Cibc stock dividend yield

The next Canadian Imperial Bank Of Commerce dividend will go ex in 17 cibc stock dividend yield for 90c and will be paid in 2 months. The previous Canadian Imperial Bank Of Commerce dividend was 90c and it went ex 2 months ago and it was paid 1 month ago. There are typically 4 dividends per year excluding specialsand the dividend cover is approximately 2.

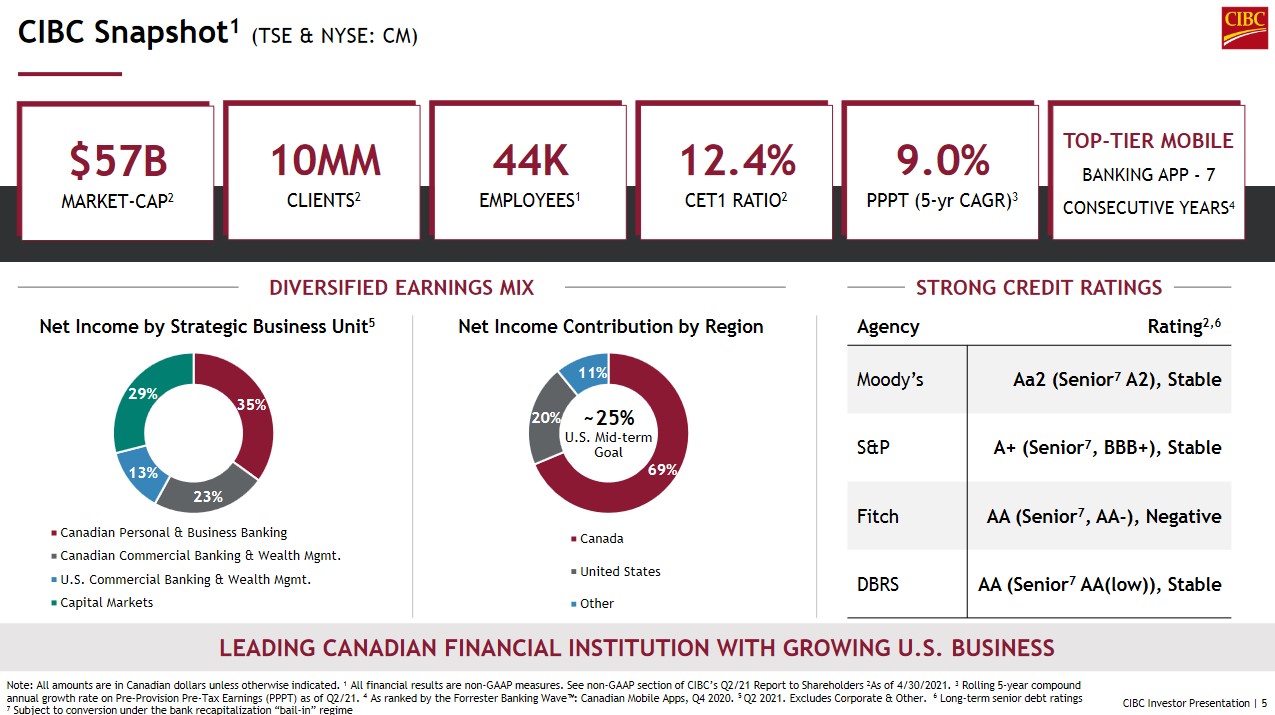

Canadian Imperial Bank of Commerce. Canadian Imperial Bank of Commerce is a dividend paying company with a current yield of 5. Next payment date is on 29th April, with an ex-dividend date of 27th March, Stable Dividend: CM's dividends per share have been stable in the past 10 years. Growing Dividend: CM's dividend payments have increased over the past 10 years.

Cibc stock dividend yield

Your experiences, your ideas, your style. They all add up to you. We embrace the diversity that makes each of us unique. Learn more. Learn more about the Board of Directors. CIBC designates any and all dividends paid or deemed for Canadian federal, provincial or territorial income tax purposes to be paid on or after January 1, to be "eligible dividends", unless indicated otherwise in respect of dividends paid subsequent to this notification, and hereby notifies all recipients of such dividends of this designation. The following table shows the common dividends paid after adjusting for a two-for-one stock split on May 13, Contact Us. Corporate Profile Corporate Profile. At CIBC we believe that long-term success requires effective governance.

Next Payment. Dividend Returns Comparison.

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools.

Your experiences, your ideas, your style. They all add up to you. We embrace the diversity that makes each of us unique. Learn more. Learn more about the Board of Directors. Dividend history. Information about CIBC's common shares, including stock exchange listings, restrictions on ownership, share repurchase and stock splits.

Cibc stock dividend yield

Canadian Imperial Bank of Commerce. Canadian Imperial Bank of Commerce is a dividend paying company with a current yield of 5. Next payment date is on 29th April, with an ex-dividend date of 27th March, Stable Dividend: CM's dividends per share have been stable in the past 10 years. Growing Dividend: CM's dividend payments have increased over the past 10 years. Notable Dividend: CM's dividend 5. High Dividend: CM's dividend 5. Earnings Coverage: With its reasonable payout ratio Future Dividend Coverage: CM's dividends in 3 years are forecast to be covered by earnings View Financial Health.

How to buy bundle on lycamobile

Share Information. Trending Stocks. Earnings Calendar. Top Financial Bloggers. TSE:CM's dividend payout ratio is Jan 29, Dividend Yield Today. Follow 1, Followers. Eligible dividends CIBC designates any and all dividends paid or deemed for Canadian federal, provincial or territorial income tax purposes to be paid on or after January 1, to be "eligible dividends", unless indicated otherwise in respect of dividends paid subsequent to this notification, and hereby notifies all recipients of such dividends of this designation. Stock Screener. Penny Stocks. Dividend Yield vs Market. Sign Up Required.

Your experiences, your ideas, your style.

Dividend Yield. About TipRanks. Free Email Notification. Inflation Rate Unemployment Rate. Dec 28, For CIBC, sustainability is integral to the way we think about and manage our business. Crypto Center. Top Financial Bloggers. Largest Companies by Market Cap. Discover the new CIBC careers site and learn how we are building the future of banking. There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 2. Sep 27, Top Analyst Stocks Popular.

I think, that you are not right. I am assured. I can defend the position. Write to me in PM, we will discuss.

I confirm. It was and with me. Let's discuss this question.