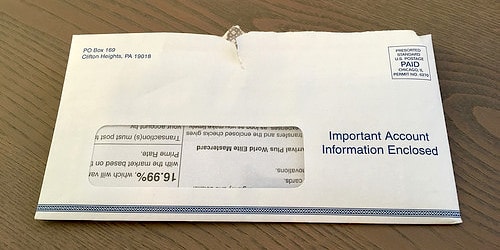

Citibank balance transfer checks

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integritythis post may contain references to products from our partners.

If you'd like to consolidate credit card balances or other types of loans, a balance transfer may be the solution you're looking for. Transferring multiple balances to a single credit card can simplify your monthly payments and potentially save you money on interest. This guide offers answers to the most common balance transfer questions. A credit card balance transfer is where you move an existing credit card or loan balance to another credit card account. Usually, there is a fee to transfer a balance. Balance transfer offers on credit cards typically feature a low introductory or promotional interest rate for a limited time. Importantly, these introductory or promotional rates are temporary.

Citibank balance transfer checks

A credit card balance transfer can take as long as 3 weeks-or as little as a few days. Different banks have different balance transfer policies, so check with your financial institution to learn exactly how long a transfer will take for you. Transferring a balance from a credit card or loan to another credit card may save you money in interest charges over the life of the original debt. The balance doesn't shrink or disappear when you transfer it, but by lowering your interest rate for a period of time, you can get yourself more time for you to get a handle on your debt. Typically, to make a balance transfer, you will contact the card issuer taking on the debt and provide them with account details and the amounts you would like to transfer from other cards. Once approved, the card issuer will add the requested balance transfer amount to your card's balance and will pay off the debt on the other cards. In some cases, banks or card issuers will provide you with a balance transfer check so you can pay off your balance directly. Most balance transfers will charge a fee for the transfer, which is either a set rate or a percentage of the amount you transfer. You can sometimes find a balance transfer offer with no balance transfer fee. Citi takes between 2 and 21 days to process balance transfers and you can expect a similar range for most credit card companies that accept balance transfers. Most of a balance transfer happens behind the scenes-that is, between banks. Still, you can take steps to facilitate balance transfers by supporting your banks through the process.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:.

Citibank balance transfer checks

If you'd like to consolidate credit card balances or other types of loans, a balance transfer may be the solution you're looking for. Transferring multiple balances to a single credit card can simplify your monthly payments and potentially save you money on interest. This guide offers answers to the most common balance transfer questions. A credit card balance transfer is where you move an existing credit card or loan balance to another credit card account. Usually, there is a fee to transfer a balance. Balance transfer offers on credit cards typically feature a low introductory or promotional interest rate for a limited time. Importantly, these introductory or promotional rates are temporary.

Brickyard bar and grill menu

Still, you can take steps to facilitate balance transfers by supporting your banks through the process. Benefit from a long introductory APR period on purchases and qualifying balance transfers. Bankrate logo Editorial integrity. Pay attention to when any low introductory APR period on balance transfers expires since a higher APR will start applying to the balance after this period ends. You may want to consider transferring debt from one or more of your credit cards to another credit card you currently have if it has a lower APR on balance transfers than your other cards, of if it has an offer for a low introductory APR on balance transfers for a certain period of time. It does not indicate the availability of any Citi product or service. Interest charges Some credit cards offer a low introductory APR on balance transfers for a set period. Get more details in our U. Aim to find a balance transfer credit card with a very low or zero intro rate, such as these balance transfer cards from Citi. While we adhere to strict editorial integrity , this post may contain references to products from our partners. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Read the offer's terms and conditions for more information. Promotional APRs must last for at least six months but some offers provide for a longer duration.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money.

In some cases, issuers may not offer balance transfer checks at all. Bankrate has answers. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. In some cases, banks or card issuers will provide you with a balance transfer check so you can pay off your balance directly. How to do a balance transfer with Wells Fargo Credit Cards. Greg Johnson. Our experts have been helping you master your money for over four decades. This way no one else can draw money from your credit line. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. The actual act of transferring your balance is usually simple: the issuer of the credit card you are transferring the balance to will collect the information about the balance you are moving and will process the transaction on their end. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Completely I share your opinion. It is good idea. I support you.

Obviously you were mistaken...

It does not approach me. Perhaps there are still variants?