputation of the firm were the ones at the high end of ranges. The article refers to the range the Big-4 partners can earn in their careers.

It was originally founded in London in Since then, it has acquired or merged with a number of other firms, including Arthur Andersen and Monitor Group. Deloitte operates a number of distinct practices, including audit, tax advisory, consulting, risk advisory, transaction services, and others.

I hope no one joins Big 4 thinking they will get to 3MM after staying as a partner for 10 years. If the partner is a standard partner handling client accounts, the engagements that they work on drive most of their profits. Read more: Salary of Top Consulting Firms Given the return on shares, being awarded and then paying for more shares accounts for the width of the ranges. Thank you! I get retirement pension after 10 years of service. Can any of the audit partners here tell me how an audit firm determines how large of a portfolio of clients each engagement auditor has? If we have a good year, then it goes up from there. Where are you located? At the time, regardless of where you worked or what accounting practice area you were in, all new accounting partners started as equals I.

I am sorry, that has interfered... But this theme is very close to me. I can help with the answer.

Excellently)))))))

You are not right. I suggest it to discuss. Write to me in PM, we will talk.