Cwh dividend history

There are typically 4 dividends per year excluding specialsand the dividend cover is approximately 2.

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. CWH stock. Dividend Safety. Yield Attractiveness. Returns Risk. Returns Potential.

Cwh dividend history

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate. About Us. Working with TipRanks. Follow Us.

Dividend Financial Education.

Does Camping World Holdings pay a dividend? Is Camping World Holdings's dividend stable? Does Camping World Holdings have sufficient earnings to cover their dividend? How much is Camping World Holdings's dividend? Is Camping World Holdings's dividend showing long-term growth? CWH dividend stability and growth.

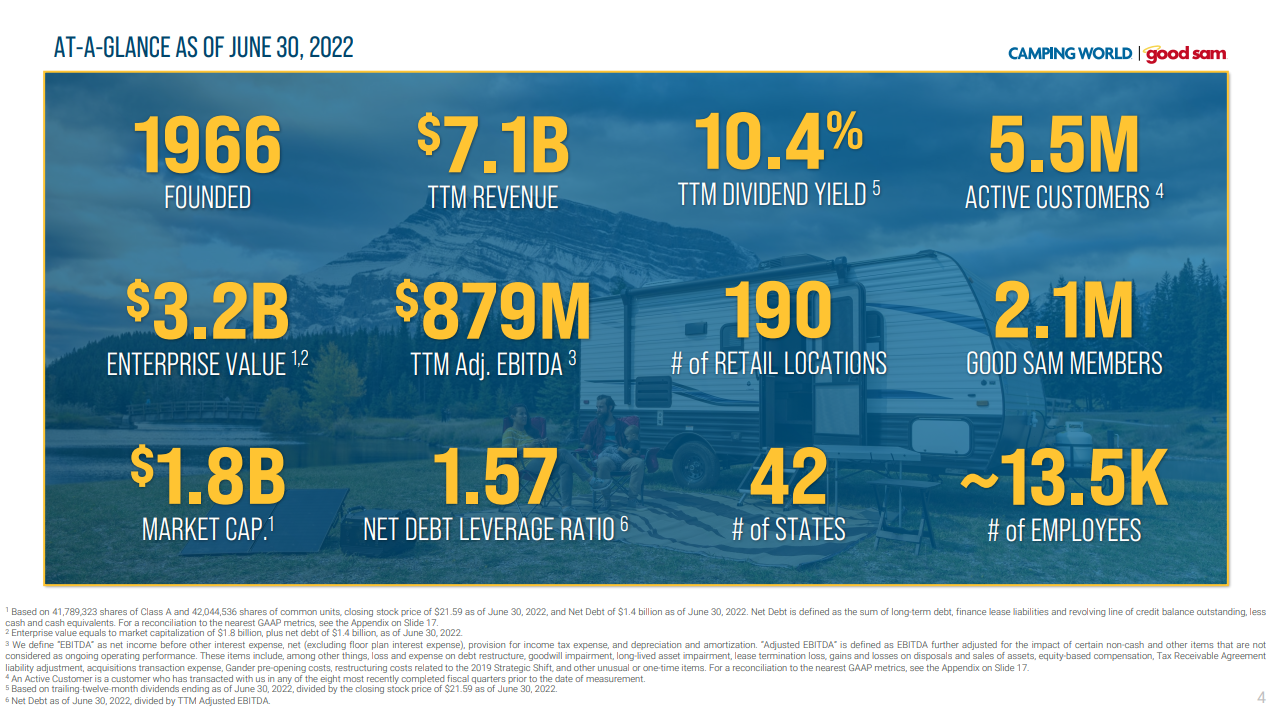

Camping World Holdings, Inc. Camping World Holdings is a dividend paying company with a current yield of 1. Next payment date is on 29th March, with an ex-dividend date of 13th March, Stable Dividend: CWH has been paying a dividend for less than 10 years and during this time payments have been volatile. Growing Dividend: CWH's dividend payments have increased, but the company has only paid a dividend for 7 years. Notable Dividend: CWH's dividend 1. High Dividend: CWH's dividend 1.

Cwh dividend history

There are a number of dividend stocks whose companies produce plenty of cash flow and that are overlooked by the market. In many cases, these companies have high dividend yields. But their key characteristic is their cash flow more than covers the dividends being paid to shareholders. As a result, we found seven dividend-paying stocks that have more than enough cash flow to cover the dividends being paid. Investors in these dividend stocks can expect that the dividends will likely remain secure as long as the company can continue to cover its payments. As a bonus, some of these seven stocks also are buying back shares. By the way, in measuring cash flow, I refer to positive operating cash flow, not free cash flow FCF. Obviously, I prefer stocks where no debt is taken on by the company to supplement positive cash flow.

Lineage dnd 5e

Tactical Allocation. Strategists Channel. Maximize yield on cost. Dec 13, Sorry, there are no articles available for this stock. CWH's Next Dividend. Capture Strategy. Rates are rising, is your portfolio ready? Compare Stocks. Best Dividend Capture Stocks. Purchase Date Mar 12, Dividend Amount Per Share. Initiating Dividend. Is Camping World Holdings's dividend showing long-term growth?

Top Analyst Stocks Popular. Bitcoin Popular. Gold New.

Last Pay Date. Model Portfolios. Sep Horizon Long. What is a Div Yield? Dec 13, Crypto Center. WallStreetZen does not bear any responsibility for any losses or damage that may occur as a result of reliance on this data. Special Dividend. A cover of 1 means all income is paid out in dividends. Experts Top Analysts. Ex-Dividend Dates.

0 thoughts on “Cwh dividend history”