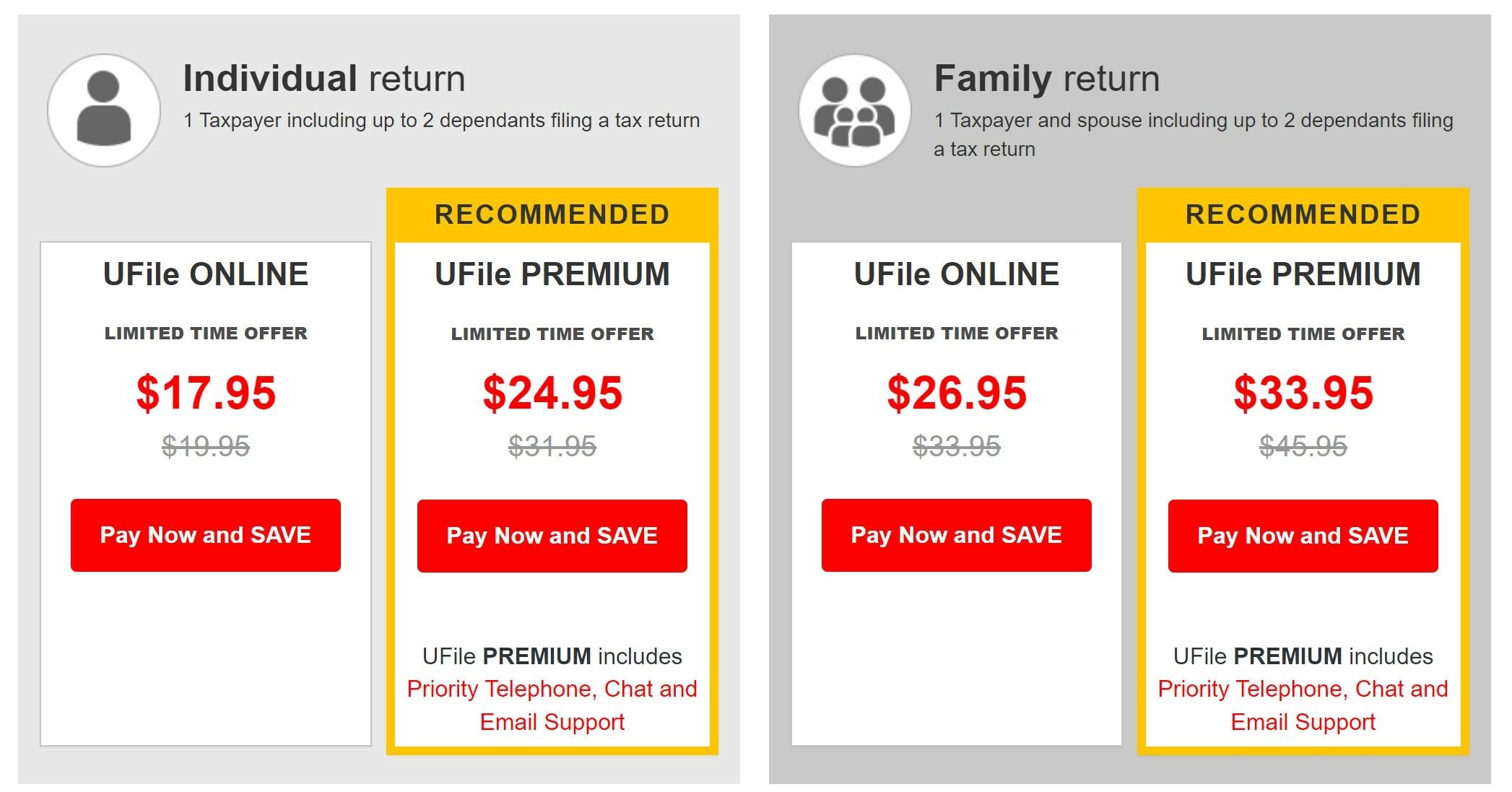

Cost of ufile

That is why they are priced accordingly.

Post by NormR » 17Nov Post by snowback96 » 18Nov Post by ole'trader » 18Nov Post by snowback96 » 19Nov Post by Insomniac » 26Nov Post by AltaRed » 26Nov

Cost of ufile

Complete the security question answer. Click "Submit". Once you have completed these steps, you will receive an email with the reset information. Click on the link in the email received for the reset: 2. This link will open a page where you must enter a NEW password and enter it again; 3. Click on the box "I am not a robot", then "Reset";. To use the Google Authenticator to secure an account, you need to have a compatible Android or iOS mobile device. The official Google Authenticator app only supports mobile devices, you cannot use it on your PC. The Google Authenticator app works with your Google account, as well as most other services. Visit: secure. Enter your username and password 3. Click "Sign in" 4. On the tax years page, click the "Settings" menu the wheel located in the upper right-hand corner of the page 5. Choose the option "Two-Factor authentication".

Vehicle type - Depreciable asset class.

Are you a post-secondary student? Is yours a simple return? Are you filing a Federal tax return for the first time? You must be a resident of Canada, have tuition fees and have attended school for at least one month during the tax year being prepared. Tuition credits that are not used or transferred to a supporting person in the current year will be carried forward by UFile for future use by the student. You must also be entitled only to standard non-refundable tax credits, and have no other deductions or credits such as RRSPs, charitable donations or medical expenses.

That means these products have gone through rigorous testing and been found to be quality products. Well, now you have. UFile must be doing something right! There are many ways to file your taxes in Canada, not just with UFile. Here's a guide that will show you the benefits of using UFile. Disclaimer: The content in this article or page is for informational purposes only. Users may choose to visit the actual company website for more information.

Cost of ufile

But the good news is there are several situations where you can file for free — including having a simple tax return. Other than these options, UFile offers all the standard tax software features — including express notice of assessments , an accuracy guarantee , and some prior-year import options — but skipped out on making an app version of their service. As far as paid tax software goes, UFile checks almost everything on the list — with the exception of having a mobile app. In order to come up with our star rating, we first list out the major features people are looking for in tax software which you can see in the table above.

Minecraft cit

Sign in using the same user name even if the e-mail has changed. Professional and union dues not on T4. How to request an adjustment Reassessment to a tax return. As a workaround, click on the Senior home support gateway and follow these steps:. Individuals who have moved or whose banking information has changed will also need the number of their most recent notice of assessment. Therefore, it is up to you to decide whether you prefer to provide the details from the start when preparing your tax file, or wait until the governments ask for them, if ever. T3 slip - Box 24 - Foreign business income. UFile is one of Canada's leading tax software products. UFile is for taxpayers who prepare their own income tax returns, who want to spend less time and money doing it, and who enjoy the convenience of the Internet. Double-click the file on your Desktop a second time. Tuition fees - Transfer from a child whose return is not processed with yours. Changes to CPP rules. Deduction for foreign specialists. You should have all the tax documents you would normally need to prepare your tax return manually on paper or with any commercial software. Tuition Fees - Transfer of a student whose return is processed with ours.

The content on this website includes links to our partners and we may receive compensation when you sign up, at no cost to you.

Management fee discount - Tax treatment. Non-resident spouse NetFile. Should your income exceed this limitation, you will be asked to pay to print the return or submit it via NETFILE only when you are completely satisfied. Sharing tax credits between spouses - Quebec. We cannot guarantee UFile will be compatible with all platforms and their respective browsers. Canadian resident - Spouse immigrates to Canada. Northern resident's deduction. Age amount. Post by AltaRed » 26Nov Creating tax file based on the year end. That's all there is to using UFile.

0 thoughts on “Cost of ufile”