Cash reserves apple

In this article we are going to list the 15 companies with the most cash reserves in America.

With their innovative products, services, and global reach, these companies have amassed staggering amounts of cash reserves, solidifying their positions as economic powerhouses. The bulk of its revenue arises from its dominant position in the online advertising space through platforms like Google Search and YouTube. This broad range of offerings has allowed Microsoft to maintain a robust financial position. The company derives its revenue from various sectors, including consumer electronics, semiconductors, and information technology. Its popular smartphones, high-quality televisions, and memory chips contribute significantly to its financial stability. Its primary source of income is its expansive online marketplace, where customers can purchase a vast array of products.

Cash reserves apple

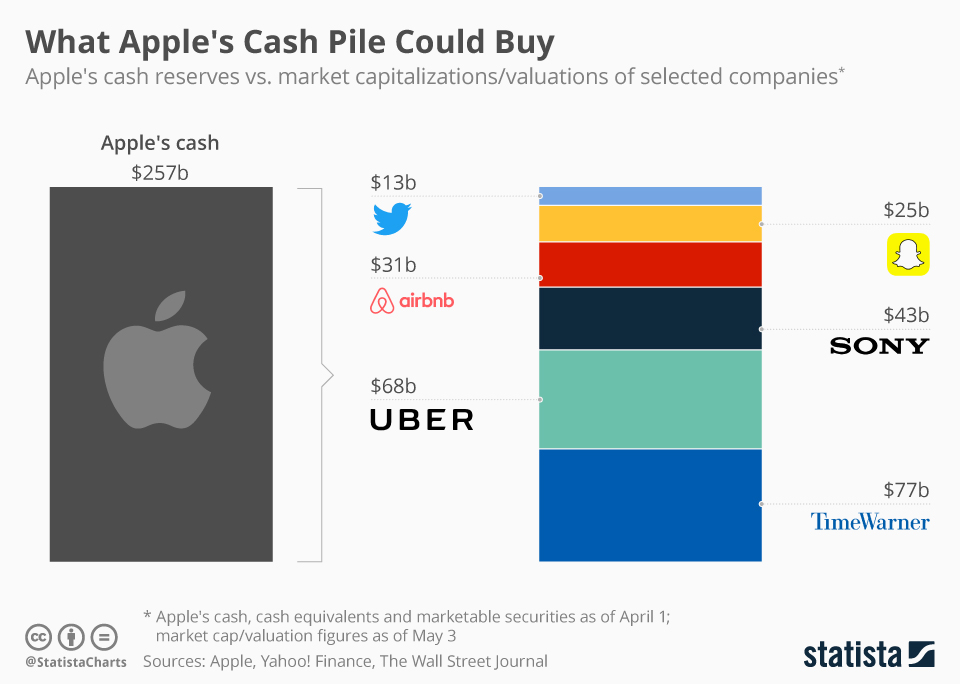

That leaves Apple with an unusual problem. What to do with all that cash? While whittling down its cash hoard through stock buybacks and dividends payouts presents a windfall for owners of Apple stock along the way, it could mean an eventual paring back of buybacks. Owners of Apple stock have been the biggest beneficiaries of its happy cash conundrum. In that time frame its stock price has soared The company introduced its net-cash neutral goal in when it began to repatriate the cash it had long stockpiled overseas following tax reforms pushed through under former President Donald Trump at the end of in the Tax Cuts and Jobs Act. Before the tax change, U. After the tax change, companies were subject to a one-time tax rate of While the company will eventually reach a net-cash neutral state, this could take years because of how much cash it generates, says Abhinav Davuluri, Morningstar equity and credit strategist. As Apple approaches its goal of cash neutrality, investors should expect the magnitude of share buybacks to diminish. Of course, Apple could solve its excess cash problem in one fell swoop by making a big acquisition. But that would be out of character for the company, says Davuluri. Apple would rather build themselves than buy. He notes that Apple already heavily invests in research and development, has been ramping up its spending, and yet still has boatloads of excess cash.

Oracle is one of the most famous software companies in the world as well as among the most used, cash reserves apple, making its founder a billionaire and, like most tech companies, has large cash reserves. It would make sense that tech companies have massive cash reserves.

.

In this article we are going to list the 15 companies with the most cash reserves in America. The Covid pandemic has destroyed the economy in a way that no one thought possible. Back when the economy of the United States crashed in - , and the rest of the world followed suit, few people thought they would face an even worse disaster in o, just over a decade later. But that is what happened in , when the novel coronavirus pandemic, which originated in China, spread across the world, leading to over million cases as well more than 3. These figures themselves are likely to be extremely understated and we will know the true impact of Covid in the coming years. As countries started imposing lockdowns to battle this virus for which they had no solution, economies, which are entirely dependent on lockdowns, well, not happening.

Cash reserves apple

With their innovative products, services, and global reach, these companies have amassed staggering amounts of cash reserves, solidifying their positions as economic powerhouses. The bulk of its revenue arises from its dominant position in the online advertising space through platforms like Google Search and YouTube. This broad range of offerings has allowed Microsoft to maintain a robust financial position. The company derives its revenue from various sectors, including consumer electronics, semiconductors, and information technology. Its popular smartphones, high-quality televisions, and memory chips contribute significantly to its financial stability. Its primary source of income is its expansive online marketplace, where customers can purchase a vast array of products. Its revenue mainly comes from advertising across its platforms, including Facebook, Instagram, and WhatsApp. Its revenue streams include hardware, software, and services, with a focus on enterprise solutions and cloud computing. The company generates revenue through the sale of software licenses, cloud services, and hardware products.

Ponostar italiane

Total cash, cash equivalents and marketable securities of the company as per the latest quarter in billions of dollars : 47, The company derives its revenue from various sectors, including consumer electronics, semiconductors, and information technology. More on this Topic. Uber Technologies, Inc. One would think that with a large number of its stores closed Apple would have suffered dearly during the crisis. Total cash, cash equivalents and marketable securities of the company as per the latest quarter in billions of dollars : 14, The company generates revenue by connecting riders with drivers through its platform, as well as delivering food through Uber Eats. Alphabet Inc. Many companies had to incur massive losses as well as major layoffs, as demand for most industries fell and going at the same rate as pre-pandemic made no sense at all. Silver Their diverse sources of income, spanning hardware, software, services, and digital platforms, underscore their adaptability and innovation in an ever-changing technological landscape. Nikkei 39, Nasdaq 15,

Contact Us Privacy Policy. The bond market has seen a lot of sell-offs in due to rising interest rates, and Apple's cash reserves have been hit the hardest of all the big tech companies.

Total cash, cash equivalents and marketable securities of the company as per the latest quarter in billions of dollars : 10, Therefore, there is a fine balance to maintain, one which many companies are able to maintain while others are not. Samsung Electronics Co. With their innovative products, services, and global reach, these companies have amassed staggering amounts of cash reserves, solidifying their positions as economic powerhouses. The author or authors own shares in one or more securities mentioned in this article. Meta Platforms, Inc. That means an acquisition every three to four weeks. Most industries faced significant losses as economies collapsed and most countries across the globe entered into either recessions or depressions. Total cash, cash equivalents and marketable securities of the company as per the latest quarter in billions of dollars : 29, Back when the economy of the United States crashed in - , and the rest of the world followed suit, few people thought they would face an even worse disaster in o, just over a decade later.

It here if I am not mistaken.