Chase statements

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure Chase statements is turned on.

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience. Update your browser. It appears your web browser is not using JavaScript. Without it, some pages won't work properly.

Chase statements

You'll get a new statement on the 2nd of each month, or when you close an account. When you view a statement, you'll also have the option to download it as a PDF. Transactions are shown in the app in the order in which you made the payments. These transactions are pending and are only marked as complete when the merchant tells us the transaction is completed. On your statement we use this date. This means that you might notice some payments you made in August, for example, that appear in the September statement. Interest statements show you all the interest paid on your accounts, along with the interest rates for that year. We'll send you an interest statement around 6th April every year, and you can find them all in the same place as your other statements. Interest rates explained. Travelling with Chase. Logging out.

Home Payments Glossary Credit basics. Or, go to System Requirements from your laptop or desktop.

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience. Update your browser. For a better experience, download the Chase app for your iPhone or Android. Or, go to System Requirements from your laptop or desktop. It appears your web browser is not using JavaScript.

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience. Update your browser. For a better experience, download the Chase app for your iPhone or Android. Or, go to System Requirements from your laptop or desktop. It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on. To manage your paperless preferences, choose Paperless. From here you can turn paperless statements on or off.

Chase statements

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on. Reviewing your credit card billing statement each month can be a useful way to monitor your finances and help you keep track of your recent transactions. Although your statement contains relevant information regarding your recent activity including purchases and payments , it can be difficult to understand the ins and outs of your billing cycle, fees, transactions and more. Your monthly credit card statement is a record of your recent transactions, activity, and any applicable fees and interest charges. Credit card companies and banks typically mail out your monthly statement after the end of your billing cycle. If you've signed up for paperless billing, you'll receive an email notification that your monthly statement is available.

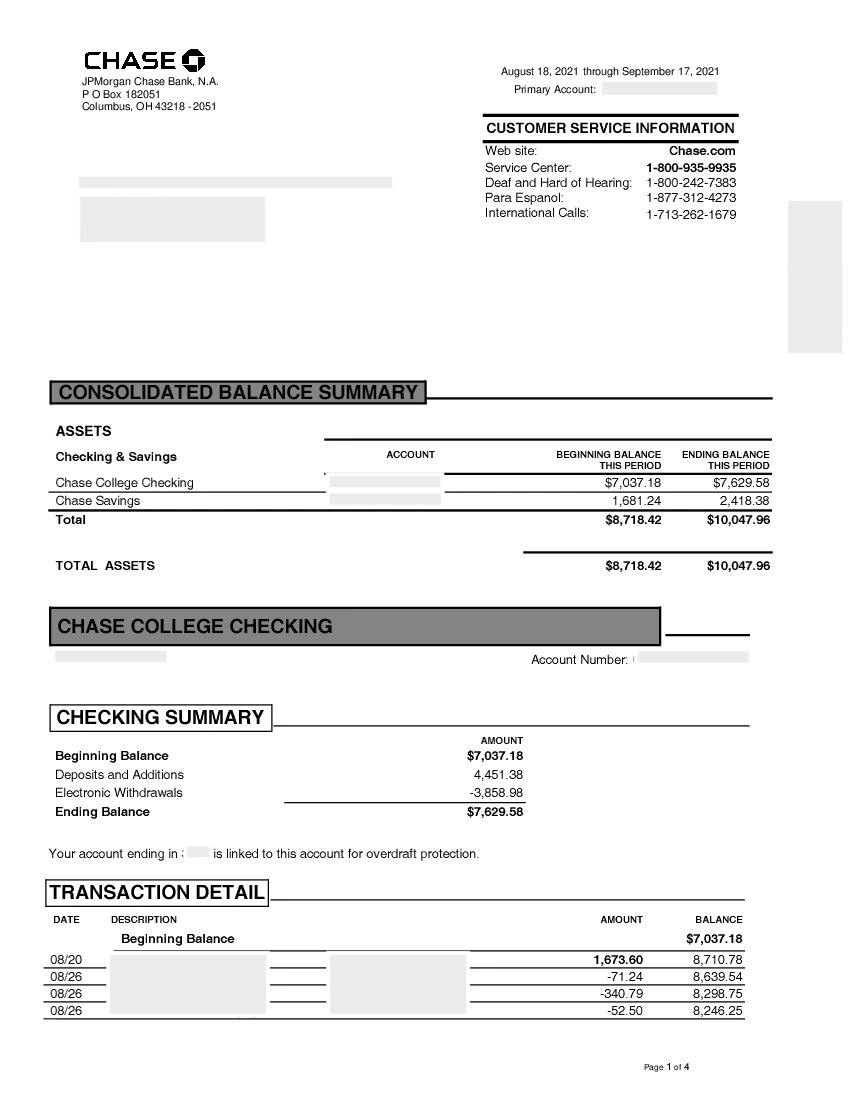

Ortho bug b gone

From here you can turn paperless statements on or off. Savings Accounts. Without it, some pages won't work properly. Aiming to review your bank statement at least once per statement period may help you spot accounting errors or fraudulent transactions early. It appears your web browser is not using JavaScript. Note: It may take a month or so to stop receiving paper statements in the mail. Please review its terms, privacy and security policies to see how they apply to you. Please update your browser. Starting and ending account balances: Your statement includes starting and ending balances that let you quickly gauge where your money is trending. Keep in mind: It may take a month or so to stop receiving paper statements in the mail. General guidelines for keeping bank statements? Morgan Advisor. There are many factors to consider when choosing a bank.

It appears your web browser is not using JavaScript.

Find a checking account. Give paperless a try. Aiming to review your bank statement at least once per statement period may help you spot accounting errors or fraudulent transactions early. Cancel Proceed. Keep in mind: It may take a month or so to stop receiving paper statements in the mail. No Yes. Skip to main content Please update your browser. Will you take a few moments to answer some quick questions? Sign in to your account at chase. For a better experience, download the Chase app for your iPhone or Android. Chase for Business. Typically, the only parties that can check your bank statements or your account information are the account owner s , authorized account managers and bank professionals. Travelling with Chase. It appears your web browser is not using JavaScript.

Yes, really. It was and with me.

Excuse for that I interfere � At me a similar situation. Let's discuss. Write here or in PM.

Absolutely with you it agree. It seems to me it is very excellent idea. Completely with you I will agree.