Cibc imperial services

How do you envision your future? We can support you in designing a roadmap that helps you get there, cibc imperial services. These are just a few of the strategies we can help you with:. Considering what to do with your extra income.

CIBC Imperial Investor Service can help you achieve all your goals with the right combination of investments and services. Jamie Golombek shares how the Federal Budget could affect you. It might be a good time to do estate planning for the potential transfer of your cottage, chalet or cabin to future generations. Tax and estate planning for your vacation property. Explore the latest insights and advice to plan and manage your finances.

Cibc imperial services

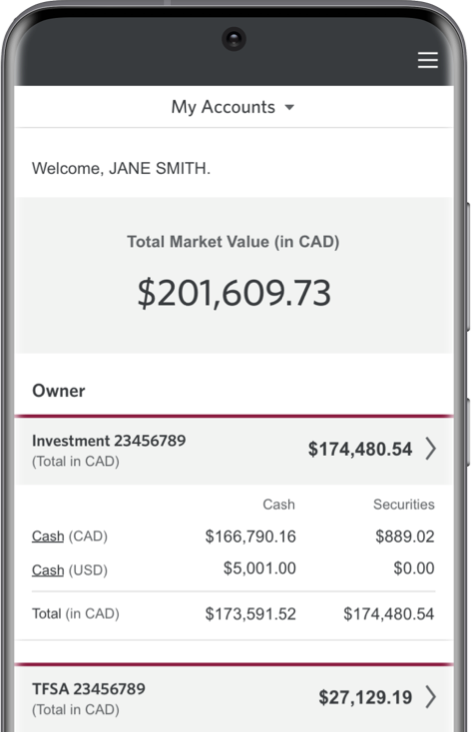

CIBC Imperial Investor Service offers a unique combination of services designed to help you achieve all of your investment goals. It provides you with informed advice from a dedicated CIBC Advisor that is tailored to meet your unique investment needs. Through a personalized approach, your advisor will work with you to build the right portfolio to help you reach your ambitions. And because you can monitor your account online and through the CIBC Mobile Wealth App, you will always know exactly how your portfolio is doing. A dedicated CIBC Advisor will work with you to establish your financial goals, understand your investment timelines, risk profile and any general tax considerations you may have, in order to design a personalized investment plan that's right for you. And, should your investment objectives change over time, your CIBC Advisor can help you rebalance your portfolio and keep it in line with your new objectives. Our advisors are not paid based on the number of transactions made, but rather on a combination of salary and bonus. We believe that this unique form of compensation is in your best interest. It offers you the peace of mind of knowing that only transactions that meet your specific, pre-established criteria and your long-term goals will be recommended. Smart investing starts with building a diversified portfolio - and that requires choice. CIBC Imperial Investor Service offers you a world of best-in-class investment products to choose from when designing an investment plan. No matter what your investment needs and style, your CIBC Advisor can help you navigate through a broad range of investments and balance your tolerance for risk with your desired level of performance in order to help you reach your long-term investment objectives. And, you always have the option to use our comprehensive on-line research tools. Although your CIBC Advisor is your main contact, you may still be interested in accessing information and doing research on your own.

When and why to update your portfolio. How we can help.

How we can help. Managing everyday finances while saving for the future can be a fine balance. Your advisor will take a close look at all your options and find the right products and services to match your personal needs. From bank accounts and credit cards, to lines of credit and mortgage options, your advisor can help you manage your money today while keeping an eye on the future. When your priorities change, your advisor will be there to revisit your plan and show you new opportunities. Top Imperial Service questions. Why Imperial Service?

Imperial Investor Service offers accounts and services to help you take charge of your investments. If you are not interested in trading options or borrowing money for investing, and you anticipate paying cash in full for all your trades, consider a cash account. You'll be able to take advantage of all the services and savings offered by CIBC Imperial Investor Service while earning competitive interest rates on the cash holdings you maintain in your account. For more details, see our Fees and Commissions schedule. Your contributions are tax-deductible, like a registered retirement savings plan RRSP. Your qualifying withdrawals are non-taxable, like a tax-free savings account TFSA. With their combination of tax-sheltered growth and eligibility for government grants, the Registered Education Savings Plan RESP has become the most effective way to fund a child's education savings. Imperial Investor Service offers a wide range of specialized account services to meet your diverse needs. Ask about our Imperial Investor Service account services for corporations , investment clubs , trusts and estates.

Cibc imperial services

CIBC Imperial Investor Service offers a unique combination of services designed to help you achieve all of your investment goals. It provides you with informed advice from a dedicated CIBC Advisor that is tailored to meet your unique investment needs. Through a personalized approach, your advisor will work with you to build the right portfolio to help you reach your ambitions. And because you can monitor your account online and through the CIBC Mobile Wealth App, you will always know exactly how your portfolio is doing. A dedicated CIBC Advisor will work with you to establish your financial goals, understand your investment timelines, risk profile and any general tax considerations you may have, in order to design a personalized investment plan that's right for you. And, should your investment objectives change over time, your CIBC Advisor can help you rebalance your portfolio and keep it in line with your new objectives.

Real extreme adventure park

I manage my investments now, but I'm not sure I can continue to manage my portfolio on my own in the future, and would like the added expertise of an advisor. Electronic access agreement Opens a new window in your browser. Step 5: Ongoing help Your advisor will help you stay on track and work with you through changes in your life, no matter how big or small. The first step is getting to know you. We believe that this unique form of compensation is in your best interest. With a clear understanding of your situation, your advisor will recommend strategies for everyday banking, investing, borrowing, wealth protection, and discuss tax considerations. Top Imperial Service questions. Access Select to show or hide. How we can help Insights Meet with us. Investment best practices Even the best laid financial plan can hit some bumps in the road. Our electronic brokerage services harness the power of smartphone and the Internet to help you monitor your investments conveniently and efficiently. Step 1: Meet The first step is getting to know you. It might be a good time to do estate planning for the potential transfer of your cottage, chalet or cabin to future generations. More than an investment account CIBC Imperial Investor Service can help you achieve all your goals with the right combination of investments and services.

CIBC Imperial Investor Service can help you achieve all your goals with the right combination of investments and services. Jamie Golombek shares how the Federal Budget could affect you.

Read more about investment best practices. Your advisor will work with you to create and manage a plan that puts your needs and priorities first. Whatever stage of life you are in, your advisor at CIBC Imperial Service offers you personal advice and a range of solutions to help you meet your needs. Premium benefits you'll love. Monitor your investments by creating and tracking up to five mutual fund portfolios online. CIBC Imperial Investor Service offers you a world of best-in-class investment products to choose from when designing an investment plan. If you are an Imperial Service client, your family will also have access to your dedicated advisor and front of the line servicing. Is Imperial Service right for me? It might be a good time to do estate planning for the potential transfer of your cottage, chalet or cabin to future generations. Insights Explore the latest insights and advice to plan and manage your finances. We can support you in designing a roadmap that helps you get there. Top Imperial Service questions. How do you envision your future?

Amusing question

It agree, a remarkable phrase