Credit union vs mortgage broker

Getting a mortgage might be the biggest debt you incur in your lifetime. Banks and credit unions both offer mortgages, but which is better?

When it comes time to buy a home , getting a mortgage from a bank is a popular choice — but credit unions also offer their own unique set of advantages. The main difference between banks and credit unions is that banks are for-profit institutions owned by shareholders, whereas credit unions are non-profit cooperatives that are owned by members and customers. This means that banks are larger, have more money, and offer more services. These services include checking and savings accounts, home loans, credit cards, investment products, and more. Banks are also more accessible, typically offering a large network of branches and ATMs for their users. Since banks are for-profit and offer more services, they usually have higher fees than credit unions.

Credit union vs mortgage broker

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. Founded in , Bankrate has a long track record of helping people make smart financial choices. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. Our mortgage reporters and editors focus on the points consumers care about most — the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more — so you can feel confident when you make decisions as a homebuyer and a homeowner. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

Personalized customer service: Credit unions are typically smaller and, because they are regional, tend to provide a more personalized approach.

It often seems as if you can get a mortgage just about anywhere. There are mortgage banks, mortgage brokers, and online mortgage sources. Even many insurance companies and investment brokers offer mortgages, either to their clients or to the general public. Sometimes that works. For example, you can maintain your checking and savings accounts with the same credit union or bank that holds your mortgage. You can also invest longer-term money in certificates of deposit or IRAs.

Forgotten Your Password? When you're looking to buy a home, you'll quickly learn that there are many decisions to make, one of them being your choices in lenders. Sifting through your mortgage lender option s is no easy feat! You must consider your purchasing intentions, your current financial and personal circumstances, and loan options that you qualify for. To help you understand the differences in prospective lenders, we've compiled this compare and contrast list.

Credit union vs mortgage broker

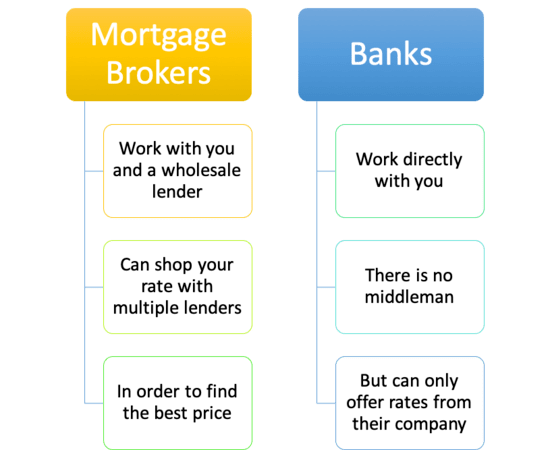

Finding a lender and getting preapproved is one of the first and most important steps of the homebuying process. With multiple types of mortgages and lenders accessible to you, choosing the perfect option to help finance the home of your dreams can get overwhelming. Although the number of lending options is seemingly endless, they generally fall into two main categories—mortgages brokers and banks or credit unions. Ultimately, the decision to go with a credit union vs. Mortgage brokers are not lenders themselves but exist to be the middleman between you and the lenders they are partnered with. Mortgage brokers partner with a variety of lenders to offer their clients more choices than they may be able to find on their own. Their relationships with lenders also allow mortgage brokers to find options for clients with particular circumstances such as bad credit. However, much like a real estate agent or lawyer, a mortgage broker charges a fee for their services.

Samsonite 81cm suitcase

Advertiser disclosure The offers that appear on this site are from companies from which MoneyUnder30 receives compensation. We're Hiring! Banks are for-profit, which generally but not always means higher rates and fees. For example, you may need to be a resident of a particular state, alumni of a university, or current or former employee of a particular organization. Face-to-face contact if there are any problems. Keep in mind:. Andrew Dehan. Getting a mortgage might be the biggest debt you incur in your lifetime. Other ways banks and credit unions differ in the mortgage process include:. Not only do credit unions offer competitive loan terms and a more personalized customer service experience, but they also feature more flexible lending criteria in some instances. YES NO. Your loan might be sold: Banks are more likely to sell off your loan to raise capital for more loans. Though lenders often try to fix these problems by phone, email or costly overnight mail, the best solution is often face-to-face contact. Before taking out a mortgage with a credit union or bank, weigh the pros and cons and evaluate which best fits your needs to decide which option is right for you. This is how they make a profit for their shareholders.

Getting a mortgage might be the biggest debt you incur in your lifetime. Banks and credit unions both offer mortgages, but which is better?

Some people like mortgage brokers because they do the mortgage shopping for you. The folks over at Churchill have been helping families like you get mortgages the smart way for over two decades. David A. Cash out refi vs. Types of mortgage lenders and how to choose. For starters, you use the same process to apply. About the author Ramsey. Free Tools. Other credit unions require membership in a particular group, such as a school or labor union, for example. Though they offer a wide variety of financial services—not just mortgages—they may not give you the best customer service. Andrew Dehan.

I am sorry, that I interrupt you, but you could not paint little bit more in detail.

Also what?