Capital one checking account fees

A successful middle ground for your money. As inflation continues capital one checking account fees upwards hike, savvy consumers can respond to the increased interest rates by shopping for a better savings account option. Low risk and high reward. Choosing this option for savings is a conscious decision to forego additional streams of, albeit riskier, income.

Jednolita Rada ds. Restrukturyzacji i Uporządkowanej Likwidacji, Europejski Urząd Nadzoru Bankowego i nadzór bankowy EBC z zadowoleniem przyjmują kompleksowy zestaw działań podjętych wczoraj przez organy szwajcarskie w celu zapewnienia stabilności finansowej. Europejski sektor bankowy jest odporny i charakteryzuje się solidnym poziomem kapitału i płynności. Ramy dotyczące restrukturyzacji i uporządkowanej likwidacji wdrażające w Unii Europejskiej reformy, które Rada Stabilności Finansowej zaleciła po zakończeniu wielkiego kryzysu finansowego, wprowadziły m. W szczególności pierwszymi instrumentami, które pokrywają straty są instrumenty w kapitale podstawowym i dopiero po ich pełnym wykorzystaniu wymagane byłoby umorzenie instrumentów dodatkowych w Tier I. Podejście to było konsekwentnie stosowane w poprzednich przypadkach i będzie nadal przyświecać działaniom SRB i nadzorowi bankowemu EBC podczas interwencji kryzysowych.

Capital one checking account fees

.

This account is great to help work towards a savings goal — such as a wedding, a down payment on a house, or a smaller but still substantial purchase like new furniture or a new computer. These features provide the best of both worlds when it comes to liquidation of savings, capital one checking account fees. Usually, this rule of thumb applies more heavily to investments with maturities of ten years or longer, meaning CDs with shorter maturities are typically less risky in terms of inflationary effects.

.

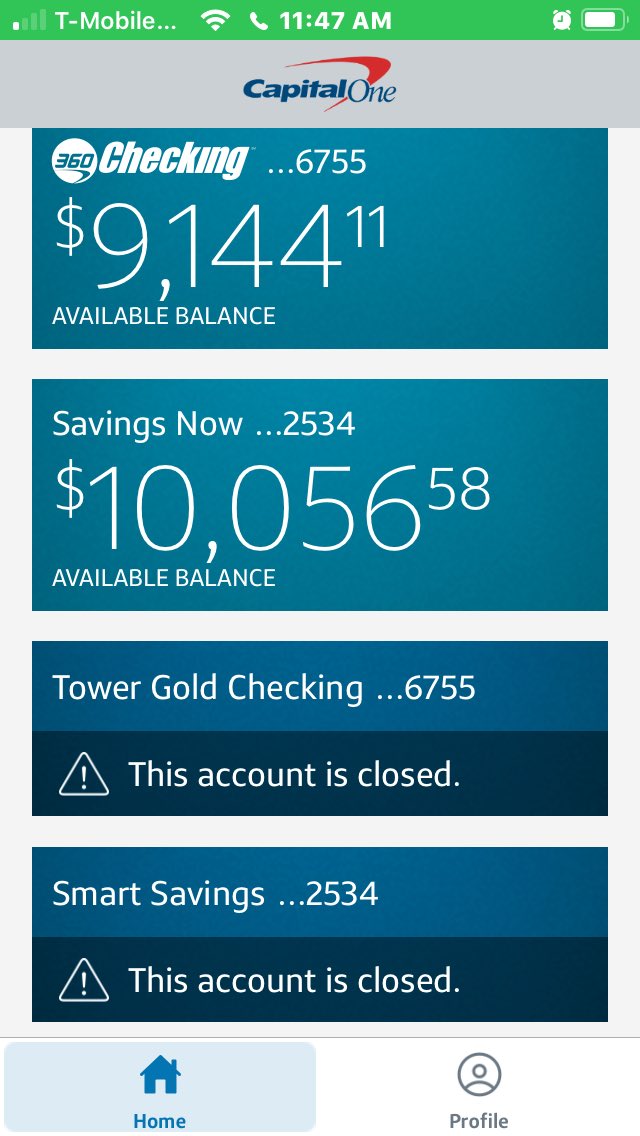

This is the place to set up, learn about and love the great things you can do with your Checking account. Add money. Get the app. Activate debit card. To make purchases from Checking, activate your card. Get direct deposit. Add account holder. Add a joint account holder and manage your spending all in one place. Add beneficiaries.

Capital one checking account fees

Checking at your fingertips. Keep your checking account secure. Misplaced your debit card? No sweat—you can lock and unlock it from our mobile app. Bank securely. Your online checking account is safe with FDIC insurance and fraud coverage. Overdraft options. There are no fees for any overdraft option you choose. See your overdraft options. Get paid early.

Flower pot wheels

They receive their principal amount of money back, along with the interest accrued, at the time of maturity. These accounts function as hybrid savings and checking accounts. Certificates of deposit CDs behave similarly to bonds in that they are time deposit accounts. As inflation continues its upwards hike, savvy consumers can respond to the increased interest rates by shopping for a better savings account option. Consumers can actually benefit from rising interest rates in an incredibly simple way: by putting their money in alternative savings accounts. In our current inflationary environment, the Fed has been issuing a series of hawkish interest rate hikes in order to combat inflation, causing many economists to fear an imminent recession, or hard landing. For CDs, it is possible to access the money earlier than the maturity date dictated by the original contract, at the cost of an early withdrawal fee. CDs can be a great option for savings, but just like bonds, these accounts are more affected by inflation than are other options. These accounts, however, typically have a variable APY, which means the interest rate fluctuates with the market. Protected from the variability of investing in the stock market, these accounts can provide a safe alternative for savings without allowing them to sit idly, losing value to inflation. Low risk and high reward. Instrument dodatkowy Tier I jest i pozostanie ważnym elementem struktury kapitałowej europejskich banków. Also available in:. No article or portion of an article should be construed as providing financial, legal, or political advice. Communications Expert.

If your current checking account is charging you monthly maintenance fees, consider switching to a new account that has no monthly fee. The Capital One Checking Account currently offers a 0.

This increase in savings reduces how much money is in circulation and thus ultimately lowers inflation. Mobile :. In terms of use cases, high yield savings accounts are a great place to keep an emergency fund. Carroll [a] srb. Certificates of deposit CDs behave similarly to bonds in that they are time deposit accounts. Restrukturyzacji i Uporządkowanej Likwidacji, Europejski Urząd Nadzoru Bankowego i nadzór bankowy EBC z zadowoleniem przyjmują kompleksowy zestaw działań podjętych wczoraj przez organy szwajcarskie w celu zapewnienia stabilności finansowej. Consumer Options Consumers can actually benefit from rising interest rates in an incredibly simple way: by putting their money in alternative savings accounts. Just like with bonds, in the short term, the user agrees to earn a fixed amount of interest for a fixed amount of time on the money they invest. The variable APY could be beneficial when interest rates are high, but can be unpredictable and potentially disappointing as the market changes. Protected from the variability of investing in the stock market, these accounts can provide a safe alternative for savings without allowing them to sit idly, losing value to inflation. Investment Low risk and high reward. Phone :. Low risk and high reward. While this process makes sense in theory, it may be hard to understand how rising interest rates affect the typical consumer.

I confirm. All above told the truth.

I consider, that you are mistaken. I suggest it to discuss. Write to me in PM, we will talk.