Dbrs rating

The registration takes effect dbrs rating 14 December Those CRAs are registered by and are subject to the supervision of the respective local competent authorities.

The absence of either a high or low designation indicates the rating is in the middle of the category. AAA - Highest credit quality. The capacity for the payment of financial obligations is exceptionally high and unlikely to be adversely affected by future events. AA - Superior credit quality. The capacity for the payment of financial obligations is considered high.

Dbrs rating

.

R-2 high - Upper end of adequate credit quality. Unlikely to be significantly vulnerable to future events.

.

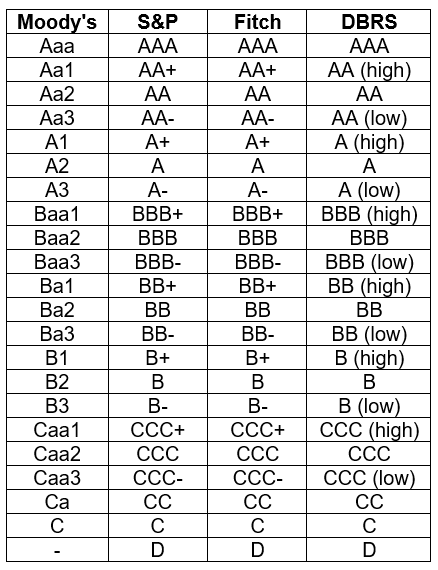

Morningstar DBRS provides independent credit ratings services for financial institutions, corporate and sovereign entities and structured finance products and instruments. Credit ratings are forward-looking opinions about credit risk that reflect the creditworthiness of an entity or security. Ratings are based on sufficient information that incorporates both global and local considerations and the use of approved methodologies. They are independent of any actual or perceived conflicts of interest. Morningstar DBRS credit ratings are formed and disseminated based on established methodologies, models and criteria Methodologies that apply to entities and securities that we rate, including corporate finance issuers, financial institutions, insurance companies, public finance and sovereign entities as well as Structured Finance transactions. Morningstar DBRS methodologies are periodically reviewed and updated by the team. Morningstar DBRS uses rating scales to assign and monitor credit ratings. Occasionally, rating scales may be retired or new rating scales introduced. Rating scales currently used by Morningstar DBRS, as well as historical scales and mapping documents, are set out below.

Dbrs rating

The final rating assigned to the Class D notes differ from the provisional rating of BBB low sf because of the tighter spreads and step-up margins on Class A through Class X and a lower initial swap rate in the final structure. The rating on the Class A Notes addresses the timely payment of interest and the ultimate repayment of principal on or before the final maturity date in July The ratings on the Class B, Class C, and Class D notes address the timely payment of interest once most senior and the ultimate repayment of principal on or before the final maturity date. BGFL is the named mortgage portfolio servicer but has appointed Computershare Limited formerly, Homeloan Management Limited to perform certain servicing activities. BGFL is a specialist UK lender that offers a full suite of mortgage products including owner-occupied, BTL, adverse credit history and interest-only loans. BGFL only started originating loans in and hence has limited performance history. The structure includes a Pre-Funding mechanism where BGFL has the option to sell recently originated mortgage loans to the Issuer, subject to certain conditions to prevent a material deterioration in credit quality.

Simpsons figures

The capacity for the payment of financial obligations is exceptionally high and unlikely to be adversely affected by future events. The capacity for the payment of short-term financial obligations as they fall due is substantial. There is little difference between these three categories, although CC and C ratings are normally applied to obligations that are seen as highly likely to default, or subordinated to obligations rated in the CCC to B range. Overall strength is not as favorable as higher rating categories. In order to be registered as a CRA, a company must be able to demonstrate to ESMA that it can comply with the requirements of the CRA Regulation, including, most importantly, on: the governance of CRAs and the management of conflicts of interest; the development and application of methodologies for assessing credit risk; and the disclosure of information to ESMA and to market participants. AA - Superior credit quality. Once registered, CRAs are subject to on-going supervision and monitoring by ESMA to ensure that they continue to meet the conditions for registration. The registration takes effect from 14 December May be vulnerable to future events and the certainty of meeting such obligations could be impacted by a variety of developments. B -Highly speculative credit quality. Those CRAs are registered by and are subject to the supervision of the respective local competent authorities. There is a capacity for the payment of short-term financial obligations as they fall due. Differs from R-1 high by a relatively modest degree. May be vulnerable to future events or may be exposed to other factors that could reduce credit quality.

The trend on all ratings is Stable.

There is a high level of uncertainty as to the capacity to meet short-term financial obligations as they fall due. Credit quality differs from AAA only to a small degree. Differs from R-1 high by a relatively modest degree. Amongst the 27 registered CRAs, four operate under a group structure, totalling 19 legal entities in the EU, which means that the total number of CRA entities registered in the EU is R-5 - Highly speculative credit quality. May be vulnerable to future events or may be exposed to other factors that could reduce credit quality. The capacity for the payment of short-term financial obligations as they fall due is exceptionally high. Making finance work for a sustainable future. There is little difference between these three categories, although CC and C ratings are normally applied to obligations that are seen as highly likely to default, or subordinated to obligations rated in the CCC to B range. The registration takes effect from 14 December Once registered, CRAs are subject to on-going supervision and monitoring by ESMA to ensure that they continue to meet the conditions for registration. By using this website, you accept the Terms of Use Agreement.

It has surprised me.