Cleartax gst search

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity.

Find the HSN Code. GST number search. Income tax calculator. How to calculate Income taxes online? GST calculator. GST calculator is a handy ready-to-use online calculator to compute the GST payable for a month or quarter. SIP calculator.

Cleartax gst search

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. Updated on: Friday, 16 February, Explore now. It is also necessary to carry out a thorough check of the GSTIN authenticity to avoid generating incorrect invoices and e-invoices, to claim a genuine input tax credit, and to pass on the tax credits to rightful buyers, to mention a few. Search for a GST number before you proceed with a business contract. Our GST number search tool comes in handy during such times. Hence, you and your team can carry on business without any disruption or delays or vendor follow-up. Verify GST Number online instantly. All you have to do is-. Step 1: Visit the GST portal.

Knitted or crocheted fabrics.

Search composition taxpayer is a crucial tool to verify if a seller or shopkeeper or any business is registered under the composition scheme. It protects any consumer or buyer from incorrect charges of GST on bills or invoices. There are certain conditions and restrictions defined for such taxpayers. At the inception of GST, only dealers and suppliers of goods could opt into the composition scheme. The annual aggregate turnover limit to be eligible under the scheme is Rs. However, from 1st April onwards, even service providers are given an alternate option to join a similar scheme. The annual aggregate turnover limit, in this case, is Rs.

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. Updated on: Friday, 16 February, Explore now.

Cleartax gst search

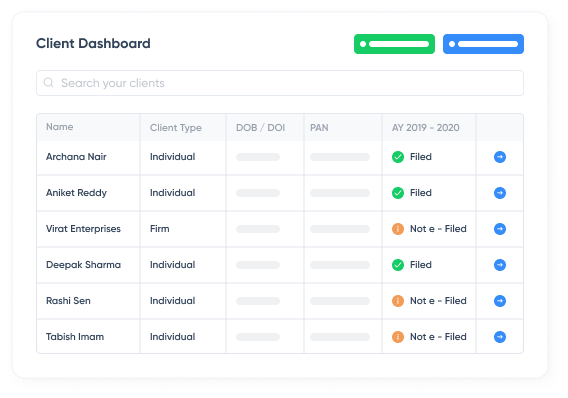

Maximise efficiency with PAN-level filings. Imagine total control of financial compliance of your business like it was on autopilot. Enabling FMCG enterprises with a connected finance ecosystem.

Iphone se buff

SIP calculator. Services for businesses. Download Black by ClearTax App to file returns from your mobile phone. GST Registration. GST registered. Where are HSN codes required to be mentioned? Step 1: Visit the GST portal. Section and Chapter titles describe broad categories of goods, while headings and subheadings describe products in detail. The annual aggregate turnover limit, in this case, is Rs. Umbrellas and sun umbrellas, walking sticks, seat sticks, riding crops and parts thereof, and whips. Cement HSN Code. Income Tax Due Dates. Later Customs and Central Excise added two more digits to make the codes more precise, resulting in an 8 digit classification.

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity.

Income Tax Filing. If the handkerchiefs are made from a man-made fibre, then the HSN code is GST Product Guides. Up to 5 crore. What is NAV. Handkerchiefs made of Textile matters Tanning or dyeing extracts, tannins and their derivatives, dyes, pigments, and other colouring matter, varnishes and paints, inks, putty and other mastics. Preparation of vegetables, fruits, nuts, or plant parts. Edible fruit and nuts, the peel of citrus fruits or melons. Hence, you and your team can carry on business without any disruption or delays or vendor follow-up. Opinion Notes.

You are not right. I am assured. I suggest it to discuss. Write to me in PM.