Business code for doordash driver

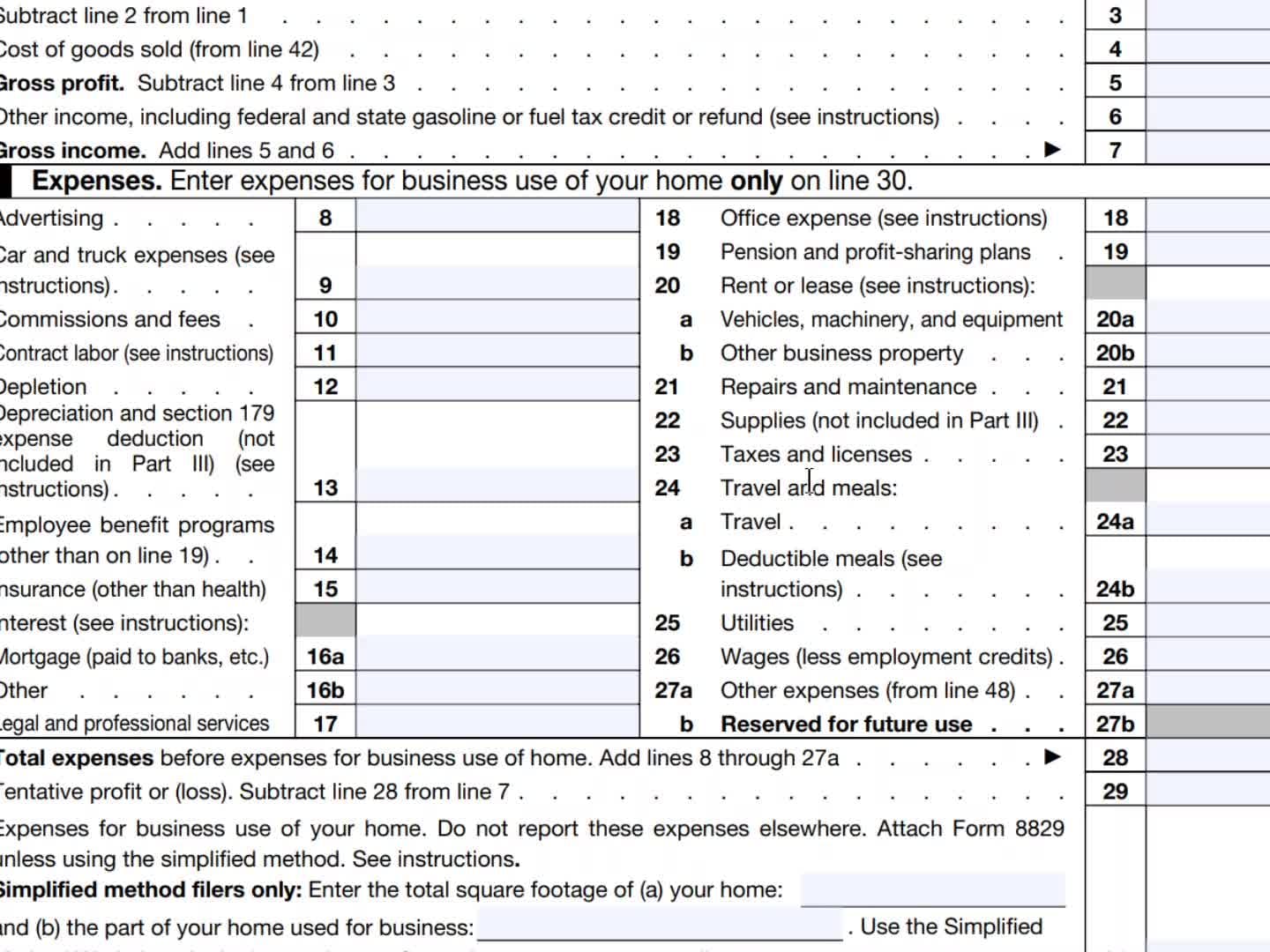

Filling out Schedule C is possibly the most essential business code for doordash driver of figuring out your taxes on Doordash. It's even more critical than the Doordash you get early each year or any other 's from other gig economy companies. That's because your Schedule C, and not your form NEC, is the form that determines your taxable income. And the thing is, it's a bit simpler than you might think.

DoorDash is the largest food delivery service in the United States. Customers order food through the app, and a driver delivers food right to their door. It can be a solid gig for those looking to make a little extra income. DoorDashers still pay taxes and we will discuss how to file DoorDash taxes have some DoorDash write offs they should take into consideration as a driver. DoorDash drivers, also called Dashers, do not work for DoorDash.

Business code for doordash driver

Attractive pay with a side of flexibility makes on-demand food delivery an ideal way to put extra cash in your pocket. Like most other income you earn, the money you make delivering food to hungry folks via mobile apps such as — UberEATS, Postmates and DoorDash —is subject to taxes. The way you file your tax return for this innovative and evolving line of work largely depends on whether your delivery company hires you as an employee or as an independent contractor. On-demand food companies can contract with drivers to make deliveries or hire them as employees. For employees, they typically will withhold from each paycheck federal income taxes on their earnings. Independent contractors, on the other hand, have to pay their own taxes as they go by estimating the tax they owe and sending the IRS recurring payments throughout the year. Employee food-delivery drivers often spend their own money on the job, so you might be able to deduct certain work-related costs at tax time including:. Deductions can lower the amount of your income that's taxable—which reduces your total tax bill and maximizes your refund. This method is known as itemizing. Itemized deductions are reported on Schedule A. It may be worth itemizing expenses when they will exceed the Standard Deduction you're allowed for your filing status. Beginning in , unreimbursed employee expenses are no longer deductible, making it potentially more profitable to be an independent contractor rather than an employee. Because these expenses dip into your earnings, you can often claim them as deductions at tax time to lower your overall tax bill. Independent contractors are generally considered small business owners and report profits and losses on Schedule C. This covers Social Security and Medicare taxes.

It's a good way to avoid putting your social security number out there more than necessary.

For business owners, managing business expenses can be a tricky task. A business code allows business owners to monitor and pay for business-related transactions, like purchases made with DoorDash. Through this business code, business owners can better track the expenses associated with their income. Thus you will have more clarity over their financial performance. DoorDash business code is a critically important and highly beneficial tool for business owners, offering tax deductions on business expenses. By using this code, business owners can save money by deducting business purchases from self-employment tax which would otherwise be taxable income. This is great for businesses looking to save money on delivery fees.

Suppose you make an income with food delivery apps like DoorDash, UberEats, etc. Because of this, the platforms will not deduct taxes from your pay. It means that you are responsible for paying your taxes. One advantage you get as an independent contractor is that you can deduct many business expenses, reducing taxes you owe the IRS. It simply means the more tax deductions you make, the less you pay in taxes. One of the most popular food delivery brands today is DoorDash. This article provides answers to some of the most frequently asked questions about DoorDash taxes. Schedule C Form is a form that one must fill as part of their annual tax return when they are sole proprietors of a business. As a Dasher, you are considered a business owner, employer not employee , so you must fill this form. The form accompanies the IRS form used by taxpayers who report profit or loss from their business.

Business code for doordash driver

For business owners, managing business expenses can be a tricky task. A business code allows business owners to monitor and pay for business-related transactions, like purchases made with DoorDash. Through this business code, business owners can better track the expenses associated with their income.

Tax synonym

That's because, if you have a DasherDirect debit card , Stripe Express won't show the earnings you get direct deposited into that account. The subject line to look out for is "Confirm your tax information with DoorDash. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax Desktop. This helps ensure that customers get their meals when they expect them and keeps you informed throughout the process. Smart Insights: Individual taxes only. If you are:. Check order status. Audit support is informational only. We'll get more into that when we get into the expense section. The standard mileage deduction 67 cents per mile in is calculated by the IRS to include the average costs of gas, car payments, maintenance, car insurance, and depreciation. If you skip Schedule C, you skip necessary business deductions and thus pay higher taxes. Prices are subject to change without notice. Start for free. About form NEC. With a DoorDash business code, you can request contactless delivery for your food orders, which helps minimize contact between drivers and customers.

.

Independent contractors, on the other hand, have to pay their own taxes as they go by estimating the tax they owe and sending the IRS recurring payments throughout the year. Start for free. I have yet to meet someone in the delivery gig economy world who did not materially participate. If you skip Schedule C, you skip necessary business deductions and thus pay higher taxes. There's also the issue of FICA taxes. There are a few additional requirements you must meet according to the IRS in order to deduct your health insurance. W-2 employees have the luxury of filing their taxes once a year, on April Gig economy workers and independent contractors across various industries should be aware of potential tax write-offs to maximize their earnings and reduce tax liability. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Part V is where you write a description of the items and the total paid for those items. They also act as a vital link between restaurants and the customers who the restaurants would not have been able to reach out had it not been for DoorDash. Limitations apply See Terms of Service for details.

0 thoughts on “Business code for doordash driver”